What is No-Fault Insurance?

In which U.S. states is no-fault insurance required, and how much does it cost?

No-Fault Car Insurance

No-fault car insurance requires every driver to file a claim for their own bodily injury and medical expenses after an accident, regardless of who is at fault. The purpose of no-fault insurance is to reduce the number of lawsuits in small claims court, which can slow the reimbursement process for the injured party.

In theory, no-fault insurance makes a lot of sense. In practice, it can lead to high premiums, fraud, and inconvenience for insurance companies and drivers alike.

No-fault insurance definition

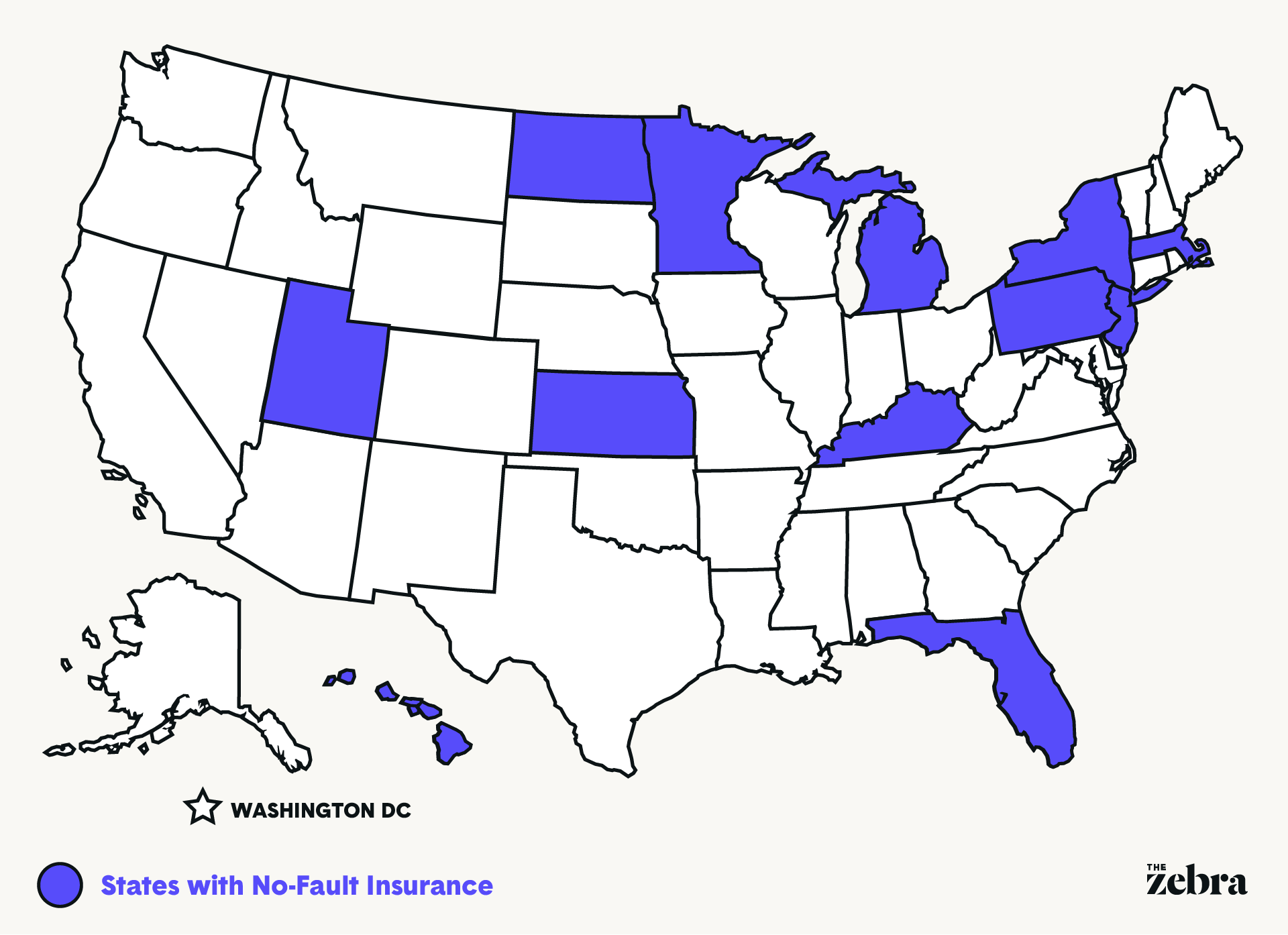

No-fault car insurance is a type of auto insurance system that provides coverage for medical expenses and other damages resulting from a car accident, regardless of who was at fault for the collision. Each driver involved in the accident files a claim with their own insurance company. There are currently 12 no-fault states in the US:

*No-fault is optional in these states — a driver may choose no-fault or liability coverage. Drivers in these states are required by law to carry Personal Injury Protection and liability property damage coverage. Personal injury protection (PIP) provides medical cost reimbursement and work loss coverage for a driver and their passengers after a car accident. This coverage applies regardless of fault.

