4 ways to lower your car payment and costs

With the cost of living rising in the U.S., Americans are finding strategic ways to save money. Car payments are at the top of the list, as the average price of a new car is at an all-time high. Whether you’re buying a new car or looking to reduce your current monthly car payment, here are four ways to help.

1. Negotiate

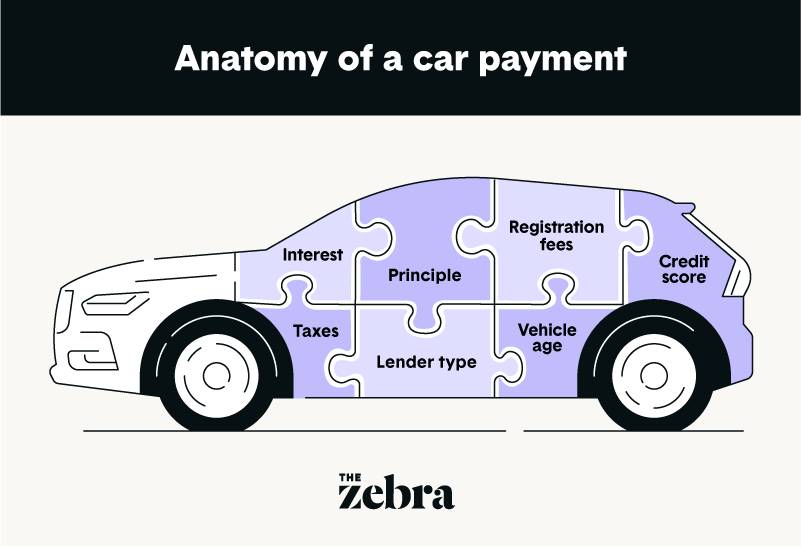

When buying a new or used car, there are two financial aspects buyers can try to negotiate with the seller — the sticker price and trade in-value. A lower sticker price or higher trade in-value can help lower monthly car payments.

The manufacturer’s suggested retail price (MSRP) is provided by automakers to determine a new vehicle’s worth. However, dealers only use this to inform their sticker price. Many vehicles today are selling over MSRP due to the auto industry’s current supply and demand issues. This may make it difficult to negotiate the sticker price, but it’s worth trying.

Where buyers have more power is with their trade-in value. Dealerships will always start at the lowest offer first on a trade-in, which is why it’s important to do your homework beforehand to understand your car’s current worth.

2. Consider leasing

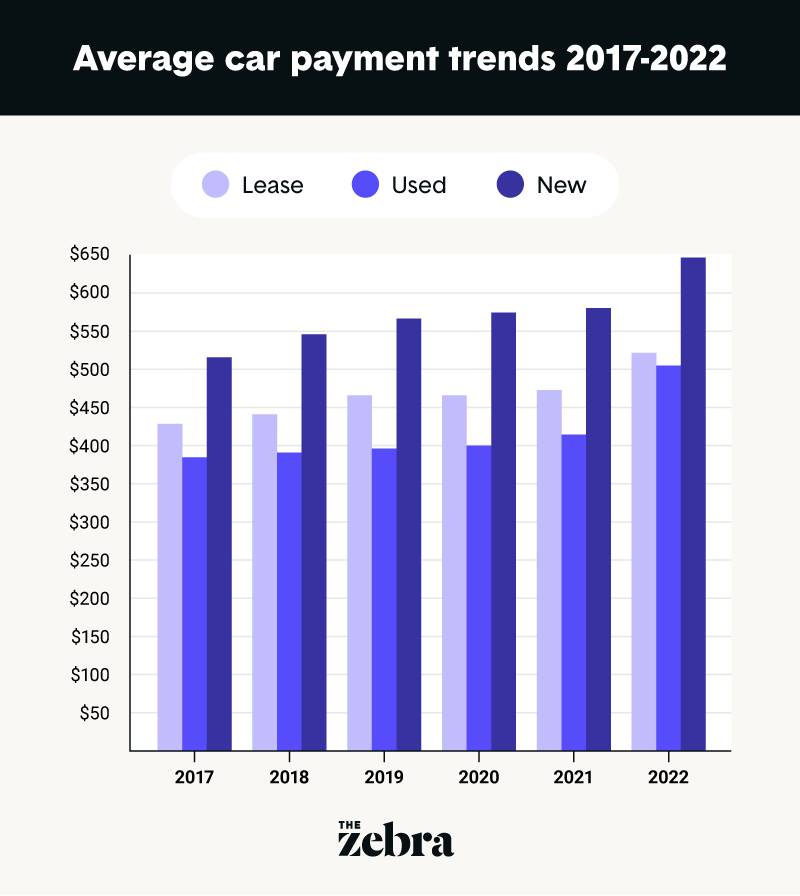

The average monthly lease payment was $522 at the beginning of 2022, $126 less than the average car payment for a new vehicle purchase. If it makes sense for you, leasing is a great way to lower your monthly car payment.

Leasing works well for those who like to be in a new vehicle every couple of years and who don’t travel long distances. Leasing used cars is not as common, as many dealerships and lenders will only approve new vehicle leases.

3. Refinance your current loan

If you’re not interested in buying a vehicle but still want to lower your monthly payments, you might be able to refinance your current auto loan with a different lender. Refinancing might be a good option if when you purchased your vehicle initially:

- Your credit score was significantly lower than it is currently

- Average interest rates were higher nationwide than rates today

- You went through a dealership or manufacturer’s financing program

Refinancing with a different lender may help you get a lower interest rate. In reaching a lower interest rate, you may be able to walk away with a lower payment, or you could keep the same monthly payment but reduce your loan term, which will help you save more on interest in the long run.

4. Compare insurance

When it comes to lowering your expenses as a car owner, there’s only so much you can actually do. Gas prices are what they are and will continue to fluctuate, and the state government sets registration and inspection fees. But you do have the power to shop around for car insurance quotes.

On average, car insurance costs $124 a month in the U.S. Progressive, Nationwide and Geico are known for offering some of the lowest rates. If you’re paying more than the average, it might be worth looking into other coverage options. You may even be able to get a lower rate with your current insurance provider by simply asking what they can do to help you out or by bringing a quote from another company to yours for them to match.

Bundling insurance types might be another option to lower your monthly insurance costs. If you’re using two different companies for your home and car insurance policies, consider finding one company to cover both. Most providers offer deals for bundling.

Like many consumer goods, the average car payment in the U.S. saw a significant increase due to impacts felt by the COVID-19 pandemic. Until automakers are able to recoup from manufacturing issues or demand drops, consumers can expect to wait another year or two before car prices, and monthly payments, begin to level out.

In the meantime, you may still be able to reduce your monthly car payment by shopping around for lower car insurance rates or refinancing your current auto loan with another lender for better loan terms.