How Much is Car Insurance in New York?

New York auto insurance rates — what to know

The average car insurance rate in New York is $1,582 per year — nearly 11% more than the national average.

Auto insurance rates are affected by factors aside from geography. Auto insurance premiums are based on an array of considerations, including a driver's marital status, driving history, credit rating, gender and age. We analyzed average New York State auto insurance rates by each of the most common rating factors.

Continue reading to learn how much auto insurance costs in each location — or enter your ZIP code to see personalized quotes from top insurance companies.

Average New York auto insurance rates by age

It's a common phenomenon: as a driver grows older, their auto insurance rates get cheaper. Auto insurance is typically costly for teenage drivers, as car insurers see inexperienced drivers as risky.

In New York State, car insurance coverage costs $5,370 annually for a 16-year-old driver and only $1,347 per year for a client in their 50s.

Find the right policy in only a few minutes.

NEW YORK CAR INSURANCE COSTS BY AGE

| Age | Average Annual Premium |

| 16 | $5,369.60 |

| 17 | $5,542.77 |

| 18 | $4,509.16 |

| 19 | $3,368.45 |

| 20s | $1,898.06 |

| 30s | $1,436.29 |

| 40s | $1,391.62 |

| 50s | $1,347.40 |

| 60s | $1,389.33 |

| 70s | $1,541.22 |

If you're shopping for car insurance for a teen driver, New York is the 14th cheapest state in which to buy auto insurance for a 16-year-old.

Average auto insurance rates by gender in New York

While gender doesn’t have as significant an impact on car insurance prices as a driver's location or age, it is used as a rating factor by car insurance companies.

In order to get the best possible value from your auto insurance policy, the best course of action is to compare offerings from a variety of insurance companies.

New York auto insurance rates for men and women

| Gender | Average Annual Rate |

| Male | $1,443.92 |

| Female | $1,467.38 |

Average auto insurance premiums in New York by marital status

One benefit of marriage — aside from the wedding gifts — is the price cut a driver receives on car insurance. In New York, married drivers save $45 per year on auto insurance. This is less than the national average savings of $76 for married drivers.

NEW YORK CAR INSURANCE RATES BY MARITAL STATUS

| Marital Status | Average Annual Premium |

| Single | $1,443.92 |

| Married | $1,399.06 |

| Divorced | $1,424.47 |

| Widowed | $1,424.47 |

Auto insurance for divorced drivers in New York is the 17th most expensive in the nation. If you're overpaying for your car insurance, don't hesitate to shop around. You could save big!

Average auto insurance costs by coverage level in New York

The amount a driver is charged each month for car insurance depends on how much protection they carry. Liability-only coverage generally is less expensive, while low-deductible comprehensive coverage costs more. One way to avoid costly car insurance payments is to compare quotes and find higher-deductible coverage that meets your needs and fits your budget.

NEW YORK CAR INSURANCE PREMIUMS BY COVERAGE

| Coverage Limits/Level | Average Annual Premium |

| $100K/$300K/$100K Bodily Injury/Property Damage — Liability Only | $1,092 |

| $100K/$300K/$100K Bodily Injury/Property Damage — $1,000 Comprehensive/Collision | $1,730 |

| $100K/$300K/$100K Bodily Injury/Property Damage — $500 Comprehensive/Collision | $1,895 |

| $50K/$100K/$50K Bodily Injury/Property Damage — Liability Only | $983 |

| $50K/$100K/$50K Bodily Injury/Property Damage — $1,000 Comprehensive/Collision | $1,621 |

| $50K/$100K/$50K Bodily Injury/Property Damage — $500 Comprehensive/Collision | $1,786 |

