Get Car Insurance With No License

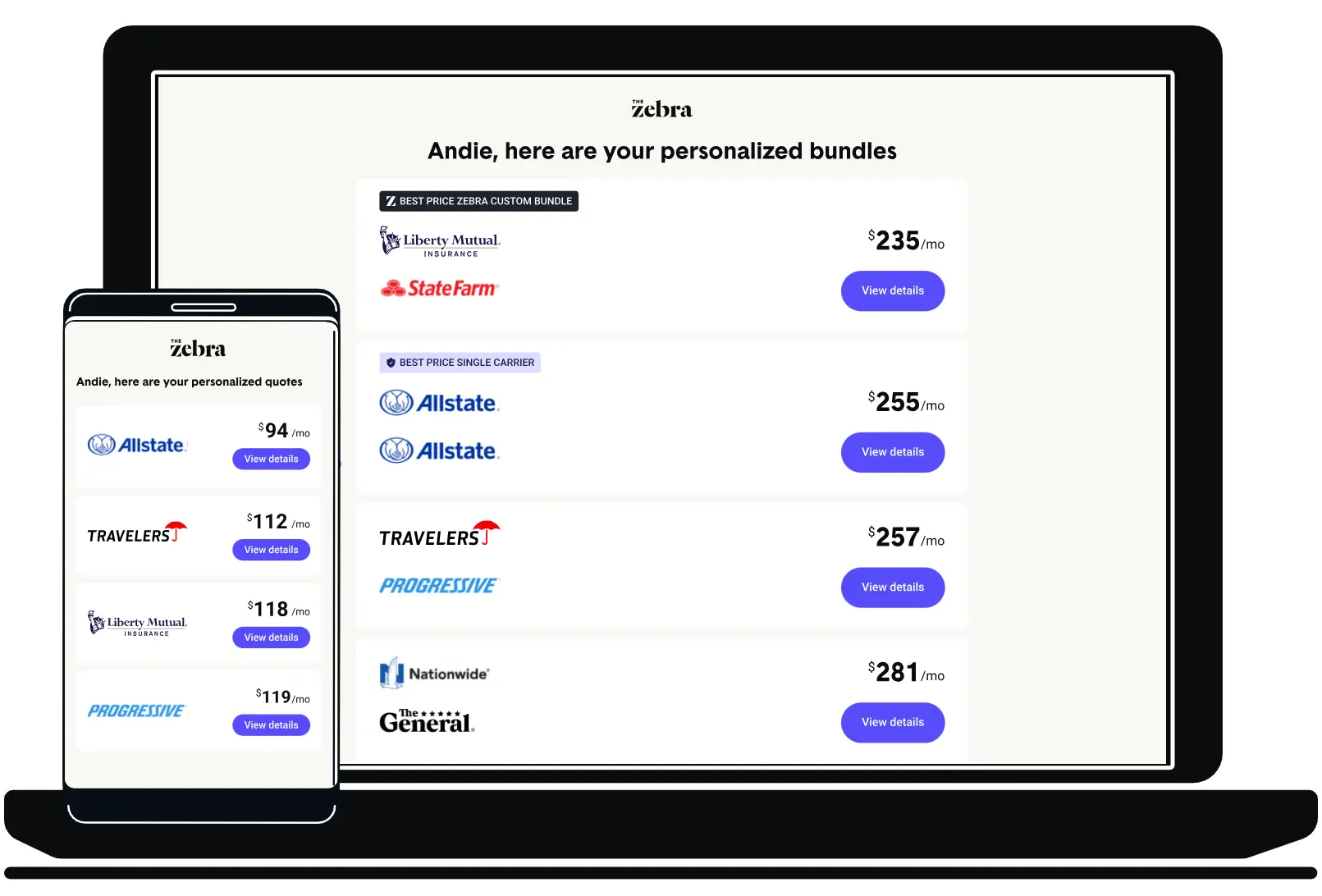

Use The Zebra to get insurance quotes with no license from GEICO, Nationwide, Liberty Mutual and Allstate (+100 other companies)

Can you get auto insurance without a license?

You can get car insurance even if you don't have a license, though it may present a few more hurdles and potentially come with higher costs. A valid driver's license plays a crucial role in securing an accurate car insurance quote. It enables insurance providers to review your driving history, which is a key factor in determining your insurance rates. In 2024, the average cost of a six-month policy is $880, so you can anticipate rates higher than this if you're unlicensed, but the exact increase will depend on multiple factors.

NOTE: If you find yourself with a suspended license or SR-22, we suggest exploring our Guide to Insurance with a Suspended License. The advice and options available differ significantly depending on whether your license has been temporarily suspended, you've never obtained one, or it has been permanently revoked.

Key Takeaways

- You can find car insurance without having a license, but it may be challenging and expensive

- Even if it is insured, you can't legally drive your car without a license

- Consider looking at smaller, lesser-known insurance companies for coverage

- Be aware of your state minimum insurance requirements if you're thinking of reducing coverage

How to get car insurance with no license

Drivers who are looking for car insurance without a driver's license will have to go a step further than most policyholders. Here are our suggestions to help make the process easier:

These agents are licensed to write auto insurance policies for different insurers and could be familiar with local companies that issue no-license car insurance. The Zebra’s licensed insurance professionals are available to talk through options—use our quote tool to start the process and connect with an agent or call us directly at 1-888-444-2833.

Some insurance companies will cover you if you have a state-issued ID card. Popular car insurance companies like Commonwealth, Advantage Auto and Direct Auto will take a state-issued ID card and issue unlicensed drivers a policy.

