Car Insurance for Drivers with Bad Credit

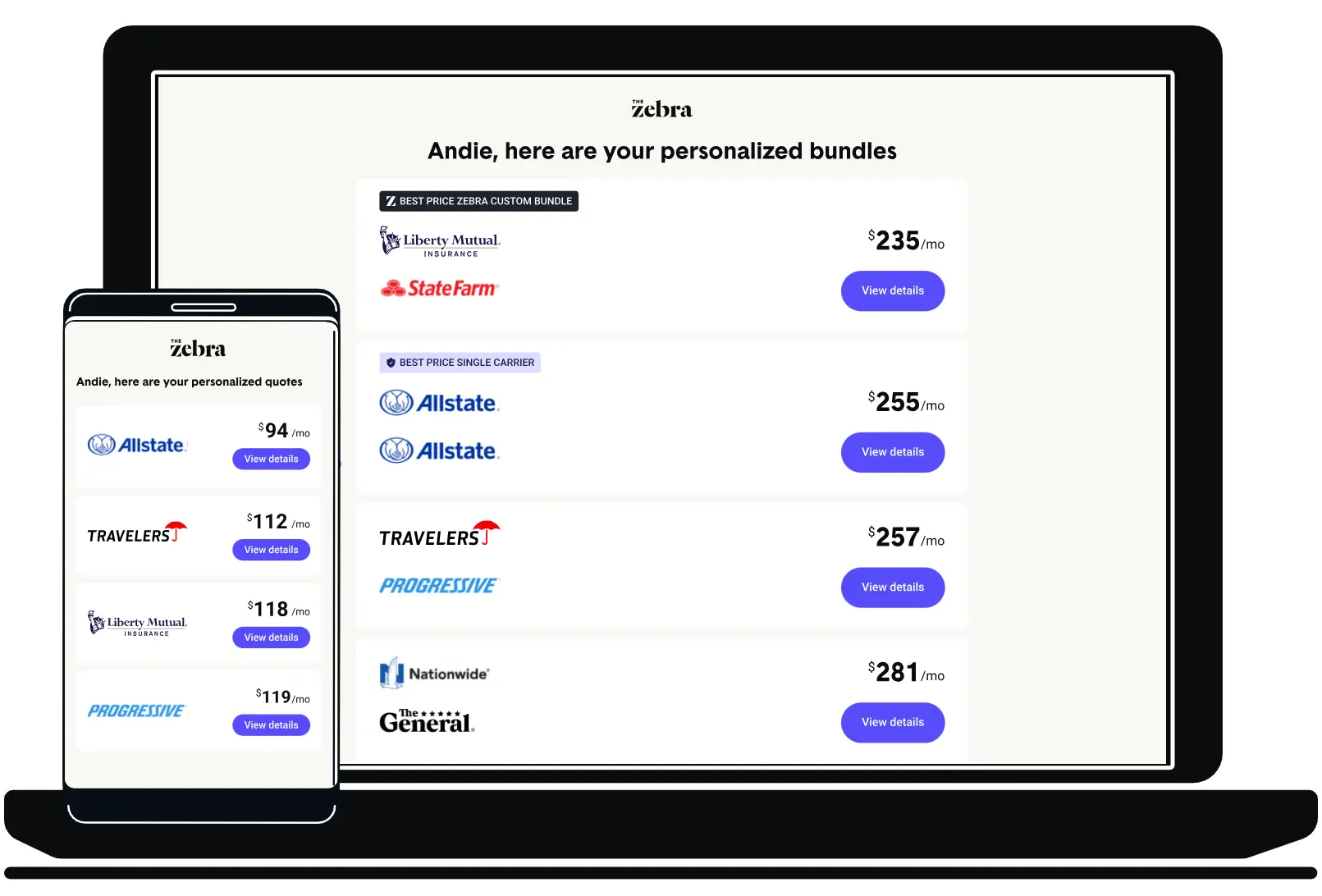

Use The Zebra to get insurance quotes with bad credit from GEICO, Nationwide, Progressive and Allstate (+100 other companies)

Best cheap car insurance for drivers with bad credit

If you're looking for cheap car insurance with a less-than-perfect credit score, you're not alone. About 14% of The Zebra's customers have a poor credit score, and as of 2024, our research shows that these drivers (with scores between 300 and 579) pay around $126 more per month than those with very good credit (scores between 740 and 799).

But there's hope! According to The Zebra's analysis, these top insurance companies are offering more wallet-friendly options for those with bad credit. Let's dive in and find the right fit for you.

Nationwide is the most affordable option with an average rate of $165 per month for drivers with poor credit.

Among major carriers, GEICO is one of the cheapest for drivers with poor credit, coming in at $181 per month.

Only slightly higher than Nationwide, USAA comes in third place for drivers with poor credit with rates of $199 per month.

