What factors are most important for car insurance rates?

A rating factor is an individual characteristic of a customer used to price car insurance premiums. Put simply, the less risky your rating factors are, the cheaper your car insurance policy will be. Some auto insurance rating factors — such as driving record or vehicle type — have relatively sizeable impacts on car insurance costs. Others — like gender or marital status — are less important.

Below are the 15 rating factors most often used by car insurance companies, along with some associated costs by insurer.

1. Age

Age is a very significant rating factor, especially for young drivers. Between the most expensive insurance premiums — paid by teen drivers — and the most affordable — paid by 50-year-olds — is a cost gap of over $5,500 per year. Insurance companies view teen drivers as very risky and potentially expensive clients to insure. Data show that teen drivers drive more recklessly and get into more accidents than do drivers in any other age group.

INSURANCE PREMIUMS BY AGE

| Insurance provider | 6-month premium — 16-year-old | 6-month premium — 50-year-old |

| Allstate | $4,393 | $930 |

| Farmers | $4,013 | $755 |

| GEICO | $2,221 | $549 |

| Liberty Mutual | $5,268 | $693 |

| Nationwide | $2,518 | $646 |

| Progressive | $5,047 | $712 |

| State Farm | $2,040 | $608 |

| USAA | $2,114 | $461 |

| Average | $3,452 | $669 |

At what age do car insurance rates go down?

Age becomes a less important rating factor at the age of 20, and even less impactful at the age of 25. Auto insurance premiums reach their low point in a driver's mid-50s before rising for older drivers aged 70-plus.