This method has been recommended by other sources, but it is a risky option. While you are technically insured, an excluded driver is often not adequately protected should an accident occur.

Shop for car insurance without a license today!

Which companies will insure unlicensed drivers?

Finding the cheapest coverage as an unlicensed driver is tricky, but not impossible. As mentioned above, some well-known companies may take a state ID card instead of a driver's license to write an insurance policy for you. It's also important to keep an open mind when comparing quotes; there might be companies you haven't heard of (smaller or regional carriers) that will work with you when others won't. Here are a few insurers that may be able to offer you options if you have identification other than a traditional US driver's license:

- Acceptance

- Access

- Foremost

- The Hartford

- Mendota

- OnGuard

Working with an independent agent who can find policies from multiple companies is likely the best way to compare and find an insurer who will work with you. If you have a state-issued ID, a foreign or international driver's license, or a passport you may be able to find coverage that fits your needs.

Below is a table showing the monthly and 6-month rates for companies that may be able to accept alternatives to a standard US driver's license.

The Zebra’s Dynamic Insurance Rating Tool data methodology

The Zebra’s Dynamic Insurance Rating Tool for home and auto insurance rates utilizes the latest ZIP code-level rate filings from across the U.S., sourced from Quadrant Information Services and S&P Global. These filings, typically updated annually or biennially by insurers, are verified through Quadrant’s QA process and then integrated into The Zebra’s estimator.

The displayed rates are based on a dynamic home and auto profile designed to reflect the content of the page. This profile is tailored to match specific factors such as age, location, and coverage level, which are adjusted based on the page content to show how these variables can impact premiums.

For a comprehensive understanding, see our detailed methodology.

"We do have some carriers that will insure someone without a driver's license! Keep in mind though, that there may be a surcharge for not having a license. Our carrier selection will be slim since not having a license is an increased risk that most carriers will not take on. However, we will exhaust all options to find the best fit for you!"

Kristin Gresset — Insurance advisor at The Zebra

Why do insurance companies prefer drivers with licenses?

Your driver's license essentially serves as a snapshot of your driving behavior, allowing insurers to evaluate the level of risk you pose and adjust the cost of your policy accordingly. Without this information, it is far more difficult for insurance companies to understand the risk they would take on having you as a policyholder.

The best car insurance companies see risk in an unlicensed driver, regardless of your reason for being unlicensed. A driver's lack of license can also influence the terms and conditions of the policy offered.

Your driving history isn't the only factor that goes into an insurance policy's availability and cost. Here are some additional factors usually considered when companies calculate rates (depending on your state):

- Age

- Gender

- Credit score

- Marital status

- ZIP code

- Annual mileage

Zebra Tip: Always be truthful regarding your license status

An insurer will run a Motor Vehicle Report (MVR) when calculating your premium. An MVR details your driving history. If you use a fake or invalid driver's license number, it will register on your MVR. The insurer could drop you, forcing you to start over again. In the long run, it's best to be honest about your driving situation.

Why insure a vehicle that you don’t plan to drive?

While you might not have a valid driver's license right now, that could change, and it’s in your best interest to avoid lapses in coverage and in turn, future premium increases. There are several scenarios in which you may want to insure your vehicle without being able to drive it:

- You are new to driving and need proof of insurance to get a valid driver's license.

- You have only a driver's permit.

- You can no longer drive but need to insure someone else who drives your car.

- Your car is in storage or is always parked and never driven. Owners of Classic cars sometimes fall into this category.

- You want to pay for a licensed family member's insurance.

In many of these cases, people without driver's licenses will acquire them eventually, and having continuous coverage in the meantime is encouraged.

Car storage insurance

If you don't currently have a license and aren't in a position where you are actively driving, you might want to consider car storage insurance (or parked car insurance). Storage coverage is typically comprehensive-only, so although it is limited to what's covered, it is usually significantly cheaper than adding liability and collision.

The main consideration with storage insurance is your state's requirements, so it's important to do your research to be sure this is an option where you live. Other than New Hampshire, all states require at least a minimum liability coverage if registered in the state; you don't want to inadvertently have your car's registration suspended for not having the proper coverage.

Can you buy a car without a license?

Before you get a car insurance policy, you need to find a car. It is legal to purchase a car without a valid license, but the process is easier if you are a licensed driver.

Some car dealerships strictly enforce proof-of-insurance driver's license regulations. Some auto dealers require a photocopy of your insurance card and driver's license before allowing you to take a test drive. Others are more focused on their sale than your legal ability to drive. It depends on the individual dealership's protocols. It's easier to buy a car without a license than it is to buy insurance without a license.

Find the right policy in only a few minutes!

Car insurance without a license: FAQs

Related Content

- How to Get Anonymous Car Insurance Quotes

- Best Cheap Car Insurance

- Average Cost of Car Insurance

- Car Insurance Without a Social Security Number

- Car Insurance Without a VIN

- When Do Car Insurance Rates Go Down?

- Are Car Insurance Rates Negotiable?

- Best Car Insurance for a Learner's Permit

- Are Car Insurance Rates Going Up in 2023?

- Best Time to Shop for Car Insurance Quotes

Related Questions

Other people are also asking...

How do I update my car insurance after getting a new license?

Can I insure vehicle I am driving in someone else's name?

Do I need storage coverage for my vehicle if it isn't running?

Does the address on my driver's license have to match the address on my insurance?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.