Key Takeaways

- Nationwide, GEICO and USAA are the best options for cheap car insurance with bad credit

- Drivers with poor credit pay about 93% more for auto insurance than drivers with very good credit

- Compare a variety of companies to find the best rate, including smaller lesser-known carriers

- You may be able to save by asking about discount options, such as telematics

| Company | Avg. 6 Mo. Premium | Avg. Monthly Premium |

|---|---|---|

| Nationwide | $992 | $165 |

| GEICO | $1,087 | $181 |

| USAA | $1,196 | $199 |

| Farmers | $1,362 | $227 |

| Allstate | $1,717 | $286 |

| Progressive | $1,858 | $310 |

The Zebra’s Dynamic Insurance Rating Tool data methodology

The Zebra’s Dynamic Insurance Rating Tool for home and auto insurance rates utilizes the latest ZIP code-level rate filings from across the U.S., sourced from Quadrant Information Services and S&P Global. These filings, typically updated annually or biennially by insurers, are verified through Quadrant’s QA process and then integrated into The Zebra’s estimator.

The displayed rates are based on a dynamic home and auto profile designed to reflect the content of the page. This profile is tailored to match specific factors such as age, location, and coverage level, which are adjusted based on the page content to show how these variables can impact premiums.

For a comprehensive understanding, see our detailed methodology.

Using a profile (check out our methodology), we surveyed six top insurance companies to see which company offered the cheapest rates for drivers with generalized credit scores.

Drivers with poor credit (between 300 and 579) pay an average of $262 per month for auto insurance, across the surveyed insurers. That comes out to over $3,000 per year, or 93% higher than a driver with very good credit (between 740 and 799).

Nationwide is the cheapest insurance company for car insurance for a driver with a credit score of 579 or less, based on our specific user profile, which likely doesn't fit yours perfectly. The best way to find cheap auto insurance with bad credit is to compare rates from as many insurers as possible.

Find an affordable policy today by comparing quotes.

Insurance rates by credit score

Reference the chart below to see the degree to which your credit score influences how much you pay for an auto insurance policy. Or, enter your Zip Code above to get personalized quotes in minutes.

Why do my credit score and history matter?

Insurers are like detectives, gathering various clues to figure out how risky for the company it might be to cover you. One of these clues is your credit rating.

They've noticed a trend: folks with lower credit scores tend to file more claims than those with top-notch credit. So, your credit score is one of the tools insurers use to understand your driving risk, along with other factors like your age, gender and where you live.

When drivers with not-so-great credit do file a claim, it usually costs the insurance company a bit more than claims from people with better credit. This means drivers with higher credit scores are generally less expensive to insure, leading to lower premiums for them.

Good news, though! When you shop for car insurance, the credit checks are 'soft inquiries', which don't affect your score. So, you can compare options worry-free. Just be honest with your details. As you finalize your quote, your premium gets fine-tuned to reflect your credit and driving record.

Stay in touch and subscribe!

Get advice, insights and tips from our newsletter.

How to save on rates if you have bad credit

Your credit score plays a big role in your car insurance rates, and it will be tough to make up the difference with a few discounts, but every little bit counts when it comes to saving money. Let's dive into some smart ways to save on car insurance, even with a not-so-great credit score.

Individually, discounts on car insurance tend to be small. But if you qualify for multiple discounts and stack them, it can lead to some not-insignificant savings:

- Bundling discounts

- Good driver discount

- Electronic signature, paperless discount, payment by bank (EFT)

- Affinity membership (discount based on your organization's loyalties)

Being smart with your claims means you shouldn't file a claim unless the damages to your vehicle are greater than the rate increase you might receive in return.

Let's say you’re a driver in Texas who gets into an at-fault accident. The estimate for the repairs is $1,700. Last year, at-fault accidents raised car insurance rates by an average of $767 per year — and most insurance companies will charge higher rates for at least three years after a violation or claim hits your driving record.

This $767 will amount to over $2,300 in total rate increases. If you include a typical $500 deductible, the average total cost of this claim would be over $2,800.

In this scenario, you would save yourself over $1,100 by paying out-of-pocket for the $1,700 in damage.

So, when deciding whether or not to file a claim, we suggest comparing the estimated cost of repairs to what you would end up paying after your rate is increased. It just might not be worth it.

Unlike a fine wine, your car's worth depreciates rapidly. What this means in terms of savings is that the insurance coverage you once had on your 1999 Geo might not be necessary anymore. Here is how to decide on coverage:

- Do you have a loan on your vehicle?

Vehicles that have a lien or loan are usually required to maintain physical coverage as the lienholder has a vested interest in the vehicle. - What’s the value of your vehicle?

