Insurify Insurance Comparison Review

Insurance comparison site review: how good is Insurify?

Insurify is an online insurance marketplace that helps users compare insurance quotes from a number of different companies. Based in Cambridge, Massachusetts, the company officially launched its website in 2016. Car insurance comprises the core of Insurify’s business, though the company has branched out to cover life and homeowners insurance as well.

Insurify claims to save customers an average of $489 on their car insurance premiums, though this number is listed differently elsewhere on the site. Insurify's product is similar to those offered by other leading insurance comparison sites such as The Zebra, which provides real-time, bindable insurance quotes. Read our review of Insurify to learn more about how the company works and how it compares with The Zebra and other competitors.

Compare rates and save on insurance today.

How does Insurify work?

Insurify partners with some of the top insurers in the country, including Travelers, Nationwide, and Farmers, to offer insurance quotes for its users based on the personal information the user provides.

Insurify homepage

The shopping experience begins on Insurify's well-organized and easily navigable homepage. Those eager to begin the quotes process can get started in a variety of ways.

At any given time on an Insurify page, you can expect at least one link to its quote comparison product. Entering your information is the easiest way to begin the quoting process. Furthermore, those who have previously received quotes can retrieve them.

A 2022 update has made the website far more appealing, both visually and through the thinning of the ZIP code inputs which previously took up a large amount of real estate on the site's information-heavy blog pages. This is especially true on mobile, where product entry points took up a good portion of the screen.

Similarly, Insurify has clarified other information that had previously been confusing. The homepage currently shows the number of quotes provided as being 26 million. Former versions had shown large discrepancies, indicating both 12 million and over 30 million quotes on the same page.

The Insurify quote comparison experience

Insurify makes the process of shopping for insurance quotes fairly easy. The site begins by asking for your ZIP code, after which you are prompted to input information about your vehicle, including its year, make, model, and whether or not you are financing or own it outright.

The left-hand column includes some handy graphics that allow you to visualize your projected savings and Insurify’s confidence in the quotes they find for you. However, it’s unclear exactly what these savings are based on as they don’t ask what you currently pay.

Does Insurify offer discounts?

As you submit the required information, you can “unlock” discounts, such as for being a safe driver or for having low mileage. This gives the shopping experience something of a game-like quality. Still, it’s interesting how Insurify can assume such savings, as not all carriers honor the same discounts. It's worth noting these discounts are not exactly guaranteed.

Subsequent pages collect more information related to your driving and insurance history, including age, prior insurance, previous accidents, and other determining factors. Insurify’s “accuracy confidence” section gives a good measure of how likely you are to get an accurate quote based on the information you provide.

It’s during this process that Insurify asks for personal information, including name, address, telephone number, and email address. These required fields must be completed in order to get a quote. See our section on how Insurify handles your personal information below.

Overall, it seems highly possible that customers could get a quote in around two minutes as Insurify advertizes.

