What is the Average Cost of Auto Insurance in Florida?

The average cost for car insurance in Florida is $1,445. Average costs range from $1,013 with Travelers to $1,877 with Direct General Insurance.

Florida auto insurance rates — what to know

Auto insurance is expensive in Florida. The average car insurance rate in Florida is $1,878 per year — 31.6% more than the U.S. average.

But auto insurance prices are dictated by factors other than state lines. Auto insurance premiums consider a number of components, including your driving record, credit history, gender, age, and marital status.

We analyzed average annual premiums in Florida for some common rating factors. See below how much car insurance costs in the Sunshine State, or enter your ZIP code to receive personalized quotes from popular companies.

Average auto insurance rates in Florida by age

It’s a fact of life: as you age, your auto insurance premiums change. Generally speaking, car insurance is more costly for teenage drivers, as insurers see inexperienced motorists as less responsible.

In Florida, car insurance runs $5,984 per year for a 16-year-old driver and only $1,641 yearly for a driver aged from 50 to 60.

Compare insurance rates quickly and easily.

FLORIDA AUTO INSURANCE COSTS BY AGE

| Age | Average Yearly Rate |

| 16 | $5,983.52 |

| 17 | $5,604.02 |

| 18 | $4,855.11 |

| 19 | $3,805.73 |

| 20s | $2,366.51 |

| 30s | $1,793.60 |

| 40s | $1,755.86 |

| 50s | $1,640.71 |

| 60s | $1,672.37 |

| 70s | $2,028.20 |

Florida is the 20th least expensive state in which to buy auto insurance for a 16-year-old.

Average car insurance costs by gender in Florida

While gender isn't as major a contributor to auto insurance costs as a driver's location or age, it is used as a rating factor by car insurance companies.

If you aren't getting the best value for your money with your current auto insurance company, compare rates and get quotes online.

Florida auto insurance prices for men vs women

| Gender | Average Yearly Cost |

| Male | $1,803.59 |

| Female | $1,837.69 |

Average auto insurance premiums in Florida by marital status

A benefit of entering wedlock — aside from the honeymoon — is the price cut you typically receive on your auto insurance. In Florida, wedded motorists save $81 annually on auto insurance policies. This is a better deal than the national savings of $76.

| Marital Status | Average Annual Rate |

| Single | $1,803.59 |

| Married | $1,722.90 |

| Divorced | $1,803.59 |

| Widowed | $1,762.38 |

Average car insurance costs by coverage level in Florida

The amount you pay each month for auto insurance depends on the level of coverage you carry. It's important to understand car insurance coverages carefully to ensure you are properly protected. Liability coverage typically costs less, while low-deductible comprehensive coverage costs more. In Florida, the price gap between liability-only coverage and comprehensive coverage with a $500 deductible is $690.

See the table below for average car insurance rates by coverage options, limits, and deductibles.

FLORIDA CAR INSURANCE PREMIUMS BY COVERAGE TYPE

| Coverage Level | Average Yearly Premium |

| $100K/$300K/$100K Bodily Injury/Property Damage — Liability Only | $1,414 |

| $100K/$300K/$100K Bodily Injury/Property Damage — $1,000 Comprehensive/Collision | $1,963 |

| $100K/$300K/$100K Bodily Injury/Property Damage — $500 Comprehensive/Collision | $2,107 |

| $50K/$100K/$50K Bodily Injury/Property Damage — Liability Only | $1,210 |

| $50K/$100K/$50K Bodily Injury/Property Damage — $1,000 Comprehensive/Collision | $1,759 |

| $50K/$100K/$50K Bodily Injury/Property Damage — $500 Comprehensive/Collision | $1,903 |

| State Minimum — Liability Only | $822 |

| State Minimum — $1,000 Comprehensive/Collision | $1,369 |

| State Minimum — $500 Comprehensive/Collision | $1,512 |

If you're facing above-average auto insurance costs, it's worth comparing options to discover reasonably priced coverage that suits you.

