How to Read a Car Insurance Policy

Parts of a car insurance policy

It's tempting to skim your car insurance policy documents — they don't provide the most compelling reading material. However, your policy contains key information about who and what is covered, as well as the limits of your coverage. Knowing how to read your insurance policy is important if you want to make sure you're covered - especially during the quote-shopping process. After all, it doesn't matter how cheap your insurance rate is if you aren't properly protected.

The basic components of a personal auto policy are the declarations page and the policy form. An insurance declaration page — or dec page — declares the basics of who and what is covered, while the policy form goes into more depth about conditions, exclusions, and the overall agreement between you and the insurance company.

Have a look at the information below to get up to speed on the ins and outs of your car insurance policy.

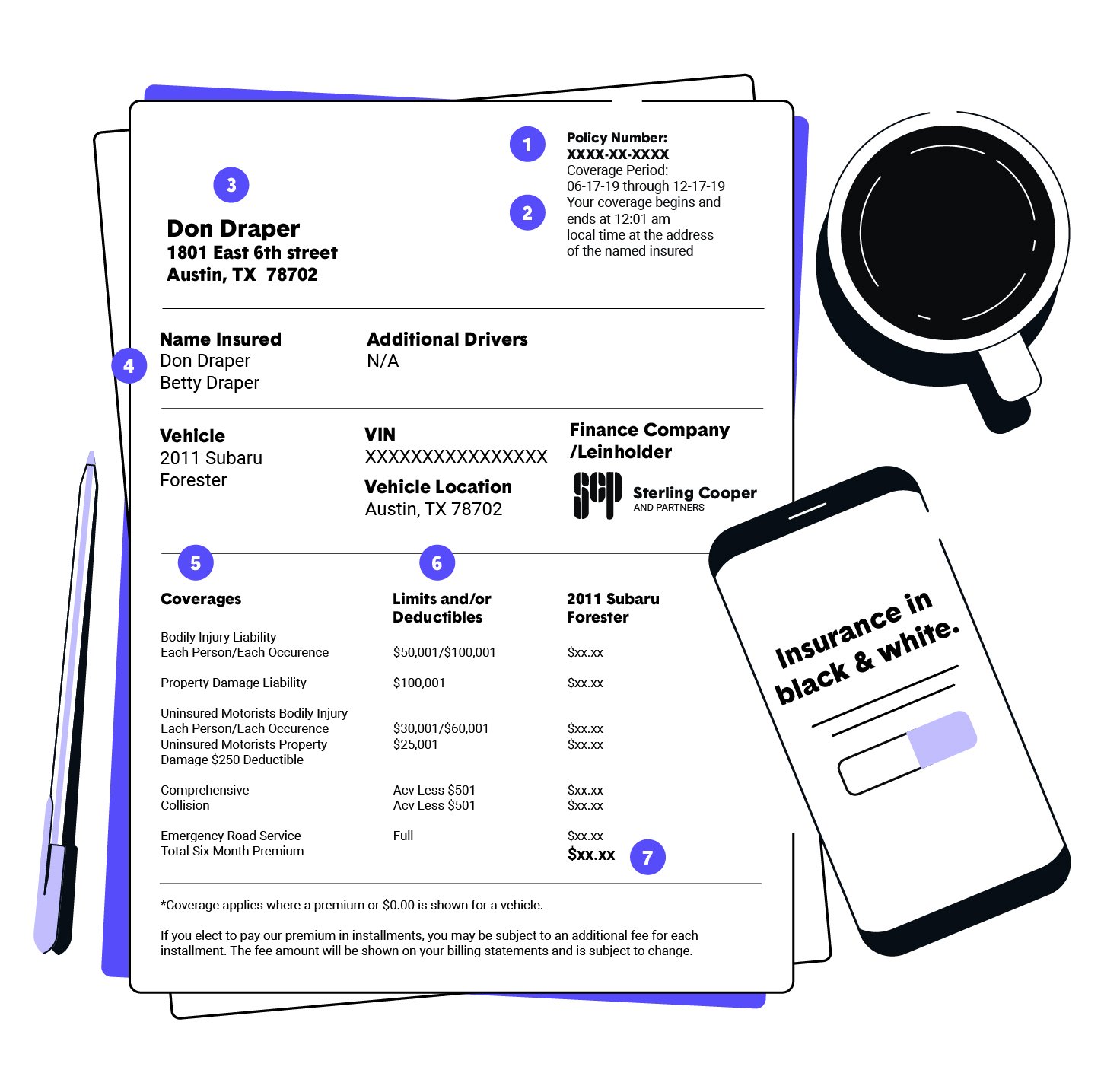

What is a car insurance declaration page?

A car insurance declaration page is typically the first page of the policy that you will see. It contains basic information about your policy as well as the name and contact information of your insurance company. The declarations page allows you to tailor an insurance policy to your individual needs. Essentially, it's the go-to place to find out what your auto policy covers. While it may not go into great detail about each facet of your insurance coverage, it can give you a good idea of your coverage amounts and the basic elements of your policy. An insurance declaration page will contain the following information:

- Policy number: This is your unique policy number, which you’ll need when filing a claim.

- Policy term: Lists the effective date and expiration date of your policy. Don’t wait until your policy period has ended to renew, as any lapse in insurance coverage can be problematic.

- Policyholder address: The address listed must be that of the policyholder and the primary location at which the vehicle is kept.

- Named insured: Any driving resident of your household should be listed under “named insured” or “additional drivers” unless you specifically exclude them.

- Coverages: Lists bodily injury and property damage liability (required), as well as any elected coverages such as comprehensive, collision, etc.

- Policy limits/deductible: Lists the maximum amount that each coverage will pay as well as any required deductible you have to pay out of pocket.