The Insurify insurance quotes page

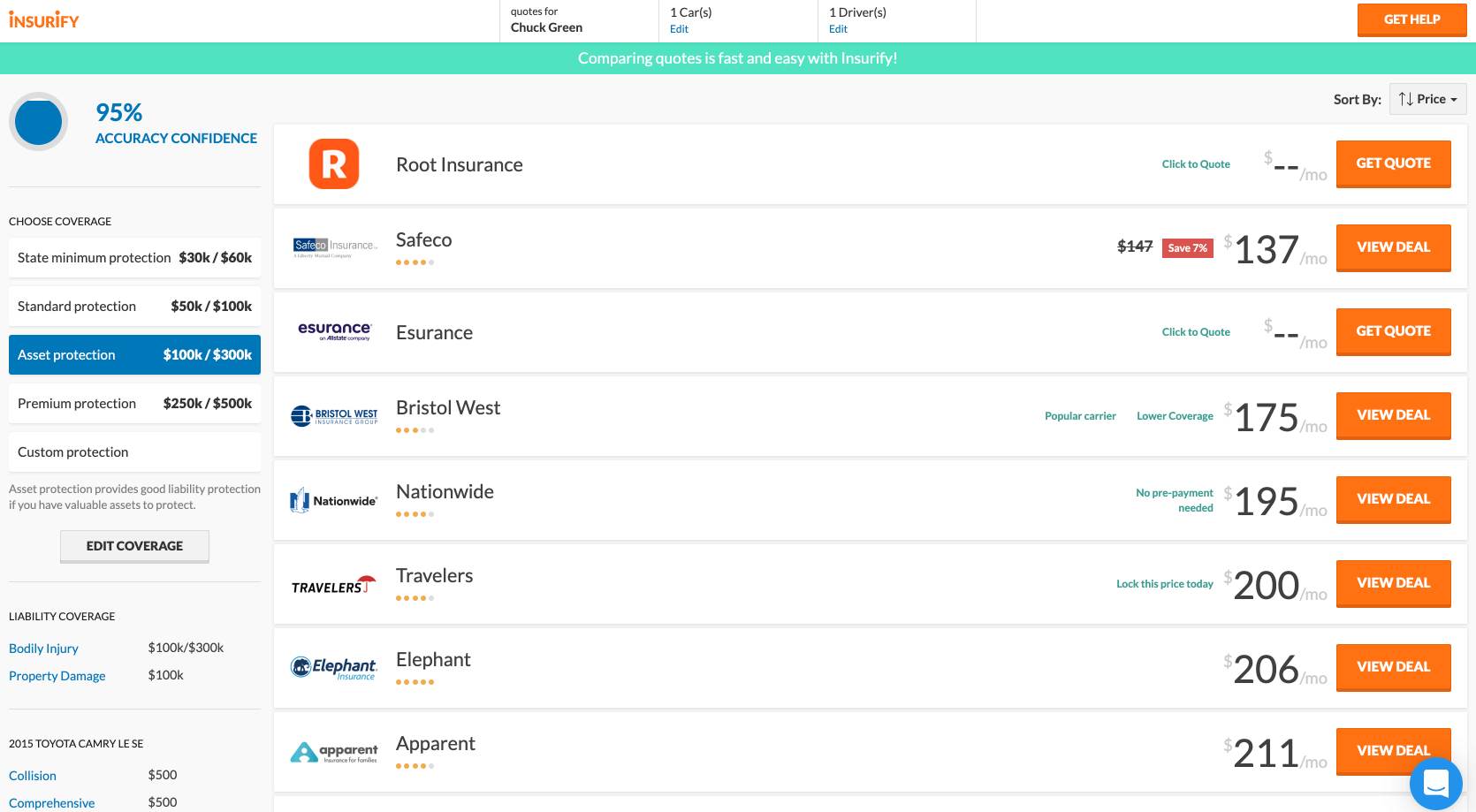

Once you’ve entered all of your information, you are taken to the quotes page. The results are clean and very easy to read. It should be noted that the confidence indicator was at 95% on the quotes page, which is fairly high.

My search turned up a number of car insurance companies and information about the policies for which I was being quoted. You can choose to have your quotes listed in a variety of different ways, sorting them by price and by what Insurify recommends.

One of the more unique features of the Insurify quotes pages is that customers have the option to change coverage options on the sidebar. This allows for a heavily customizable search experience. A toggle switch below these results allows you to “track rates.” This gives you the option to request a new car insurance quote be sent to you as often as every month.

Along with quotes from insurance carriers, Insurify offers helpful definitions of terms commonly found on a car insurance policy, including bodily injury, property damage, collision, comprehensive, roadside assistance, and car rental.

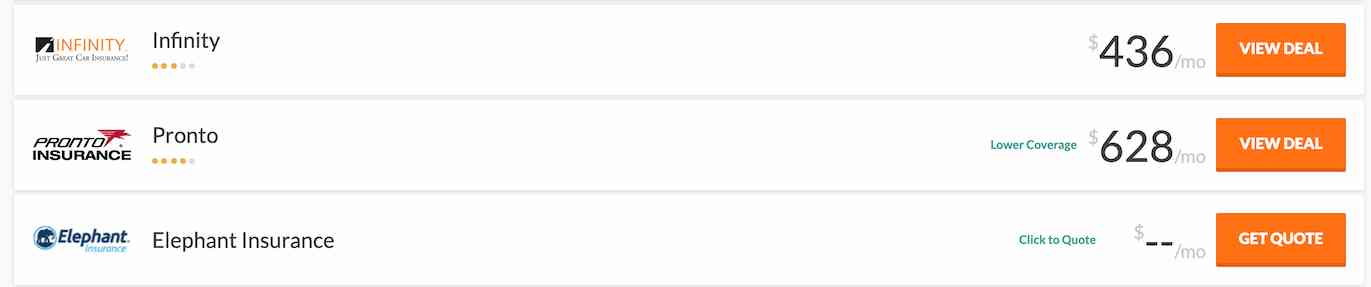

Insurify’s results are not always consistent: upon multiple distinct visits to the quotes page, Elephant Insurance appeared twice within the results, with one listing showing a quote and another displaying a blank dollar amount and urging customers to “click to quote.”

Buying an insurance policy with Insurify

Insurify’s results page returns a number of different types of results, most of which will send you to the partner site for binding. The cheapest option our tester received through Insurify was from Safeco. However, it was for a 12-month policy, not the requested six-month policy duration. It gave our tester the option to call them, have them call the tester, or to purchase the policy online. When we clicked the buy online option, it directed us to Answer Financial, an insurance agency able to finish transactions fully online or by phone.

