Best Car Insurance with a $500 Deductible

Car insurance with a $500 deductible

The average six-month premium for car insurance with a $500 deductible is a little over $850, or about $143 per month. That comes out to $1,720 per year when we looked at rates from seven top insurance companies. $500 is considered a standard car insurance deductible, but there are other considerations to think about when deciding on the best car insurance deductible for your situation.

We'll explore what deductibles are, how they impact your premium and your insurance policy, and which insurance companies offer the cheapest car insurance with a deductible of $500. Let’s get started.

Key Takeaways:

- A full coverage policy with a $500 deductible runs an average of $1,720 per year, or about $143 per month

- Because a lower deductible means higher rates, increasing your auto insurance deductible to $1,000 can save money upfront

- If you have a loan or lease on your vehicle, you might be required to maintain a $500 deductible

- Violations and accidents can significantly increase your rates for up to three years after a claim

- Check for discounts to help lower your premium, or shop around and see quotes (it's free!) from different companies

How much is car insurance with a $500 deductible?

Between the range of deductibles available — which can sometimes be specifically set by an insurance company — $500 is fairly standard. To find out which car insurance company offers the cheapest rates at this deductible level, we surveyed some top insurance companies' rates for a driver — profile outlined here — with a $500 deductible.

| Company | Avg. Monthly Premium | Avg. Annual Premium |

|---|---|---|

| USAA | $114 | $1,365 |

| Nationwide | $123 | $1,476 |

| GEICO | $129 | $1,542 |

| State Farm | $131 | $1,569 |

| Farmers | $149 | $1,786 |

| Progressive | $157 | $1,886 |

| Allstate | $201 | $2,413 |

USAA is the cheapest insurance company when it comes to full coverage with a $500 deductible, with an annual premium of $1,365, or $114 monthly. If you don't qualify for USAA insurance, which is only available to military and their families, then look into Nationwide or Geico as other reasonable options.

This reflects only our standard driver profile, which might not match your situation. Use our data as a starting point and try to look at as many insurance companies as possible.

How are deductibles and insurance premiums related?

While your deductible is what you pay in the event of a collision, comprehensive, or UMPD (uninsured motorist property damage) insurance claim, your premium is what you pay every month — or every 6-12 months, depending on your billing cycle.

Basically, your deductible and your premium are inversely related; if you raise one, you lower the other. Let’s look at an example where you raise your deductible amount from $250 to $500. This would lower your insurance rates because you are taking a greater amount of financial responsibility for the potential repairs your insurance company would otherwise have to pay. If you were to cause $2,000 in damages to your vehicle, your insurance company would only have to pay $1,500 versus $1,750. So, they will reward you for their decreased financial responsibility by lowering your premium.

Compare car insurance quotes and save today!

Pros and cons of a $500 auto insurance deductible

While the $500 deductible level is common, there are other options — each of which alters the rates you'll pay and the financial consequences you'll face in the event of an accident. Because a lower deductible means higher premiums, increasing your auto insurance deductible to $1,000 can save a bit of money upfront. Take a look below at the different rates from leading insurance companies when it comes to $500 deductible policies, versus the $1,000 deductible policies shown.

| Company | Avg. Annual Premium |

|---|---|

| USAA | $1,365 |

| Nationwide | $1,476 |

| GEICO | $1,542 |

| State Farm | $1,569 |

| Farmers | $1,786 |

| Progressive | $1,886 |

| Allstate | $2,413 |

| Company | Avg. Annual Premium |

|---|---|

| USAA | $1,189 |

| Nationwide | $1,343 |

| GEICO | $1,348 |

| State Farm | $1,457 |

| Farmers | $1,616 |

| Progressive | $1,668 |

| Allstate | $2,118 |

On average, you could save $186 per annual insurance policy period by choosing a high deductible amount, such as $1,000 instead of $500. But there’s another reason to consider a higher deductible that can end up saving you thousands. By increasing your deductible, you also discourage yourself from using it and filing what would be considered an at-fault claim.

How rates can change after an accident or violation

When you file a claim under your collision coverage (and sometimes for a UMPD insurance claim) after a car accident, your insurance company will raise your rates for what they see as an at-fault accident. An insurance company views collision claims to be at-fault accidents because they see you, the driver, as in control of the vehicle when the accident occurred. Thus, you’re responsible.

The average insurance company in the U.S. will increase your rates by nearly 50% after your first at-fault accident. Moreover, this rate increase will stay on your insurance record for three years — meaning that that percentage increase will persist all three years. Below, you can see some average rate estimates after specific violations, including at-fault accidents.

| Accident/Violation | Avg. Annual Premium |

|---|---|

| Speeding 16 - 20 MPH over limit | $2,190 |

| At-fault accident - greater than $2000 | $2,605 |

| Reckless driving | $3,187 |

| Racing | $3,291 |

| DUI | $3,441 |

As you can see, filing an at-fault claim where the damages are greater than $2,000 will raise your premium by over $885 per year, when compared to the $1,720 per year average rate for a $500 deductible policy. Because of this, most insurance experts recommend only filing an insurance claim if you suffer a catastrophic loss where the value of the premium increase plus your deductible is less than the cost of repairs.

Although you can expect a hefty increase from filing a collision claim, your comprehensive deductible is a little different. Your insurance company will generally consider comprehensive claims to be not at-fault because they tend to happen outside the control of the driver. Thus, the monetary impact of a comprehensive claim is almost zero.