- Premium: The amount you’ll pay over the course of the policy term. Can be listed as a six-month or one-year total.

What is an insurance policy form?

Going into a bit more depth than the insurance declarations page, the policy form outlines various coverages as well as the insuring agreement, conditions, exclusions, and endorsements for your policy. These go into more detail about what is covered (or not covered) and your specific obligations.

This is where your insurance company promises to actually provide coverage in exchange for the premium you pay. It also explains the specifics of what is covered in your policy. This is where you’ll find any perils (causes of loss) that are explicitly covered.

Any legal agreement is conditional on both parties holding up their end of the deal. This section lists any rules, provisions, obligations, or codes of conduct to which you are required to adhere. If you are in breach of any of these conditions, it is likely that coverage or claims will be denied.

Some common conditions include the documentation required when filing a claim as well as the amount of time that you have to file a claim after an accident. It is your responsibility to file a claim in a timely manner. If you miss that window, your claim will be denied.

This section also contains information pertaining to the terms for cancellation of the policy (for you and for the insurance company). While you can cancel your policy at any time, an insurer has to give advance notice and can only cancel your policy for certain reasons.

Knowing what your car insurance policy won’t cover is nearly as important as being aware of what it does cover. The policy exclusions section lists any perils that are not covered. These exclusions can differ by state and from one driver to another.

Typical insurance policy exclusions include:

- Intentional damage or bodily injury

- Government action or confiscation

- Using a vehicle for prearranged racing events

- Catastrophic events: war, nuclear accidents, etc...

- Using your vehicle for delivery/ride-share purposes

This is where you add any specific coverages you may need. If you own a modified vehicle, be it for mobility, performance, or cosmetic reasons, your modifications will require extra coverage. Other endorsements include things like rental car coverage, roadside assistance, or coverage for transportation costs should your vehicle be unable to be driven. It’s important to note the cost of your premiums will likely be affected by any additional endorsements.

Compare auto insurance rates from top companies today!

