Buying your first home is a major life decision and generally aligns with other factors, like career stability, feeling settled in your location, disposable income and maybe even thoughts of growing a family.

But is there a right age when these factors should be in place? And are these the factors Americans should consider when deciding to become a homeowner for the first time?

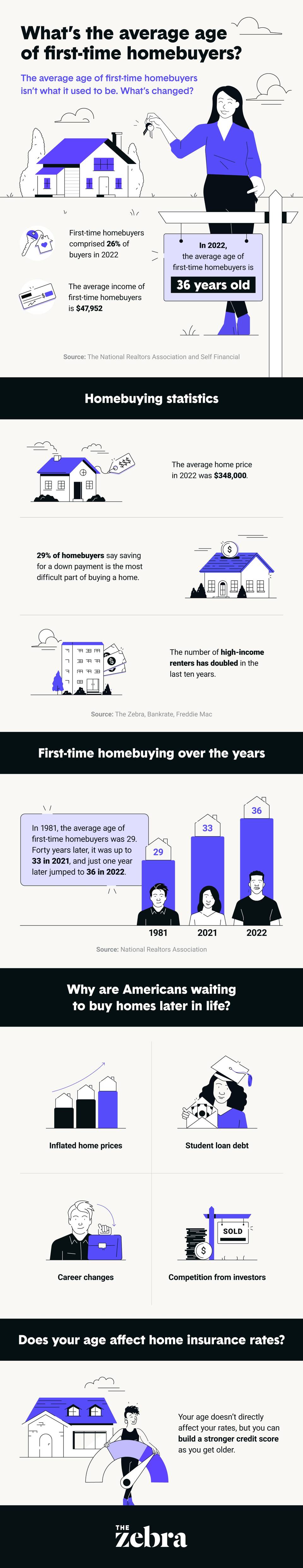

In 2022, the average age of first-time homebuyers was 36, according to the National Association of Realtors (NAR). This is up from 33 in 2021.

A more notable stat, however, is that only 26% of homebuyers in 2022 were first-time homebuyers — the lowest percentage since the NAR started tracking the metric. It’s also a dramatic decrease from 2010, when first-time homebuyers accounted for 50% of all homebuyers.1

The increase in age and decrease in first-time homebuying in 2022 shouldn’t come as a shock. Home prices have skyrocketed in the last few years, with the median home sales price rising to $428,700 in 2022 — an increase of $58,900 from 2021.2

These increases are happening most notably in urban areas. For example, the typical home value in Washington D.C. is $826,124 versus $177,710 in Arkansas.3 As a result, first-time home buyers are moving farther away from their current home to buy a more affordable house, as the median distance that first-time homebuyers moved from their previous location was 50 miles.

All this is to say that first-time homebuying looks a lot different today than it used to. Keep reading as we explore how homeownership has changed at the state and national level and reveal how age affects home insurance rates.