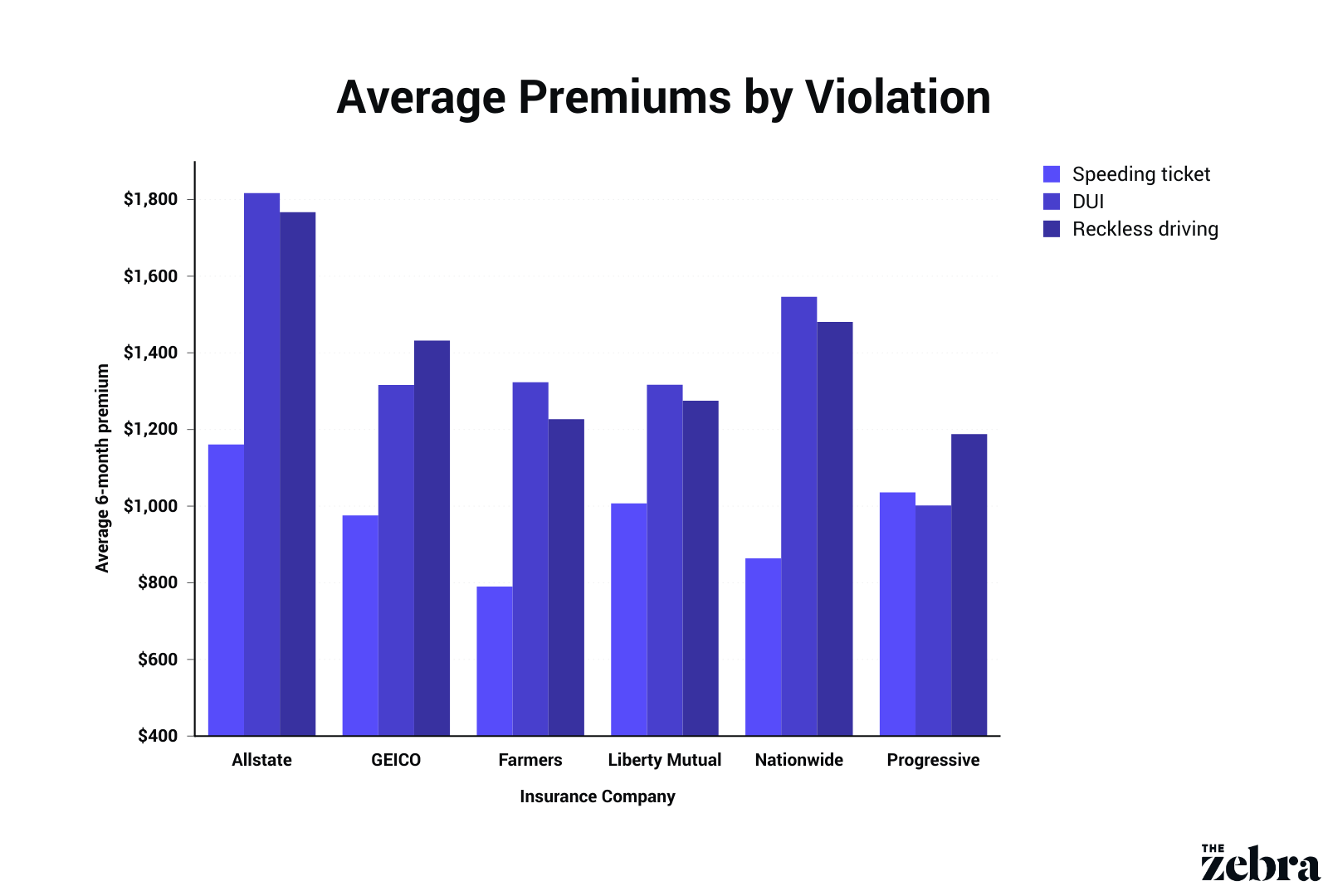

2. Driving history

This rating factor is straightforward. Car insurance companies see a driver's past as an accurate predictor of their future performance. A history of tickets or violations will inflate the cost of current and future insurance premiums. The below data show how a speeding ticket (speeding 16 to 20 miles per hour over the limit), a DUI, and a reckless driving charge may impact insurance premiums.

3. Credit score

Credit is a major — but often overlooked — rating factor. Data shows drivers with poor credit file more claims than do drivers with better credit. And when they do file claims, they are generally more expensive than claims from drivers with good credit. The difference in car insurance rates between drivers with the lowest level of credit and the highest is over $1,500 annually. This comes out to a $784 increase for a six-month policy or $130 a month.

INSURANCE PREMIUMS BY CREDIT HISTORY

| Insurance provider | 6-month premium — Very Poor Credit |

6-month premium — Great Credit |

| Allstate | $1,692 | $885 |

| Farmers | $1,293 | $714 |

| GEICO | $1,087 | $512 |

| Liberty Mutual | $1,921 | $705 |

| Nationwide | $1,059 | $637 |

| Progressive | $1,658 | $617 |

| State Farm | $1,435 | $527 |

| USAA | $1,199 | $475 |

| Average | $1,418 | $634 |

In the above table, "worst credit" is defined as a credit rating between 300 and 579. A "best credit" rating sits between 580 and 800.

4. Years of driving experience

This rating factor is simple. The more experience you have behind the wheel, the less likely you are to make the mistakes that lead to violations and claims. For an insurance company, this means you’re less risky as a client. Drivers with many years of experience typically enjoy lower insurance prices than do newer drivers. Learn more about finding affordable car insurance as a new driver.

5. Location

Location functions as a rating factor on two levels: state and ZIP code. Car insurance is regulated at the state level and subject to each state's regulations. For example, Michigan, a no-fault state, requires all drivers to carry unlimited Personal Injury Protection (PIP) coverage by law. This makes car insurance expensive because the costs of PIP coverage and “unlimited" coverage are passed to insurers. Car insurance rates in Michigan are greater than $2,000 per year more expensive than in adjoining state Ohio.

Car insurance is also priced by location at a more granular level. Car insurance is priced by ZIP code to help insurance companies adjust for the external rating factors associated with each area. Insurance costs are higher in locales with more drivers. ZIP codes prone to hurricanes, tornadoes, floods, wildfires, crimes such as vandalism or theft, or other risks also face higher rates. In many cases, those in rural areas pay less in car insurance premiums than do their urban counterparts.