You can determine this through Kelley Blue Book or NADA. Our general rule of thumb is that if your vehicle is worth less than $4,000, you should drop your collision coverage and potentially your comprehensive. These coverages are optional if you own your vehicle and are designed to protect its physical integrity. If the car isn't worth very much, you could be paying for coverage you do not need. If you decide to drop both of these coverages, consider adding uninsured and underinsured motorist coverage. If you need to keep these coverage options, consider raising your deductible. Because they are inversely related, a higher deductible will equal a lower premium.

Follow our lead and shop with as many companies as possible to find the cheapest rate for you. Don’t be afraid to consider non-standard companies.

It's easy to go for the names of insurance companies you're used to seeing on billboards and in the media, but there are many smaller, regional carriers or just names you've never heard of that might be more willing to work with you despite your credit (and possibly offer you better rates).

Here at The Zebra, we compare hundreds of companies to find the best coverage for you with the right company, not just the most well-known name.

Zebra Tip: Get started with a policy sooner rather than later

If you don't have car insurance yet and are worried about your credit making things expensive, it can benefit you to take the leap and buy a policy. One of our insurance experts here at The Zebra, Erick Sosa, shared his best advice for drivers with poor credit looking for reasonably priced car insurance.

"My best advice for those with poor credit is to just get started: buy a policy and make sure it stays active and paid. When you're first insured with a low credit score your prices will be higher than someone with good credit. However, staying consistently insured (without accidents or tickets) will help offset the extra expense because insurance companies will typically give substantial discounts to those with at least six months of continuous coverage."

Erick Sosa — Licensed insurance professional at The Zebra

Which car insurance companies don’t use your credit score?

This is a great question, but it's actually less about companies and more about states. Your location plays a significant role in how your car insurance rates are determined.

In places like California, Hawaii, Michigan and Massachusetts, your credit score won't affect your insurance premiums, as these states prohibit using credit scores for this purpose. Every state has its own rules and regulations, but in most parts of the U.S., auto insurance companies will consider your credit report when setting your car insurance rates.

For drivers who are working to improve their credit score, there are innovative insurance options available. Telematics-based insurance companies, for example, focus on your driving habits rather than just your credit score. They use data from your actual driving to calculate your premiums. This means that if you're a cautious and responsible driver but have a credit score that's not quite where you want it to be, telematics insurance could be an excellent choice for you.

Can I be denied coverage because of my credit?

Yes, any insurance company has the right to deny coverage. Likely, poor credit won't be the only reason you're denied auto insurance, but it can be a major contributing factor. Other factors that may lead to denial of coverage can include:

- Poor driving record

- Not enough driving experience

- Certain high-risk locations

- Certain vehicle types

If you're unable to get traditional coverage after looking at multiple companies, there are high-risk options you can consider. You can take other steps to become less risky to insurers, such as driving a safe vehicle, taking a defensive driving course, avoiding citations and driving safely, and, of course, working to improve your credit.[1]

It's also a good idea to confirm the laws of your specific state since insurance is not regulated at a federal level. The Insurance Information Institute offers a comprehensive list of all 50 states and their insurance department contact information.

Rates for drivers with bad credit by location

Below is a state-by-state breakdown of how much a poor credit report can impact your annual car insurance premium. On average, there is a $1,667 — slightly over 100% — difference in average insurance rates between drivers with very poor credit and drivers with exceptional credit. If you have bad credit, you can expect to pay double the premium a driver with great credit would.

Click on your state below to learn more.

Choose a car insurance company by comparing rates side-by-side.

How to improve your credit score

As we've mentioned, your credit score isn't the only factor that goes into your car insurance rate. But it will likely be an important part of the equation. Improving your credit score takes time, but there are things you can do to help it along.[2]

- Get started now: Bad credit can make things challenging, but so can a complete lack of credit history. The longer you can show you've been responsible with your credit, the better.

- Make payments on time: This is key — make any payments you have on time, every month. Setting up automatic payments can make this easy so you don't forget.

- Don't max out your credit: Just because a credit card will give you a large balance doesn't mean you should use it all. If you can pay off your balances each month, this is a great strategy to improve your score.

- Only apply for what you need: Be thoughtful about applying for new credit, and don't go overboard. Applying for multiple lines of credit in a short time can be a red flag for lenders.

- Check your credit reports yearly: You have the right as a consumer to request your credit report every year, and it's a great idea to keep an eye on your various accounts to make sure nothing is fraudulent or incorrect.

Frequently asked questions

Related Content

- Low-Income Car Insurance

- Car Insurance for High-Mileage Drivers

- Car Insurance with No Credit History

- Car Insurance for Recent Graduates

- Car Insurance for Students

- Car insurance for Low-Mileage Drivers

- Car Insurance for Drivers with Disabilities

- Car Insurance for Foreign Drivers in the U.S.

- Car Insurance for Drivers with Good Credit

- How Does Bankruptcy Affect Car Insurance Rates?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.