How to Read a Renters Insurance Policy

Learn where to find important details like your policy number and coverage limits as well as what to look for in the fine print of your renters insurance policy.

What's inside your renters policy?

Your renters insurance policy documents contain all of the important information about your coverages, policy limits, covered perils and exclusions. While it may seem overwhelming to read the whole policy, there are some sections that contain information that you should know.

Consult our guide below to learn more about what's in your renters insurance policy.

What is a renters insurance declaration page?

The declaration page — sometimes called a dec page — is where you’ll find the basic coverages of your renters policy. It is supposed to provide you with a summary of your coverage types, limits, endorsements, billing information, and details about the insured property for quick reference.

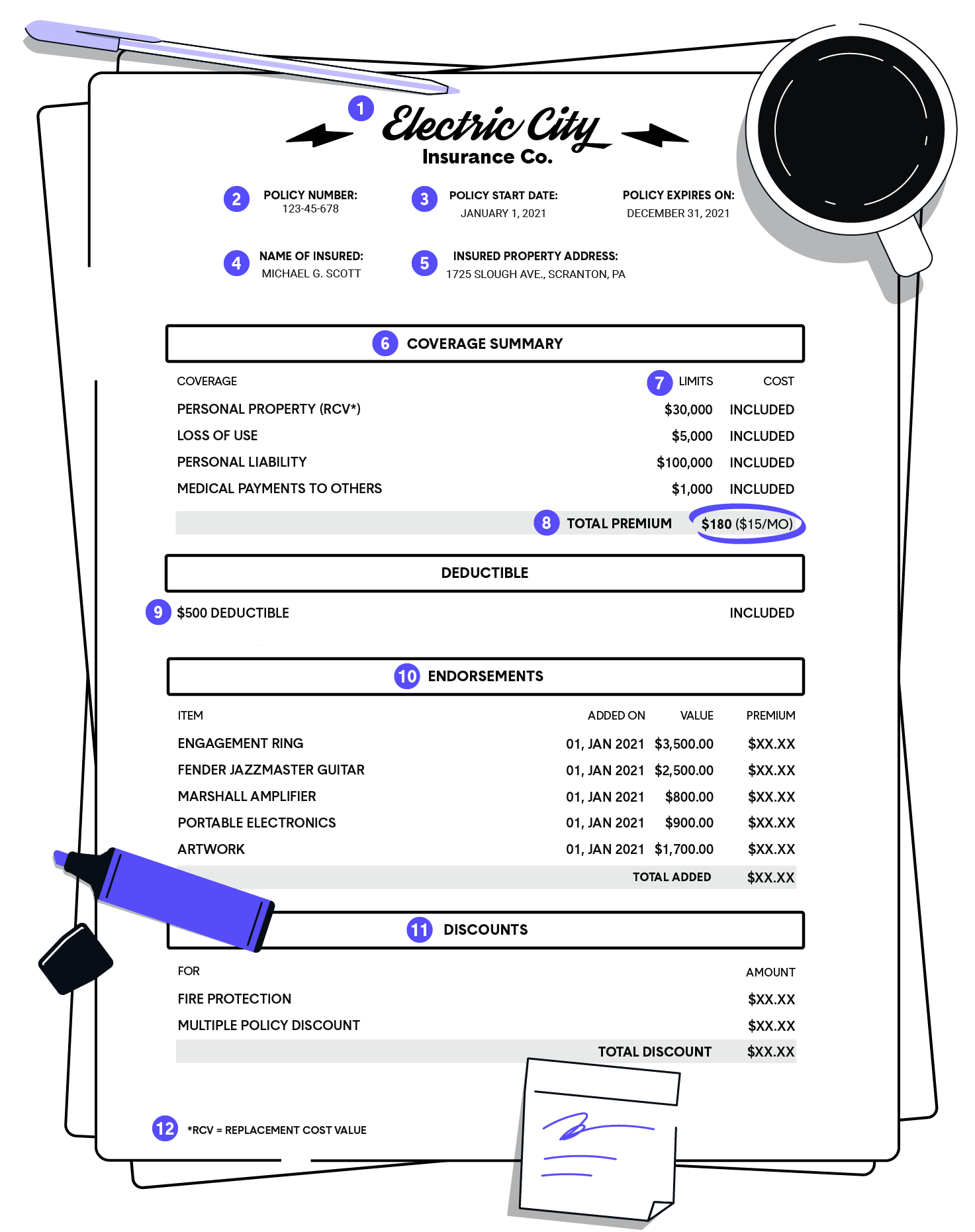

See the below example along with explanations for each section of your renters declaration page beneath it.

Your company's name and business address.

This is your individual policy number. You will need this in order to make a claim.

This shows the dates between which your policy is active.

This is the physical address covered by the renters insurance policy.