6. Gender

Another lesser-known risk factor, gender primarily impacts rates for young drivers. On average, a male teen driver pays $754 more per year in auto insurance premiums than does a female teen driver. Again, this is because car insurance companies see young male drivers as more likely to take risks than their female counterparts. The relatively safe driving habits of young female drivers result in their earning lower rates than teenage male drivers, on average.

INSURANCE PREMIUMS BY AGE & GENDER

| Gender and age group | 6-Month premium |

| Female teen driver | $2,446 |

| Male teen driver | $2,823 |

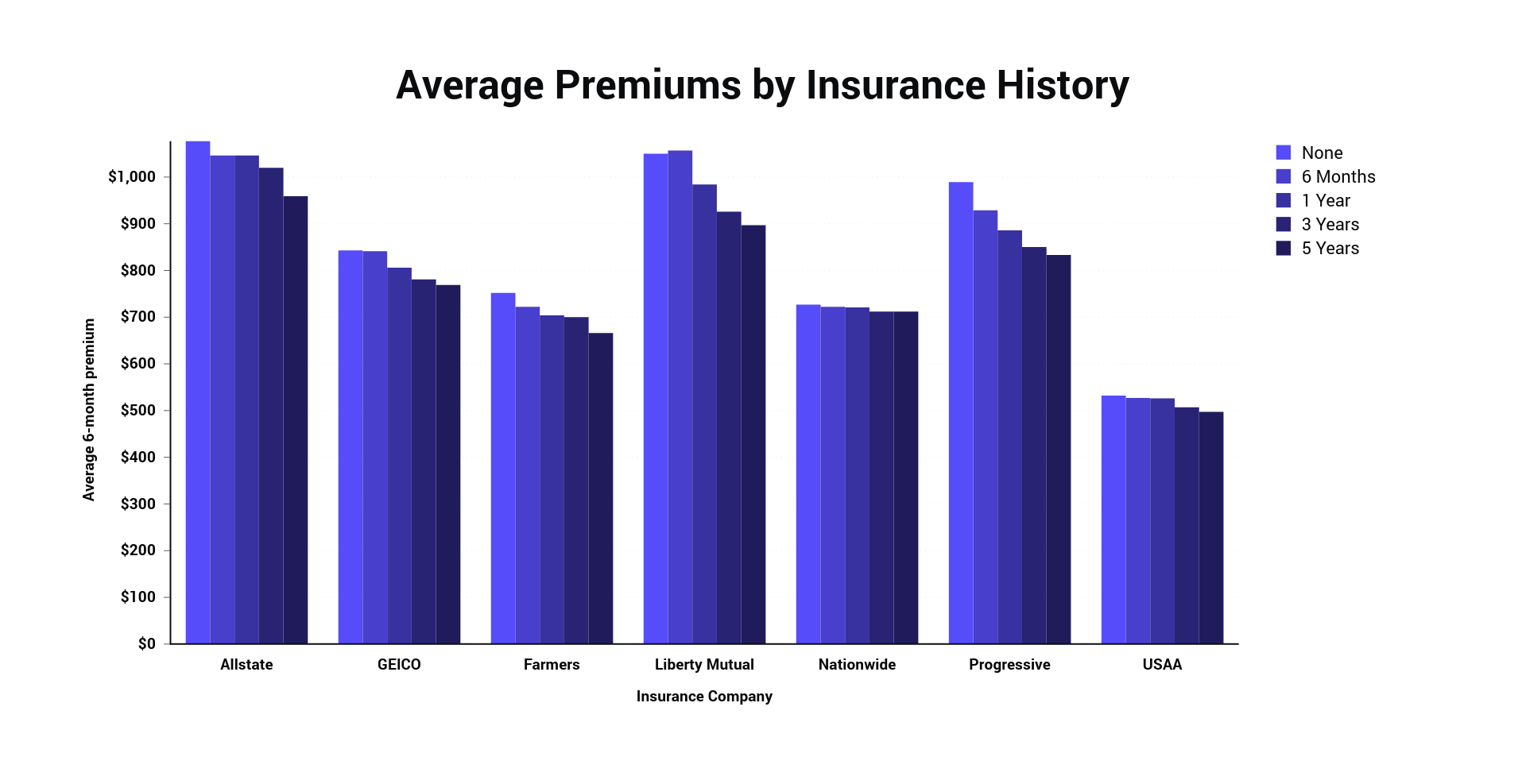

7. Insurance history

Unless you are a brand new driver, insurance companies see a lack of continuous coverage as an indicator of higher risk. In an insurance company's estimation, if you were licensed but didn't have insurance, you may have been driving while uninsured. The below data show the difference between drivers with no previous coverage and five years of consecutive coverage: $182 per year.

