What is the Average Cost of Homeowners Insurance?

What's the average cost of homeowners insurance?

The average annual premium for homeowners insurance in the United States is $1,406 per year or about $117 per month.

Among the myriad factors insurance providers take into account when pricing homeowners insurance rates, the location of your home along with its coverage level at replacement cost tends to be most important.

While things like claims history, credit score and residing in an older home can definitely impact your premium, we found that premiums are most affected by location, coverage limits and which insurance company you choose.

Key takeaways:

- Homeowners insurance costs are on the rise due to higher material and labor costs

- The average American pays about $117 per month for homeowners insurance

- The cheapest states on average are Delaware, Hawaii, Maine, New Jersey and Vermont

- The cheapest average home insurance rates are offered by USAA and Nationwide

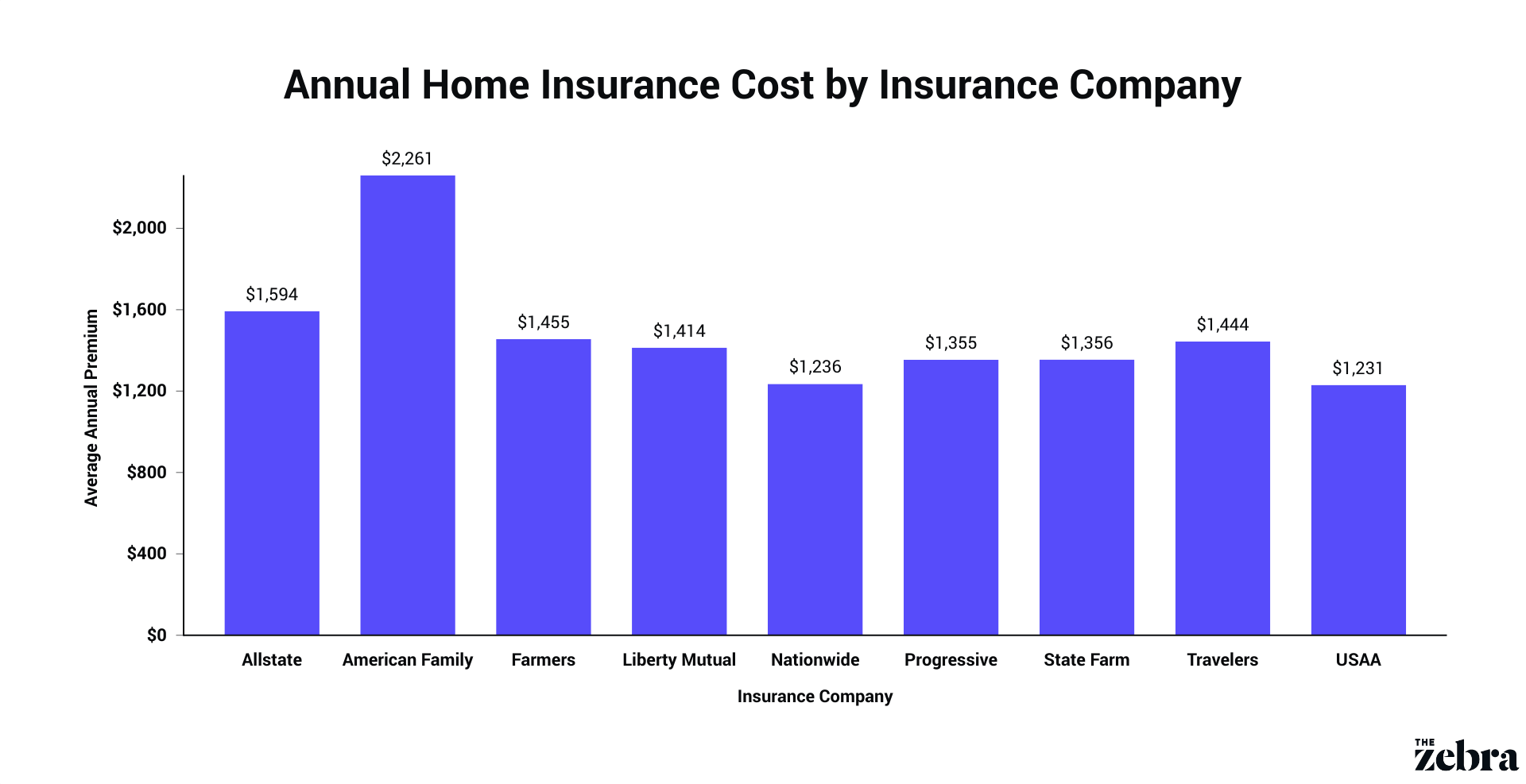

Average homeowners insurance cost by insurance company

Some insurance companies are more expensive than others, even when comparing similar homeowner profiles and coverage levels. Every insurer differs in how it calculates rates and the variety of insurance discounts it has on offer.

Bundling a home insurance policy with auto insurance for a multi-policy discount is a popular way to save on your premium. See more information on home insurance discounts and see average costs from some top home insurance companies below.

What is the cheapest homeowners insurance company?