| State Minimum — Liability Only | $887 |

| State Minimum — $1,000 Comprehensive/Collision | $1,525 |

| State Minimum — $500 Comprehensive/Collision | $1,690 |

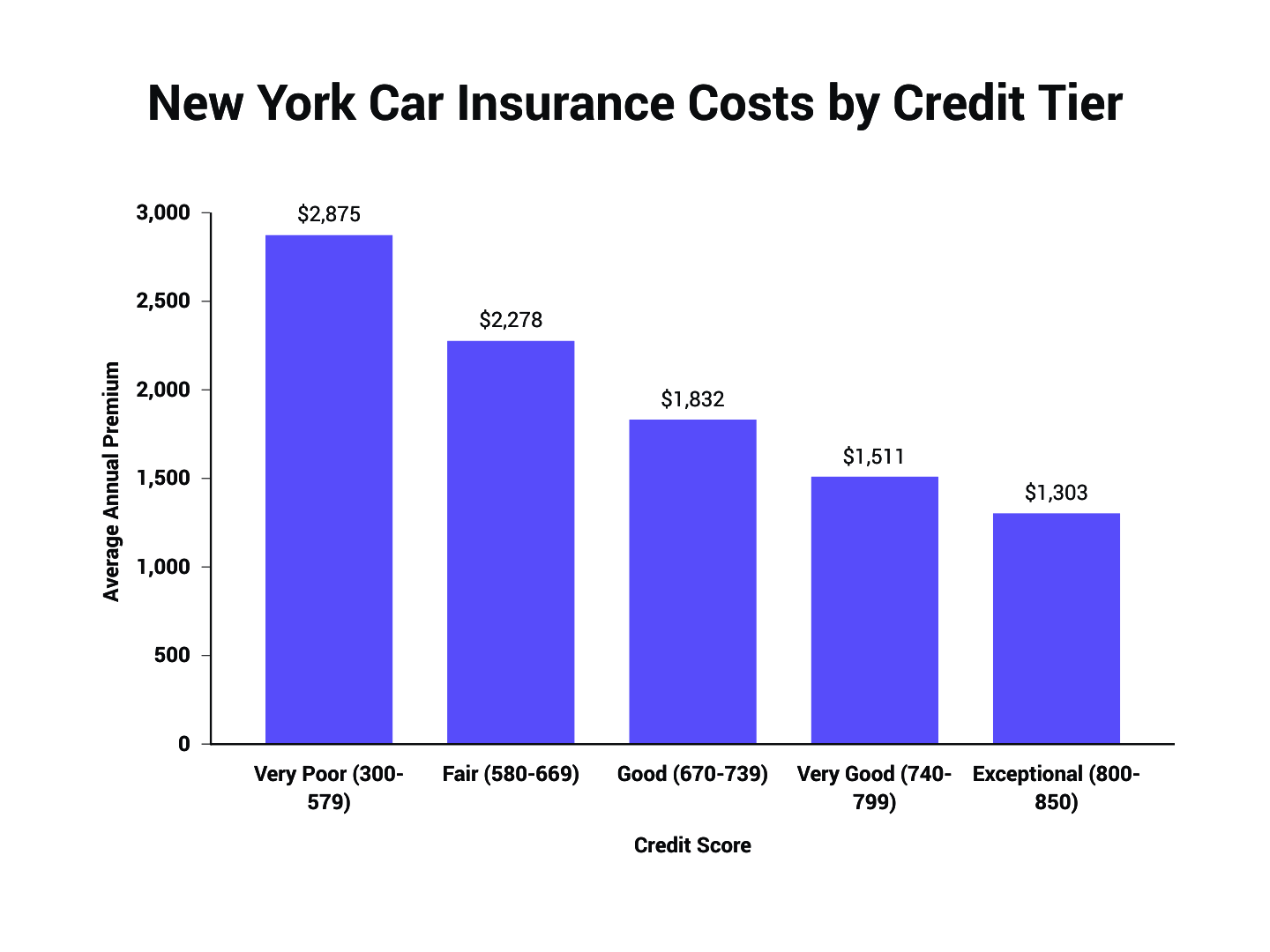

Average auto insurance rates in New York by credit history

Car insurers use credit history to gauge the reliability of a prospective customer. Historical data show motorists who carry superior credit are more dependable car insurance customers: they less commonly file claims.

In New York State, a driver with excellent credit saves $1,571 per year in auto insurance premiums, compared to a driver saddled with a poor credit history. Read more about how credit score affects auto insurance expenditures:

Finding affordable auto insurance with a bad credit history can be difficult. Read our tips on getting auto insurance with bad credit.

Average car insurance costs after speeding tickets and violations in New York

If you’re found at fault after a driving incident or convicted of a driving infraction, your insurance rates are bound to grow. The more violations a driver accumulates, the more expensive car insurance gets.

In New York, a driver's first minor at-fault accident will lead to an extra $70 per year in auto insurance premiums. A DUI — thought of as one of the most serious driving infractions — can raise your yearly insurance rates in New York by as much as $645.

NEW YORK AUTO INSURANCE PRICES AFTER TICKETS

| Violation | Average Yearly Rate |

| DUI or DWI | $2,228 |

| Reckless Driving | $2,524 |

| At-Fault Accident (<$1,000) | $1,512 |

| At-Fault Accident ($1,000-$2,000) | $1,993 |

| At-Fault Accident (>$2,000) | $1,940 |

| Open Container | $1,553 |

| Speeding (21-25 MPH > limit) | $1,581 |

| Speeding (16-20 MPH > limit) | $1,581 |

If you're dealing with expensive auto insurance after a ticket, consider comparing rates to find cheap car insurance coverage that meets state minimum requirements.

Make an informed decision: compare insurance quotes today.

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.