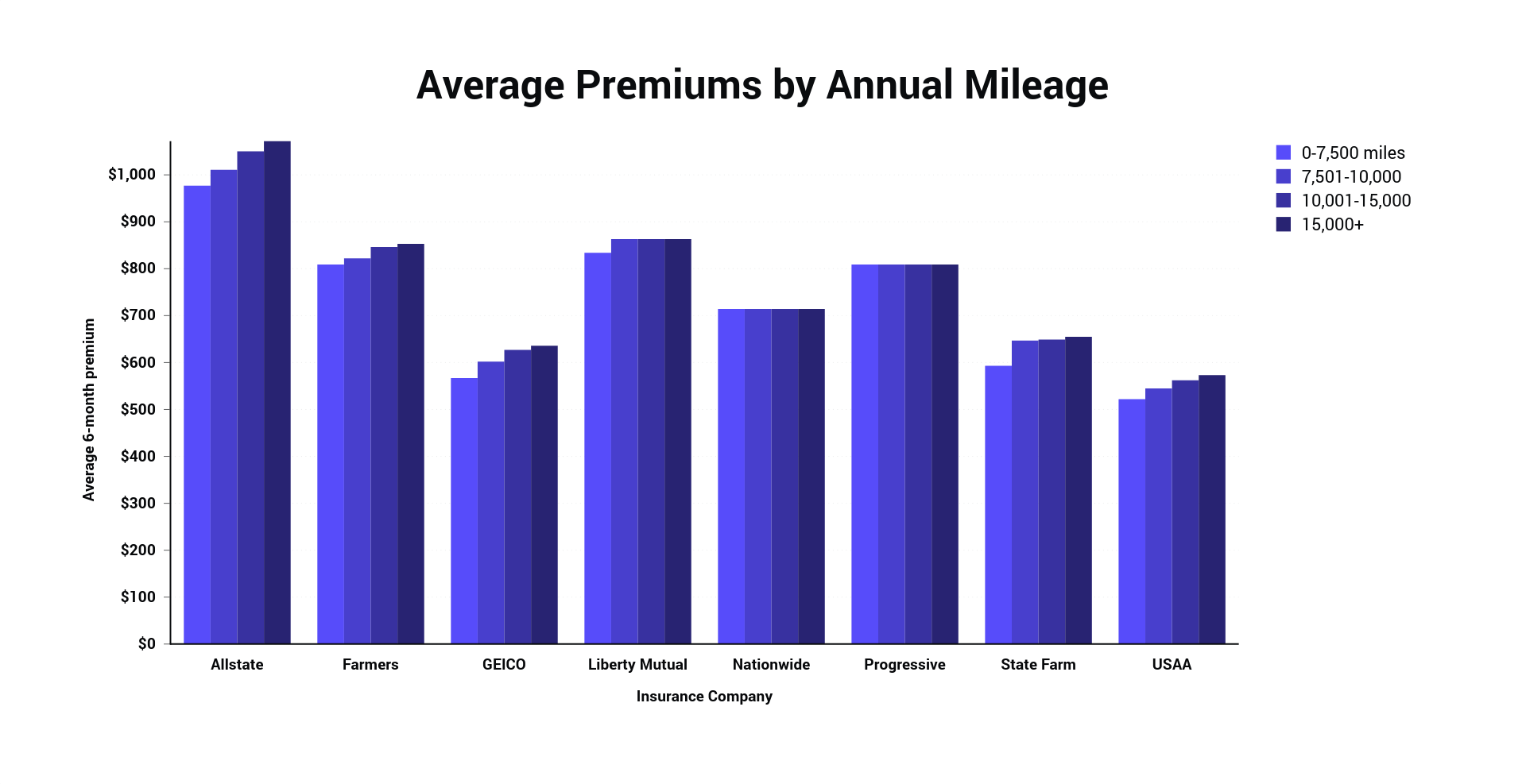

8. Annual mileage

Annual mileage has a major bearing on insurance premiums — mainly in California. The national difference in annual premium for drivers who travel fewer than 7,500 miles per year versus those who drive 15,000-plus miles annually is $92. But in California, this difference is nearly 32% — or $557 per year. Below are the US averages by mileage driven and insurance company.

For more information on how annual mileage affects car insurance rates, see the related articles below.

9. Marital status

Marital status has a minor effect on auto insurance rates. Historical data show married drivers share driving duties, filing fewer individual claims. The difference between car insurance rates for married, divorced, single, and widowed drivers is minimal.

10. Claims history

Every single insurance company views a long claims history as a red flag. Included in your claims history is any insurance claim you file — and any claim filed against you. If your insurance company pays out a claim, you should expect your rate to increase. Below are estimated rates from popular insurance companies across the US after an at-fault accident.

