Leased car insurance: What you need to know

Leasing a vehicle, rather than buying it, is similar to renting an apartment. You enjoy a lower down payment, your warranty covers many of the repairs, and you can get a new car every few years. However, if you lease a vehicle, you’re not earning equity. When your lease is over, you have no stake in the vehicle and cannot sell it. Even though you don’t technically own a leased vehicle, you still need your own insurance for it. And there are some considerations specific to car insurance for leased vehicles worth remembering. Let’s explore.

Table of contents:

- What coverage do you need?

- Is gap insurance mandatory?

- Is insurance more expensive for a leased vehicle?

- What to do after your lease ends

- Ways to save on leased car insurance

Requirements for insuring a leased car

Because you'll need to return your leased vehicle in the same condition you received it, you should remain properly insured for the duration of your lease agreement. Below are common insurance coverage options for a leased car:

- Bodily Injury Insurance

- Property Damage Insurance

- Uninsured and Underinsured Motorist Coverage

- Personal Injury Protection (PIP)/Medical Payments Coverage

Carrying only liability coverage could leave you in violation of your lease agreement, as it would offer no physical protection in the event of an at-fault accident, so in addition to the coverages above, you may also need:

- Comprehensive and Collision Insurance

- Gap Coverage

Is gap insurance required for leased vehicles?

Gap insurance is sometimes required for leased and financed vehicles. Gap insurance covers the difference between the market value of the car — accounting for depreciation — and what is still owed on the lease. In the event a leased vehicle is totaled, the driver would be responsible for the difference between the amount owed on the lease and what the insurance company pays out on a claim.

Gap insurance comes with a few considerations. First, confirm with your leasing company that this coverage is required. Some lease contracts include a Gap Waiver Provision. This forgives the difference between the amount owed on the lease and the amount paid out by the insurance company in the event of a major claim.

Not every insurance company sells gap insurance. For example, GEICO currently does not offer gap insurance.

You can purchase gap insurance from an insurance provider or the dealer through which you acquire your lease. Because the dealership’s coverage might be a little more expensive, it's always worth comparing prices.

Is insurance more expensive for a leased vehicle?

In short, no. While your insurance rate reflects many factors, it doesn’t increase or decrease only on the basis of the car's financed or leased status. However, it may end up being pricier due to your lease agreement requiring that you carry full coverage insurance for your vehicle — especially if you're used to carrying only the state-mandated minimum.

Learn more about which vehicle is cheaper to insure in this short video:

What to do with auto insurance after a lease ends

After your lease ends, what to do with insurance is actually pretty straightforward.

- If you’re extending the lease: keep your insurance coverage

- If you're trading in the vehicle for a new one: update your insurance with new vehicle information

- If you're buying the vehicle: remove the leasing company from the insurance and update your coverage and policy, if necessary

- Walking away: if you’re going car-free, just cancel your insurance (and maybe invest in non-owners insurance)

Buying your leased car

There are many reasons you'd want to buy your leased car after your term is over. These might include:

- Financing the leased vehicle is a lower monthly payment than another lease agreement

- You've damaged the vehicle and are worried about the penalties

- You've surpassed the mileage restrictions and are worried about the penalties

- You like the vehicle and want to avoid another shopping/leasing experience

Whatever your reason, the process of buying your car out of the lease will be simple. Get a few estimates of the vehicle's value and wait until the end of your lease agreement. Buying your vehicle before the lease is over might result in additional fees. Your leasing company will most likely contact your 90 days before your contract is over to discuss the next steps. Be sure to inquire about discounts and incentives in order to get the best offer.

In terms of auto insurance, the only steps to take are evaluating your coverage (consider if you need gap insurance) and removing your leasing agency from your policy. If you are going to finance your previously leased vehicle, you will need to add a lienholder as an additional interest to your policy.

How to save on insurance for a leased vehicle

If you have a monthly lease payment, you likely want to make sure your insurance premium is as low as possible. Let's break down our top ways to save on auto insurance at every stage of car ownership.

Pay smart

If you have the ability to the entirety of your premium upfront, you can save some money on auto insurance. In 2018, the average driver lowered their premium by 5% — or $34 per standard six-month policy.

|

|

|

|

|

|

|

|

|

Because you cut out the cost of transaction fees and pay the premium at the start of your term, you could receive a lower premium.

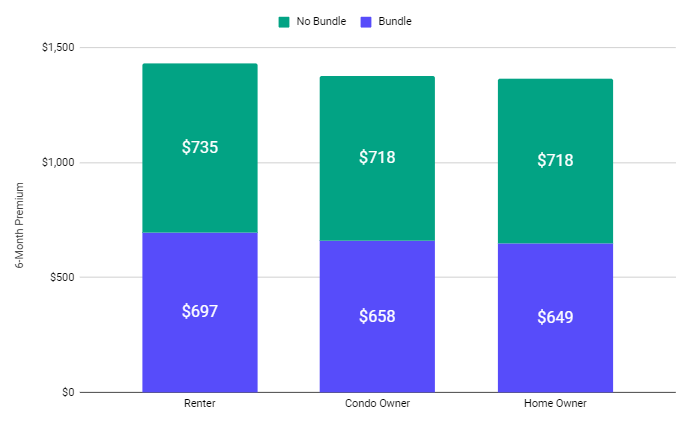

Bundle

Bundling insurance policies earns you a multi-policy discount and reduces the number of insurers with which you have to deal.

Telematics

Telematics can be a great option for saving money while leasing a vehicle because of how they work. Telematics devices plug into your car and help your insurance company monitor the way you drive to generate a more accurate premium. Driving carefully and less often can result in a lower premium. Because a leased vehicle has mileage restrictions and you need to take care of the vehicle, this might be a good way for you to save. While this program isn't available in every state, below are some major insurers and corresponding usage-based savings.

|

Company |

Estimated Savings |

|

Progressive SnapShot |

Average of $130 |

|

Allstate Drivewise |

Average of 10-25% |

|

State Farm Drive Safe & Save |

Up to 15% |

|

Esurance DriveSense |

Varies |

|

Nationwide SmartRide |

Up to 40% |

|

Liberty Mutual RightTrack |

Average of 5-30% |

|

Root Car Insurance |

Varies |

|

Metromile Car Insurance |

Varies |

Compare rates frequently

No matter which car ownership classification you fall into, it's usually worth comparing car insurance quotes to find the best deal.

Compare rates from more than 100 insurance companies!

Related Content

RECENT QUESTIONS

Other people are also asking...

What are my options if I am paying over $700 a month in car insurance?

If I am leasing a car and die before the end of the lease term, can I buy insurance to cover that?

What are the laws in Nevada about storing a car?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.