Results from other carriers allowed us the option to “reserve” a rate and to have the carrier call at a later time. While most companies listed quotes, some did not. Instead, some insurers required users to “click to quote,” which links directly to the insurer’s website. Some customer information is carried over to the carrier site, though it’s possible that you may have to manually input your information once there. At this point, representatives from the insurance company can help you complete your policy purchase.

How does Insurify handle your personal information?

Insurify doesn’t sell personal information and has stated it does not spam customers. In recent searches, the results page no longer features ads from lead generation sites. By removing these ads, Insurify has removed the risk of a customer unwittingly clicking through to a site that most certainly utilizes spamming techniques.

Does Insurify require a phone number?

You must enter your phone number before you can see your quotes, but the company states that you never have to worry about unwanted phone calls or emails unless you opt-in to receive them.

Previous results:

Insurify life and home insurance

Insurify provides more than just auto insurance quotes. Home insurance is another area in which Insurify operates. However, this portion of the business is far less developed. The list of questions in the funnel about your dwelling has increased, making it more likely that they could provide an accurate home insurance quote. The results page is rather sparse, with only a few quotes provided from the likes of Travelers and Hippo.

The company also compares life insurance rates. This portion of their business has grown significantly over the past few years, moving from a few life insurance ads with no actual quotes to a page full of reasonably-priced policies from many top life insurance companies.

Insurify artificial intelligence

One of Insurify’s primary selling points is its use of artificial intelligence to find the best rates for customers. It’s unclear how exactly this occurs. An example of such artificial intelligence would appear to be their use of a virtual insurance agent, though the use of this seems to have been de-emphasized over the years. The company claimed that by taking a photo of your license plate with your smartphone, they would be able to match you with the best carrier for your insurance needs.

More recently, the company has talked about a proprietary software called RateRank™ that supposedly uses algorithms to match customers with the best policy. Still, based on the results page, it’s unclear how their results differ from other insurance comparison websites.

Insurify customer ratings and reviews

Insurify reviews tend to be positive. In general, customers seem to be quite happy with Insurify’s insurance shopping option. On top of an A+ rating from the Better Business Bureau, Insurify’s customer reviews are as follows:

| Rating site | Average rating |

|---|---|

| Yelp | No ratings |

| Shopper Approved | 4.8 |

| Trustpilot | No ratings |

| Clearsurance | 3.8 |

Which insurance quote comparison site is best?

If you’re on the hunt for a new auto or home insurance policy, it pays to shop around. While there’s no shortage of comparison websites claiming to provide the best insurance quotes, if you want attention to detail and a great customer service experience, The Zebra is a great choice.

With an easy-to-use website and licensed in-house insurance agents, The Zebra can make finding the best insurance rates much easier. That, paired with a commitment to keeping your personal information secure, means that you can put your confidence in The Zebra to help you find a policy that fits your needs.

Insurify FAQs

Insurify partners with some of the top insurance companies to give you real-time, side-by-side quotes, much like The Zebra. Policies can be purchased online or by calling the insurance companies themselves and providing the reference number for the quote. The site is free and relatively easy to use, though customers looking for home and life insurance quotes could find themselves with fewer options as Insurify is still working to build up this portion of their business.

The Zebra and Insurify operate in very similar ways, both offering real insurance quotes from a number of different companies. However, The Zebra is the largest direct quotes insurance comparison site with a much larger customer base and close relationships to most of the top insurance companies.

Both The Zebra and Insurify operate in-house insurance agencies, which can sell policies directly to customers. Both can spend time answering complex questions and lead you to the right policy for your needs.

While both companies claim to operate on a no-spam basis, only The Zebra forgoes the phone number requirement, meaning its users can't receive follow-up calls.

Pros of Insurify

Insurify has an easy-to-use interface and gets great customer reviews. They work with a number of top insurers to provide car insurance quotes. They also allow users to significantly personalize policy details to receive quotes that fit what the customers actually need. More recently, they've branched out into life insurance and offer many options for consumers looking for a term life policy.

Cons of Insurify

Insurify requires users to submit a phone number in order to get quotes, which may put some customers off. Lastly, those seeking home insurance on the site will inevitably be disappointed at having fewer options.

Compare quotes and start saving!

Methodology:

We used a profile of a single, 30-year-old male who was employed full-time. The sample driver insured a 2015 Toyota Camry and had one at-fault accident on their record in the past three years.

Related Content

- What is Collision Insurance?

- What is No-Pay, No-Play Insurance?

- What is Reinsurance?

- What is Standard vs. Non-Standard Insurance?

- Does Auto Insurance Cover Preexisting Damage?

- Does Auto Insurance Follow the Car or the Driver?

- Proof of Insurance

- Property and Casualty Insurance

- What is SR-22 Insurance?

- What is No-Fault Insurance?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.