Different types of car insurance coverage

There are different types of auto insurance available depending on your situation and individual needs. Take a look at some of the common types of coverage below and consider what may be a good option for you. Then, call your own insurance agent or reach out to The Zebra's agency to learn more and discuss coverage with an expert.

Put simply, liability insurance coverage pays the other party. This coverage protects you from having to pay out of pocket for any damages you cause in a collision.

Liability auto insurance covers the following:

- Bodily injury: pertains to the medical expenses of those injured as a result of your actions.

- Property damage: covers the losses of property you caused to other drivers, including the cost of repairing their vehicle. Property damage often has a separate limit to bodily injury.

Medical payments steps in to cover medical or funeral expenses that arise. This coverage does not consider fault, and covers everyone in the vehicle at the time of the accident. It does not cover the medical expenses of those in other vehicles: that cost is covered exclusively by liability coverage.

An important thing to note about medical payments coverage is that medical payments can be made even if there is not a traffic accident. For instance, if someone were to hurt themselves by slamming their hand in the door of the vehicle, it would be covered under medical payments.

Personal injury protection covers the medical expenses of you and other passengers in your vehicle. For this coverage, fault is not considered. In some states, PIP is required. This coverage is not available in all states.

If you were to be hit by an uninsured motorist, they might not be able to cover the damages out of pocket. For this reason, it can be beneficial to carry extra coverage that kicks in to keep you and your property protected.

However, even if an at-fault driver is insured, if they carry the state-mandated minimums, it may not be enough to adequately cover the costs. This is where underinsured coverage comes in handy, as it steps in when the at-fault driver’s limits are maxed out. This is especially true if there are multiple vehicles involved or if your vehicle is on the more expensive side.

These coverages protect you against damage to your automobile. In many cases, these options are optional, though if you still owe money on a car loan, your financial institution may require such coverage to protect the interests. Some states may have different requirements as well.

Collision insurance is just what it sounds like: it protects the car in the event of an impact with another vehicle. This coverage also protects your vehicle should it overturn on the road, as that is considered a collision as well.

Comprehensive insurance covers other perils that could damage your vehicle. Common perils include:

- Falling objects

- Hail

- Riot/civil unrest

- Hitting an animal (such as a deer or bird)

- Glass breakage

- Explosion

- Earthquake

- Theft

- Malicious mischief or vandalism

Understanding car insurance liability limits

Knowing how much coverage you have is important, especially if you are at-fault in a car accident. If you injure others or cause property damage in amounts that exceed your liability limits, you could be found personally responsible for those damages.

You’ll usually see your liability limits in a split limits form. In this form, bodily injury liability limits are the first two numbers of your limits statement. If your overall liability limits are $25,000/$50,000/$30,000, your policy will cover up to $25,000 of medical expenses per injured person. The total amount of expenses the policy will cover is $50,000 for all injured parties. Property damage liability limits are the last number of this sequence. A policy with the limits listed above will cover up to $30,000 in damage to the property of others.

Sometimes insurance limits come in the form of a combined single limit. This may have the same overall coverage as the split limits above, but may not separate bodily injury from property damage. For instance, with the limits listed above, you may have a total limit of $105,000 to cover both bodily injury and property damage.

Buy car insurance online and start saving.

Related Content

- CARCO Inspections

- What is Permissive Use Car Insurance?

- Bodily Injury Liability Insurance

- Reciprocal Insurance Exchange Guide

- Is Car Insurance Tax-Deductible?

- Personal Injury Protection Insurance (PIP)

- Subrogation in Insurance: What to Know

- How is Fault Determined in a Car Accident?

- Agreed Value vs. Stated Value Insurance

- How Much Car Insurance Do You Need?

RECENT QUESTIONS

Other people are also asking...

How long into getting a new policy can I file a claim?

How many cars can I have on my progressive policy?

Can I insure a car that is being financed by someone else?

Can an insurance company force me to be added to a policy?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.