| Insurance provider | None | 6-month premium after at-fault accident |

| Allstate | $994 | $1,508 |

| Farmers | $762 | $1,113 |

| GEICO | $638 | $998 |

| Liberty Mutual | $823 | $1,179 |

| Nationwide | $673 | $1,087 |

| Progressive | $802 | $1,386 |

| State Farm | $656 | $808 |

| USAA | $474 | $644 |

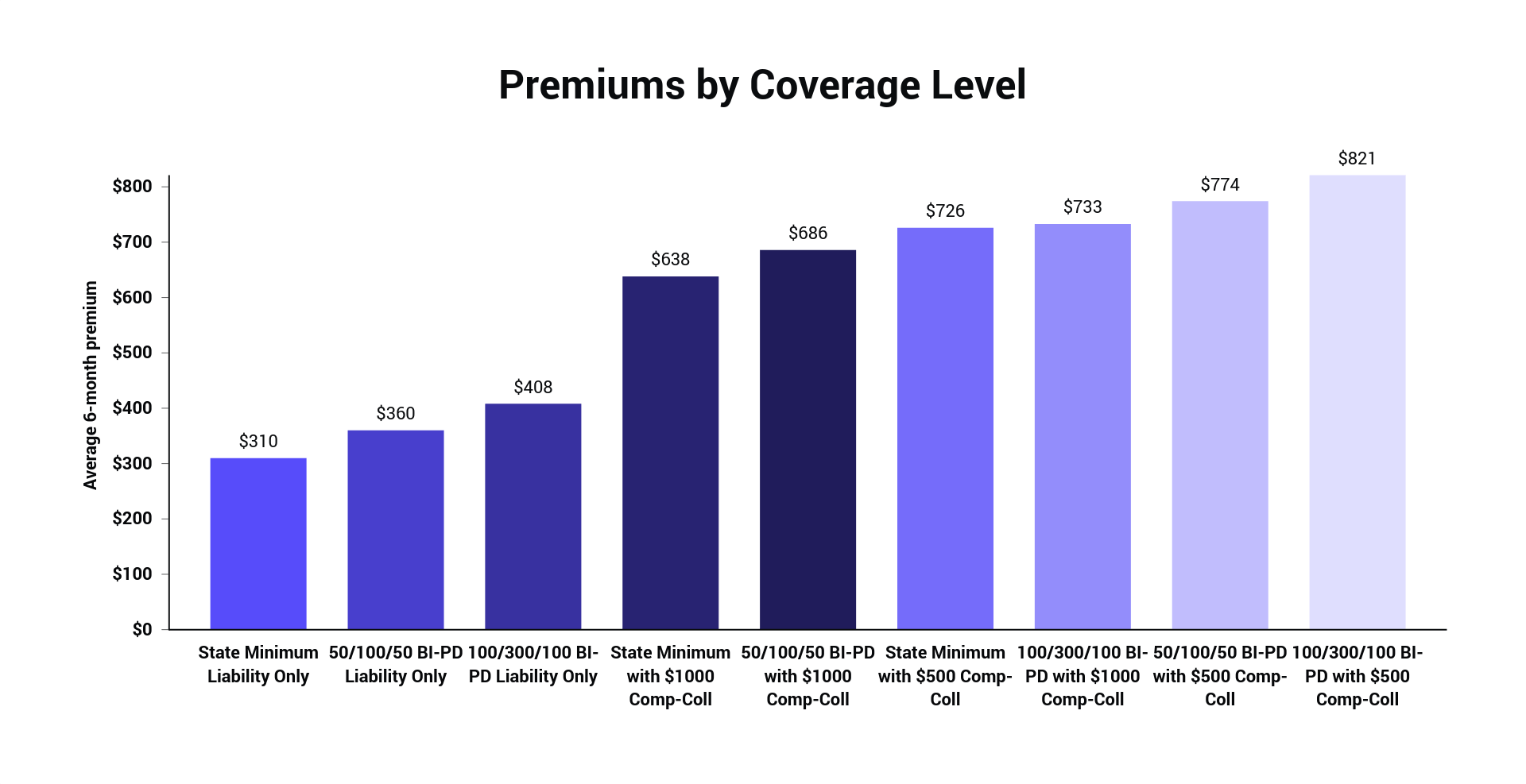

11. Coverage level

The more coverage you carry, the more expensive your premiums will be. The cost difference between the lowest levels of car insurance coverage and the highest can add up to more than $1,000 annually. The reason for this is simple: if you carry more coverage, your insurance company is obligated to pay out to meet a higher coverage limit.

See our guides to car insurance deductible amounts below:

12. Vehicle

Insurance rates on a brand new sports car will be more expensive than premiums for an old Civic. If a vehicle costs more to replace, the insurance company will charge you more each month to cover these potential costs (via collision and comprehensive coverage). Find car insurance rates by vehicle type.

13. Vehicle ownership status

Car insurance companies categorize car ownership in three ways: owned, leased, and financed. Premiums vary by ownership status.

For more information, see our guides to each of these stages:

- Car insurance coverage for a leased vehicle

- Car insurance coverage for a financed vehicle

- Car insurance coverage for a vehicle that's paid off

14. Discount options

Auto insurance discounts depend on your location and insurance company, and many are reflections of your individual rating factors. If you’re a homeowner, pay your insurance premium upfront, or have a clean driving record, you might qualify for a discount. Below are some common discounts.

- Affinity discount

- Anti-theft device discounts

- Bundling policy discount

- E-Pay discount

- Good driver discount

- Good student discount

- Green vehicle discount

- Low mileage discount

- Loyalty discount

- Military discount

- Multi-vehicle discount

15. Insurance company

The biggest factor in determining auto insurance costs is the insurance company you decide to go with. Rates vary substantially from company to company and while there are other factors that comprise your driving profile, you could be paying too much for car insurance simply because your current company is too expensive. Let the Zebra help you gather quotes from as many companies as possible using your individual rating profile to find the best possible rate for you.

Find an affordable car insurance policy today!

Related Content

- Car Insurance with No Insurance History

- Car Insurance for Drivers with Disabilities

- Car Insurance for New Drivers

- Car Insurance for Expats

- Car Insurance with No Credit History

- How Does a GED Affect Car Insurance Rates?

- What is an Auto Insurance Score?

- Car Insurance for Good Drivers

- Car Insurance for Foreign Drivers in the U.S.

- Car Insurance for High-Mileage Drivers

Related Questions

Other people are also asking...

If I hit an object in the road, can I claim this under my comprehensive coverage?

Do car insurance companies price match?

Will my insurance be affected by an MIP if it was dismissed?

How far back do insurance companies look?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.