Based on The Zebra's research, the cheapest home insurance company is USAA ($103 per month). For those who don't qualify for USAA, Nationwide costs just $5 more per year.

| Insurance Company | Average Premium |

|---|---|

| Allstate | $1,594 |

| American Family | $2,261 |

| Farmers | $1,455 |

| Liberty Mutual | $1,414 |

| Nationwide | $1,236 |

| Progressive | $1,355 |

| State Farm | $1,356 |

| Travelers | $1,444 |

| USAA | $1,231 |

Homeowners rate methodology

Rates are based on a 45-year-old homeowner with a home constructed in 2004 and carrying the following coverage:

- $250,000 dwelling coverage at replacement cost

- $125,000 personal property limit

- $100,000 personal liability limit

- $25,000 for additional living expenses

- $1,000 deductible

Average home insurance premiums by state

What you pay for homeowners insurance coverage varies depending on where you live. Insurance companies set rates by analyzing the chances of a homeowner needing to file a claim — and statistically, certain states are riskier to reside in. Home insurance companies charge higher premiums for homeowners in locales susceptible to natural disasters such as wildfires or hurricanes.

The table below shows how impactful location is when it comes to homeowners insurance; homeowners in some states pay as little as $50 a month, while others can average more than $200 a month.

What are the cheapest states for home insurance?

Hawaii, Vermont, Maine, New Jersey and Delaware are the cheapest on average. This can be attributed to a number of factors, including local rebuilding costs, state insurance regulations, and the risk of natural disasters in the area.

What are the most expensive states for home insurance?

Oklahoma, Kansas, Nebraska, Texas and Colorado come in as the most expensive state on average. At least some portion of each of these states is susceptible to tornados or damaging wind storms. Oklahoma and Colorado also have a high risk of earthquakes. Texas, being situated on the Gulf of Mexico, has also seen numerous hurricanes that have led to astronomical losses.

Average homeowners insurance costs by city

Insurers are interested in more than just which state you call home — they will price your premium right down to your specific ZIP code.

For example, if underwriters determine that your home in New Orleans is too vulnerable to flood damage, they could charge a higher premium to make up for the potential risks, anticipating the financial blow should you need to file an insurance claim.

In many states, owning a home in the city could often be more expensive than living elsewhere in the state. The higher cost of home insurance can be partially linked to factors like crime rate and local building costs, which tend to run higher in most cities. Our data show homeowners in Miami, Detroit and New Orleans have the largest disparities in what they pay versus their respective states' average rates.

Compare quotes to find an affordable homeowners policy.

