How to choose the right deductible for homeowners insurance

If you’ve had any experience with insurance in the past — perhaps as an auto or renters insurance policyholder — you’re likely familiar with deductibles. Deductibles are a standard part of property insurance, and while its primary definition and purpose remain the same across these lines of insurance, there are certain nuances to be aware of when it comes to what it means for homeowners.

Your home is likely the most significant purchase you’ll make in your life. Understanding home insurance and choosing the right deductible will ensure you have the resources to rebuild or replace your property if you suffer a loss. In our guide, we’ll cover everything you need to know about home insurance deductibles, what coverages they apply to and how to choose the right one for your situation.

A guide to homeowners insurance deductibles — table of contents:

- Understanding deductibles: how do they work?

- What are the different types of deductibles?

- How do deductibles affect home insurance premiums?

- How to choose a deductible

Homeowners insurance deductibles defined

A deductible is your out-of-pocket expense before your homeowners insurance covers the rest of the financial cost of your claim. For instance, if your home sustains $25,000 in damage and you have a $1,000 deductible, you can expect your insurance company to pay out $24,000 for the claim. Ultimately, it is your portion of financial responsibility before your insurer will cover the remainder for the covered loss.

Which home insurance coverages require a deductible?

The cornerstone of a homeowners insurance policy is coverage for your dwelling — the structure of your home (including attached structures, like a garage). It also includes coverage for other (detached) structures, personal property, additional living expenses, personal liability and medical payments. Learn more about what home insurance covers.

Your deductible is only required for the property-specific coverages: your dwelling, other structures and personal property. It is not required for additional living expenses (also known as loss of use), personal liability and medical payments.

If you’ve fortified your home insurance policy with additional endorsements or riders, a deductible may be required if you file a claim to get coverage through one of these endorsements. However, these deductibles tend to be much less — depending on the company you insure your home with — and are separate from your primary deductible.

Types of deductibles in home insurance

Unlike auto insurance, in which your deductible is always a fixed amount, there are two types of deductibles offered by homeowners insurance:

- Fixed dollar standard deductible: This is the fixed dollar amount you pay before your insurance company covers the rest of your claim. The most common amounts range from $500 to $2,000, but higher and lower amounts can be found as well.

- Percentage deductible: This type of deductible is calculated as a percentage of your dwelling coverage amount, i.e. your home’s insured value. It usually ranges from 1-10%. So if your home is insured for a replacement cost of $150,000 and you have a 1% deductible, $1,500 would be deducted from your claim payout as your portion of financial responsibility.

It is important to note that percentage deductibles are commonly reserved for disasters, like windstorm and hurricane-related insurance claims, which we’ll cover next.

Deductibles for natural disasters

Natural disasters in which homeowners insurance does not cover are subject to separate deductibles. These tend to be very state-specific, as not all states mandate coverages like hurricane deductibles. Depending on your location, insurer, and coverage type, you may have the option of opting for the traditional fixed deductible rather than a percentage.

| Type of Disaster Coverage | Deductible Type |

|---|---|

| Hurricane and windstorm | Percentage; may have the option of a fixed amount for a higher premium |