Despite the evidence that a $500 deductible may not be the way to go, it's still a pretty standard deductible. Plus, there are times when your deductible will be chosen for you. If you have a loan or lease on your vehicle, you might be required to maintain at least a $500 deductible. When you enter these types of agreements, you do not own the vehicle and thus are required to maintain its physical integrity. Your loan and lease company might fear if you have a deductible greater than $500, you will be unable to pay it. Thus, $500 is usually the maximum amount they will allow.

Other ways to lower your insurance premiums

The amount of money that you pay for insurance is influenced by a number of things, including your coverage limits, driving history, credit score and — as discussed above — your insurance deductible. Many companies also offer discounts you may qualify for, such as:

- Bundling or multi-policy

- Good driver

- Good student

- Defensive driving course

- Military or affinity

- Telematics

- E-Pay

- Anti-theft

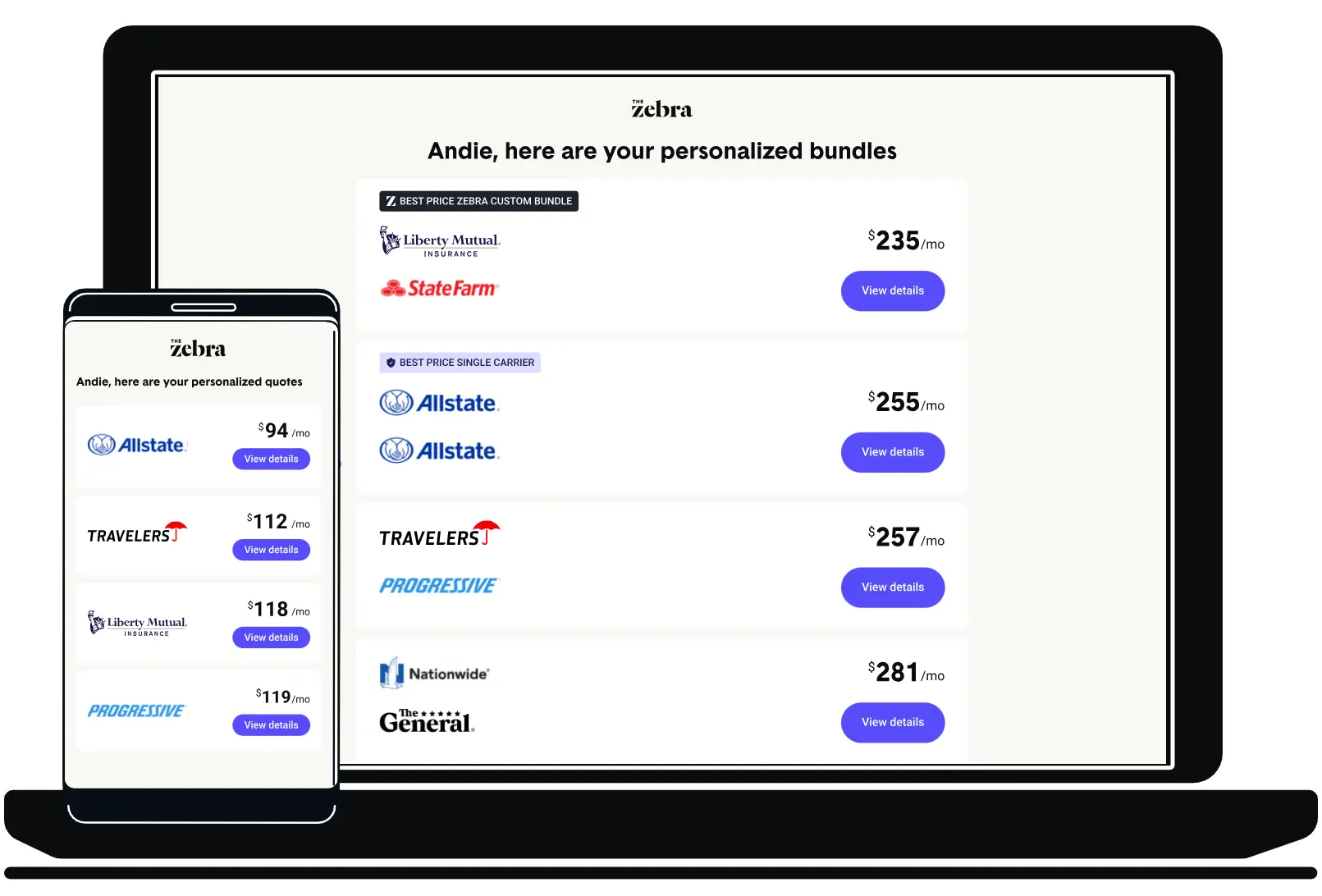

If you are unhappy with what your current insurance company charges, it may be time to consider shopping for a new car insurance policy. The Zebra can help you find free quotes from the nation's top insurance companies, giving you the chance to compare coverage options and insurance rates. Get started by entering your ZIP code below.

Compare rates and save!

Related Content

- Does Car Insurance Cover Windshield Repair?

- New Car Replacement Insurance

- Mechanical Breakdown Insurance

- Vanishing Deductible

- Total Loss Car Insurance

- Car Insurance with a Lapse in Coverage

- Accident Forgiveness Policy Comparison

- Car Insurance After Identity Theft

- Stacked vs. Unstacked Car Insurance

- Hit and Run Car Insurance Coverage

RECENT QUESTIONS

Other people are also asking...

Do I have to pay a deductible if I hit someone but my vehicle is not damaged?

Can a lender dictate what my deductible is?

I scraped my car in a parking garage and it's a $1600 repair. Should I pay out of pocket or file an insurance claim?

If my laptop was stolen from my car, how do I get it replaced?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.