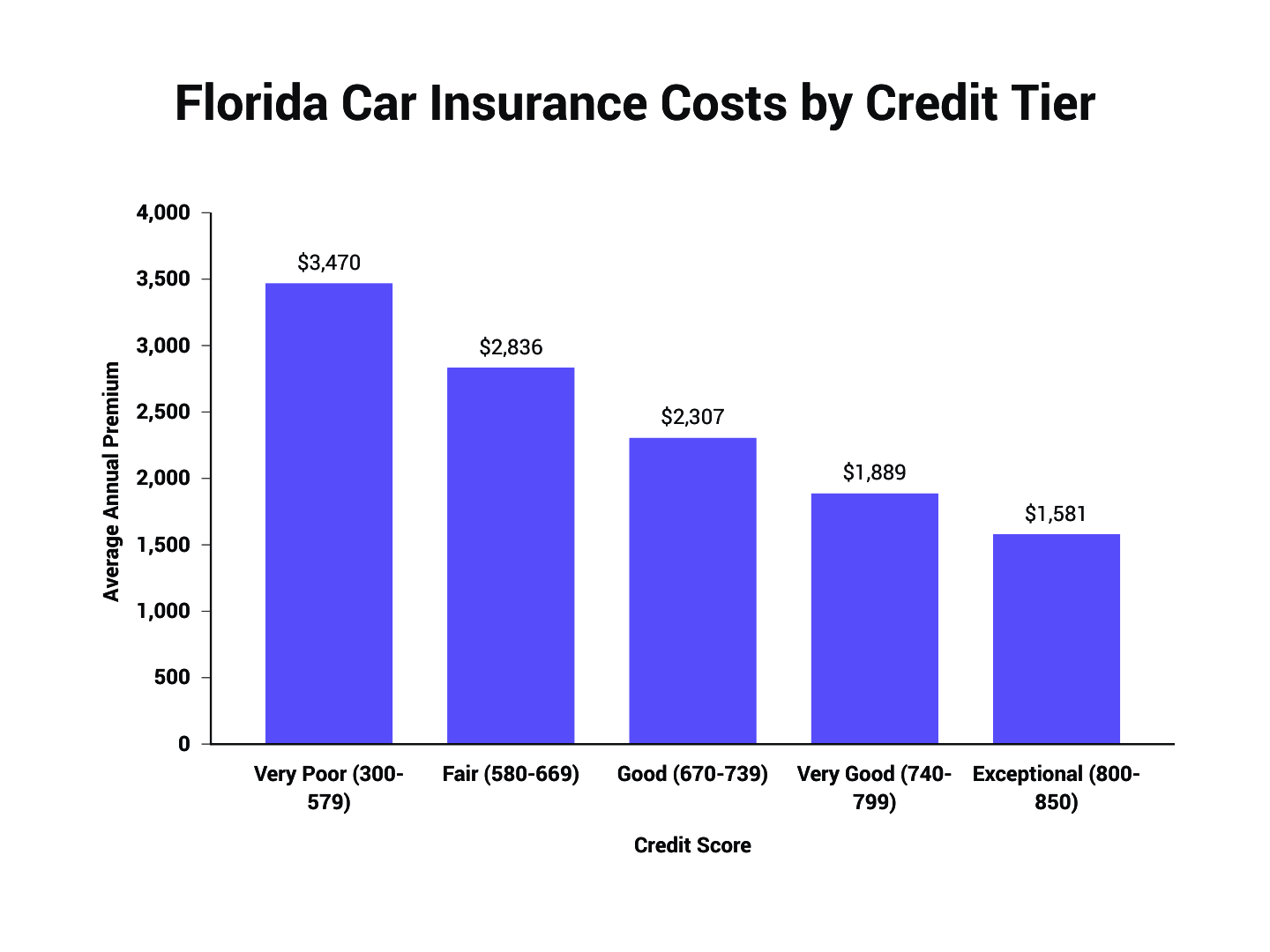

Average auto insurance rates in Florida by credit history

Auto insurance underwriters use credit history to predict a potential customer's reliability. Trended data show drivers who hold exceptional credit are often more dependable car insurance customers: they less commonly file claims for which insurance companies pay.

In Florida, a driver who maintains an exceptional credit score saves $1,889 per year in car insurance premiums, compared with a driver who has a poor credit rating.

Finding affordable car insurance with bad credit is difficult. But we're here to provide some help. Review our guide to getting car insurance with poor credit and start saving!

Average car insurance costs for high-risk drivers in Florida

If you are at fault in a collision or convicted of a driving offense, your car insurance premiums will probably rise. The more violations you accumulate, the more expensive your car insurance becomes.

In Florida, your first minor at-fault accident costs $598 each year in auto insurance payments. A DUI — considered one of the most grievous driving offenses — will raise your insurance rates in Florida by an average of $861.

FLORIDA CAR INSURANCE PREMIUMS AFTER TICKETS

| Age | Average Yearly Rate |

| DUI | $2,739.96 |

| Reckless Driving | $2,715.59 |

| At-Fault Accident (<$1,000) | $2,476.08 |

| At-Fault Accident ($1,000-$2,000) | $2,584.21 |

| At-Fault Accident (>$2,000) | $2,476.08 |

| Open Container | $2,315.21 |

| Speeding (21-25 MPH > limit) | $2,425.34 |

| Speeding (16-20 MPH > limit) | $2,425.34 |

If you're facing above-average car insurance costs, consider weighing your options to find affordable coverage that fits your budget.

Get personalized insurance rates in less than 5 minutes.

Related content

- Palm Bay, FL Car Insurance

- Car Insurance in Orlando, FL

- Car Insurance in Hollywood, FL

- High-Risk Driver Car Insurance in Florida

- Car Insurance in Boca Raton, FL

- Pembroke Pines, FL Car Insurance

- Car Insurance in St. Petersburg, FL

- Davie, FL Car Insurance

- Car Insurance in Jacksonville, FL

- Plantation, FL Car Insurance

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.