This is where your basic rental coverages are listed. For renters, this includes personal property, personal liability, medical payments and additional living expenses (loss of use).

This is the amount that each coverage type will cover.

This is how much you must pay each month, including any endorsements and discounts.

This is how much you must pay before your coverage kicks in. Damages less than this amount should be covered out of pocket.

These are additional items that have been added at an additional cost. Scheduled items can typically be added on for less than a dollar per month — depending on value. Other renters insurance endorsements can include water damage coverage, etc. Those with valuable collectibles should seek additional coverage to fully protect those items.

Some renters insurance companies offer discounts for fire protection, security systems (alarms, deadbolts, etc.) and for bundling with car insurance.

Your personal property may be covered at replacement cost value or actual cash value (ACV). Replacement cost coverage replaces your belongings up to the full cost of replacement, while ACV factors in depreciation and will only pay what the item is currently worth.

What else is in a renters insurance policy?

Beyond the declarations page is when the fine print starts. While it can be somewhat intimidating to wade through multiple pages of insurance lingo, there are some important pieces of information inside that you should know*.

The specifics will vary depending on your insurer, but the following are generally included in most renters policies.

What's in the fine print

- Coverage types: Oftentimes you’ll find specific explanations of each of the above coverage limits. This often includes special limits of liability for certain types of property. Furthermore, you may find more detailed information about what is included in your loss of use or liability coverage.

- Perils insured against: This lays out — often in great detail — what is considered a covered loss. When you start your policy, it’s always a good idea to know your insurance company’s covered perils to avoid having a claim denied.

- Exclusions: These exclusions may refer to perils, property types or people not covered by the policy.

- Insurance definitions: If you’re unsure of any of the wording your policy is using, it’s likely defined here. Furthermore, they may go into more detail about insurance terms such as “bodily injury” and “property damage.”

- Conditions: This is typically where insurance jargon and legalese combine to spell out the fine details of your policy. While it may seem indecipherable at times, the basic purpose of this section is to explain the responsibilities that both you and your insurer have in regard to payments and claims.

- Endorsements: While your endorsements — or riders — are listed on your dec page. This section will typically go into far greater depth about the specifics of each endorsement, including info on perils and exclusions.

- Disclosures and notices: Depending on your state and policy type, the space at the end of your policy documents typically feature notices in regards to fraud, state regulations and credit information.

*If you are uncertain about any part of your policy, we advise speaking with your insurance agent or contacting a lawyer who may help clarify certain clauses.

What does my renters policy cover?

What your policy usually lists as covered:

- Personal property coverage (your possessions up to your limit)

- Loss of use coverage (hotel stays, meals, etc. if your unit is uninhabitable due to a covered peril)

- Liability coverage (you or your pet damage someone's property or cause them bodily injury)

- Medical payments coverage (

What your policy usually lists as an exclusion:

- Intentional damage

- Flood or earthquake damage

- Pest or bug damage or infestations

- Damage to the physical structure of your rental unit

Reading your renters insurance policy: considerations

While it may seem tedious, knowing what’s in your renters policy can ensure that you and your personal possessions are fully covered. Take a moment to study your renters policy to find the key features we've listed and help prevent headaches down the line.

Think you might need a new policy?

If you are considering getting a new renters policy, we recommend speaking with a friendly member of The Zebra's insurance agency. Not only are they knowledgeable about the nuances of insurance policies, but they can help you compare quotes from both large and small insurers ensuring you get the lowest price. Give them a call at 1-888-444-2833 to get started.

Or, get a single quote from our friends at Lemonade below. While Lemonade is not a quote comparison engine, the company specializes in hassle-free renters insurance that is a great fit for many renters. Click below to get a quote in as little as 90 seconds.

| Aspect | Answer |

|---|---|

| Availability | AZ, AR, CA, CO, CT, DC, FL, GA, IL, IN, IA, MD, MA, MI, MO, NV, NJ, NM, NY, OH, OK, OR, PA, RI, TN, TX, VA, WA, WI |

| Rates | Usually only $5-$10 per month |

| Discounts (state-dependent) | Security-related (e.g. deadbolts, alarms), bundling (e.g. with pet insurance), paid-in-full |

| Basic Coverage Options | Highly customizable through their app |

| Extra Coverage (Scheduled Personal Property Coverage) | You can add Extra Coverage (with a $0 deductible and coverage for mysterious loss and accidental damage) for jewelry, fine art, cameras, bicycles, and musical instruments. |

| Claims process | Convenient and quick online claims process |

How to read a renters policy FAQs

Read more about renters insurance

RECENT QUESTIONS

Other people are also asking...

Do I need to change my policy when I rent out my home?

Do I have to file a claim with my renters insurance company if my apartment was flooded by an upstairs neighbor?

If I'm in between apartments, when do I need to change the address on my renters insurance?

If my laptop was stolen from my car, how do I get it replaced?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.