No-fault insurance versus at-fault auto insurance

The remaining states in the US operate on a tort liability system — or an at-fault system. A tort is an action that results in injury to another person or their property, leaving the afflicted party entitled to compensation.

In states using the tort system, responsibility for damages paid to an injured party is assigned to the at-fault driver and their insurance carrier. If anyone involved in the accident disagrees about where fault should be placed, they — or their insurance company — can sue for monetary compensation to cover damages.

With no-fault insurance, each driver uses their own auto insurance coverage to pay for their damages, regardless of who caused the crash. This precludes drivers from suing another party — with some exceptions, depending on the severity of injuries — in civil court. This also eliminates the wait for the resolution of a lengthy and potentially costly lawsuit before being reimbursed.

No-fault coverage only applies to medical expenses. Property damage is covered through property damage liability protection or collision insurance.

How much does no-fault insurance cost?

This varies, depending on personal characteristics and location. Because each state has certain requirements, insurance premiums will vary by location. Insurance premiums reflect a driver's personal attributes, including their driving record, age, and vehicle. We created a generalized profile and outlined how much car insurance costs in no-fault states.

| State | Avg. Annual Premium |

|---|---|

| Florida | $2,923 |

| Hawaii | $1,409 |

| Kansas | $1,791 |

| Kentucky | $2,567 |

| Massachusetts | $1,418 |

| Michigan | $2,176 |

| Minnesota | $1,707 |

| New Jersey | $2,043 |

| New York | $2,171 |

| North Dakota | $1,555 |

| Pennsylvania | $1,777 |

| Utah | $1,617 |

The Zebra’s Dynamic Insurance Rating Tool data methodology

The Zebra’s Dynamic Insurance Rating Tool for home and auto insurance rates utilizes the latest ZIP code-level rate filings from across the U.S., sourced from Quadrant Information Services and S&P Global. These filings, typically updated annually or biennially by insurers, are verified through Quadrant’s QA process and then integrated into The Zebra’s estimator.

The displayed rates are based on a dynamic home and auto profile designed to reflect the content of the page. This profile is tailored to match specific factors such as age, location, and coverage level, which are adjusted based on the page content to show how these variables can impact premiums.

For a comprehensive understanding, see our detailed methodology.

How much does personal injury protection coverage (PIP) cost?

A state’s no-fault insurance laws determine how much PIP a driver needs and what their premium will be. Below are average rates for state-minimum PIP requirements.

| State | Avg. PIP Premium |

|---|---|

| Delaware | $232 |

| Florida | $400 |

| Hawaii | $89 |

| Kansas | $54 |

| Kentucky | $175 |

| Massachusetts | $55 |

| Michigan | $428 |

| Minnesota | $200 |

| New Jersey | $336 |

| New York | $236 |

| North Dakota | $97 |

| Oregon | $124 |

| Pennsylvania | $78 |

| Utah | $54 |

Michigan has the highest overall PIP requirement because of its no-fault insurance laws. Michigan requires unlimited PIP and Property Protection Insurance (provides coverage for other drivers’ vehicles) of $1,000,000. These high limits cause Michigan’s rates to be 70% higher than the national average.

If your state requires no-fault coverage, get personalized quotes from local and national companies.

Get personalized insurance rates in less than 5 minutes.

Related Content

- Umbrella Insurance

- What is an Excluded Driver?

- Personal Injury Protection Insurance (PIP)

- Does Auto Insurance Follow the Car or the Driver?

- What is a Car Insurance Premium?

- What is Standard vs. Non-Standard Insurance?

- Property Damage Liability Insurance

- What is SR-22 Insurance?

- Reciprocal Insurance Exchange Guide

- Subrogation in Insurance: What to Know

RECENT QUESTIONS

Other people are also asking...

What is the statute of limitations to file a claim with GEICO in Vermont

Will my auto insurance cover damage to a fifth-wheel camper, or should I use my RV insurance?

If I backed into another person's car (which was sitting in their driveway), should I file a claim if repairs are estimated to be $2,500?

Whose insurance is liable if my car was broken into at a tow yard?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.