| Flood | Both; varies by state and insurance company |

| Earthquake | Percentage |

How deductibles impact homeowners insurance rates

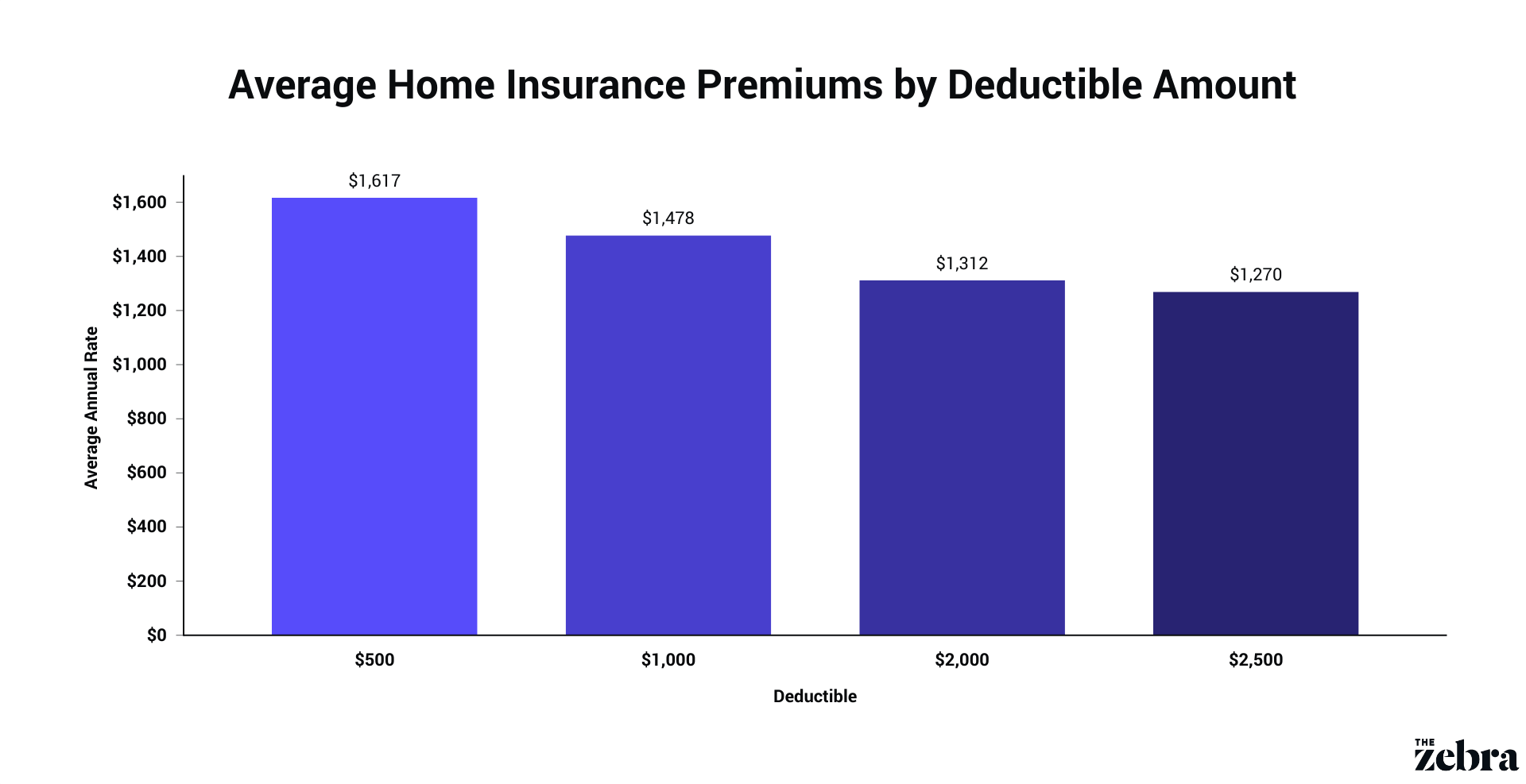

Your homeowners insurance premium and your deductible have an inverse relationship. Just like with auto insurance, a higher deductible will lower your premium, and a lower deductible will increase your premium. This is because a high deductible means you’ll be bearing more of the financial burden in the event you need to file a claim, thereby reducing some of the costs your insurance company would otherwise be responsible for. Below is an illustration of the nature of this relationship.

| Deductible Amount | Average Annual Premium | Monthly Premium |

| $500 | $1,617 | $135 |

| $1,000 | $1,478 | $123 |

| $2,000 | $1,312 | $109 |

| $2,500 | $1,270 | $106 |

Rates also vary from company to company, and some insurers will also impose a percentage-based deductible rather than a fixed-dollar rate. Consult the data below to see how premiums can fluctuate depending on the insurer and deductible amount. Or, check out our guides:

| Insurance Company | $500 Deductible | $1,000 Deductible | $2,000 Deductible | $2,500 Deductible |

| Allstate | $1,763 | $1,594 | $1,391 | $1,322 |

| American Family | $2,474 | $2,261 | $2,084 | $2,003 |

| Farmers | $1,523 | $1,455 | $1,349 | $1,325 |

| Nationwide | $1,365 | $1,236 | $974 | $968 |

| Progressive | $1,462 | $1,355 | $1,259 | $1,117 |

| State Farm | $1,470 | $1,356 | $1,234 | $1,231 |

| Travelers | $1,561 | $1,444 | $1,257 | $1,231 |

| USAA | $1,364 | $1,231 | $1,049 | $1,049 |

How to choose a homeowners insurance deductible

The key question to reflect on when choosing your deductible is: what can you afford in the short term versus the long term? Finding a way to balance the cost of your deductible (a short-term cost) and your premium (a long-term expense) is the best way to make a smart decision for your homeowners policy. Consider these questions before you start shopping for home insurance:

- While a low homeowners insurance premium may be attractive, can you reasonably afford a higher-than-average deductible if you need to file a claim?

- Would you rather pay a little more in premium if it means you’ll have less of a financial burden for a covered loss?

- What perils, if any, is the location of your home vulnerable to? If you live in a state that requires hurricane deductibles or other disaster coverages, this is another expense to consider on top of your primary policy deductible.

Every insurance company rates your individual factors differently, making it ever-important to explore options wherever you can; rates can vary substantially from company to company. The Zebra can help you compare home insurance rates instantly and easily. Enter your ZIP code below to get started.

Compare homeowners insurance rates in just a few minutes.

Related content

- Service Line Coverage

- Does Homeowners Insurance Cover Vandalism?

- Jewelry Insurance

- What is Windstorm Coverage?

- Homeowners Insurance and Earthquakes

- Does Homeowners Insurance Cover Roof Leaks?

- Sewer Backup Insurance

- Does Home Insurance Cover Hail Damage?

- Homeowners Insurance for a New Construction Home

- What is Other Structures Coverage?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.