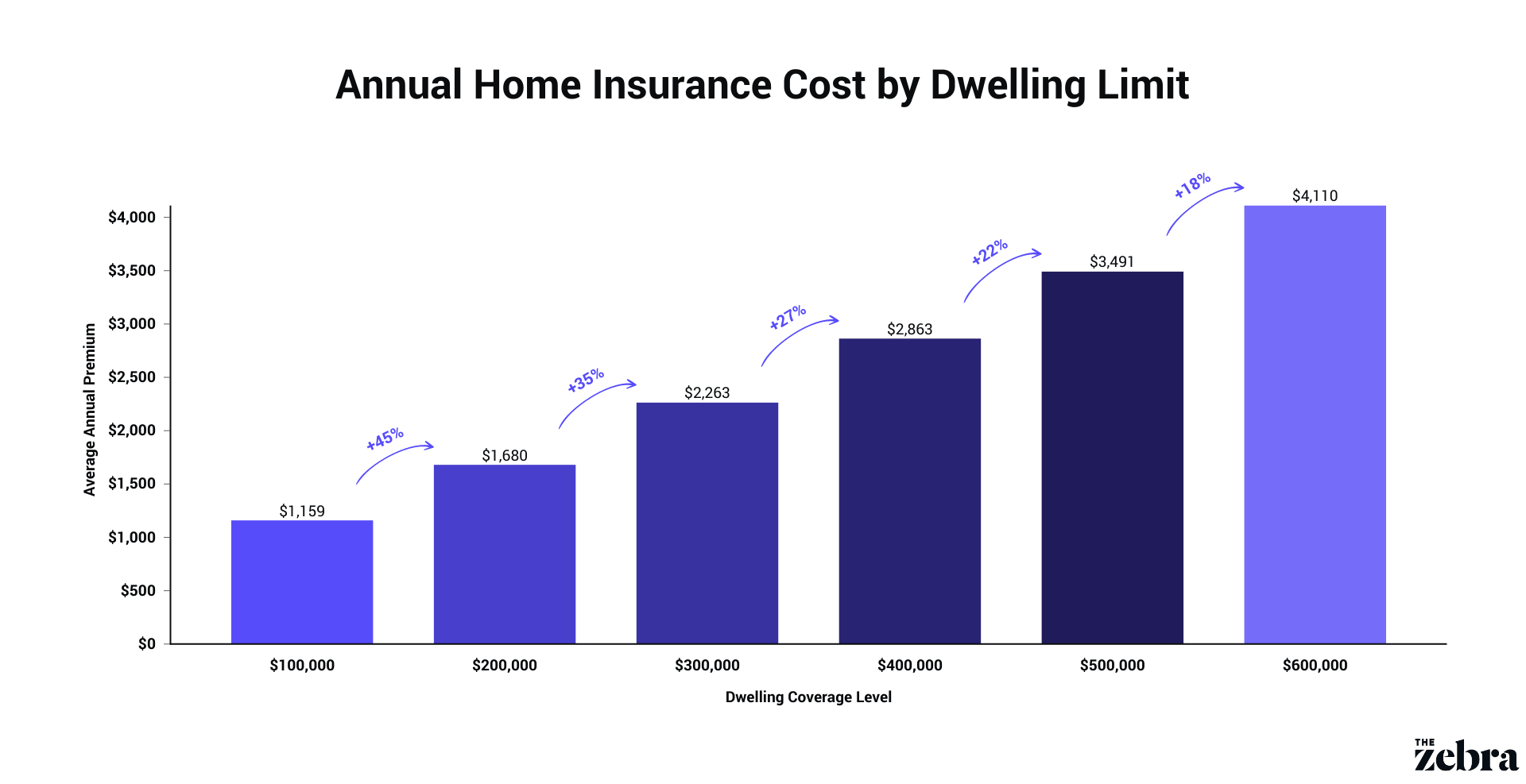

Average homeowners insurance cost by coverage level

The capital required to replace your home in its entirety — including any detached structures and outdoor features like swimming pools — is a critical factor in homeowners insurance pricing. Not only does it affect your average annual cost, but an accurate assessment will also protect you from the unwelcome surprise of ending up under-insured following a catastrophic event.

The replacement cost of your home is the cornerstone of a homeowners insurance policy and is independent of your property's market value. It will help to determine the coverage amounts as a percentage of the dwelling limit.

| Coverage | Typical Coverage Limit |

|---|---|

| Dwelling (Coverage A) | Replacement cost |

| Other Structures (Coverage B) | 10% of Coverage A |

| Personal Property (Coverage C) | 50% of Coverage A |

| Loss of Use (Coverage E) | 20-30% of Coverage A |

| Medical Payments (Coverage E) | Varies |

| Personal Liability (Coverage F) | Varies |

Homeowners should be mindful of the fact that inflation can cause fluctuations in a home’s replacement cost. In addition, the costs of labor and construction can rise — especially when demand for both goes up after a natural disaster. Consider adding an extended replacement cost endorsement that guarantees or extends your dwelling limit in these situations. Learn more about how to calculate the replacement cost of your home.

The average premium to insure a home with a replacement cost of $100,000 is $97 per month, while a $600,000 dwelling limit costs about $343 a month. This difference in rates is one of the many reasons that knowing your home value is crucial when choosing a policy. See more information on insuring high-value properties.

| Dwelling Limit | Other Structures Limit | Personal Property Limit | Average Premium |

| $100,000 | $10,000 | $50,000 | $1,159 |

|---|---|---|---|

| $200,000 | $20,000 | $100,000 | $1,680 |

| $300,000 | $30,000 | $150,000 | $2,263 |

| $400,000 | $40,000 | $200,000 | $2,863 |

| $500,000 | $50,000 | $250,000 | $3,491 |

| $600,000 | $60,000 | $300,000 | $4,110 |

Average home insurance rates by deductible

The average monthly premium with a $1,000 deductible is $123 per month, while a $2,000 deductible costs about $109.

A higher deductible — your portion of financial responsibility in a claim — will lower your rate because of the inverse relationship deductibles have with premiums. Choosing to pay a higher portion if you need to file a claim equals less money your insurance company will have to pay out, thus resulting in a lower rate.

Consult the table to see how deductibles can influence home insurance premiums.

| Deductible | Average Premium | % Difference |

|---|---|---|

| $500 | $1,617 | - |

| $1,000 | $1,478 | -9% |

| $2,000 | $1,312 | -11% |

| $2,500 | $1,270 | -3% |

Find the right homeowners policy in only a few minutes.

Average home insurance cost FAQs

See answers to commonly asked questions regarding average home insurance below.

What is the average cost of homeowners insurance?

In the U.S., the average monthly premium is about $117 per month (or $1,406 annually), but rates vary based on factors such as your location, insured property and your profile as a homeowner.

Why did my homeowners insurance go up?

If your home insurance premiums went up after renewal it can be the result of many different things. If you increase coverage limits or filed a costly homeowners claim, you can expect a rate hike. However, there may other reasons beyond your control, such as an increase in the cost of building materials or changes in your local labor market. If you are facing higher rates, the first thing you should do is shop around for new homeowners insurance quotes.

How much does home insurance cost in my state?

Expect to pay more for insurance if your state of residence is prone to hazards like extreme weather and higher levels of crime. Insurance companies assess risks down to your specific ZIP code and charge accordingly. The most expensive states are Oklahoma, Kansas and Nebraska; the cheapest states are Hawaii, Vermont and Maine.

Which home insurance companies offer the cheapest rates?

Our data showed that USAA costs an average of $103 per month — less than the national average and making it the cheapest company. Nationwide was a close second, costing just $5 more per year than USAA.

Compare home insurance quotes and find the right policy for you.

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.