How to lower your costs when buying a new car

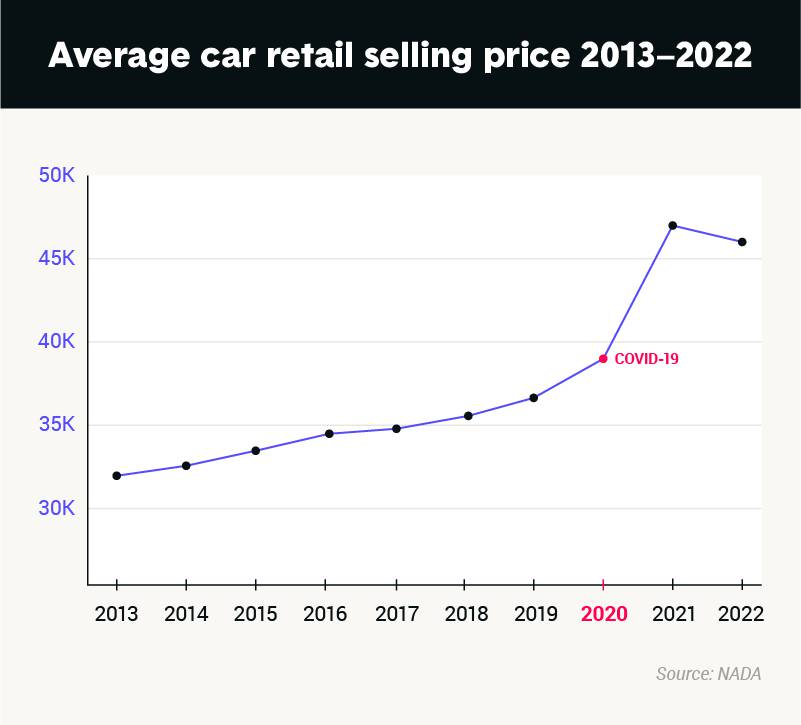

With new car prices at an all-time high and dealerships negotiating less, it’s best to have a plan of attack before taking a step into a car dealership — starting by setting a budget. A car affordability calculator can help you get an idea of where to start price-wise.

It might seem like there’s not much you can do to save on a car purchase right now, but there are things you can try.

1. Negotiate the sticker price

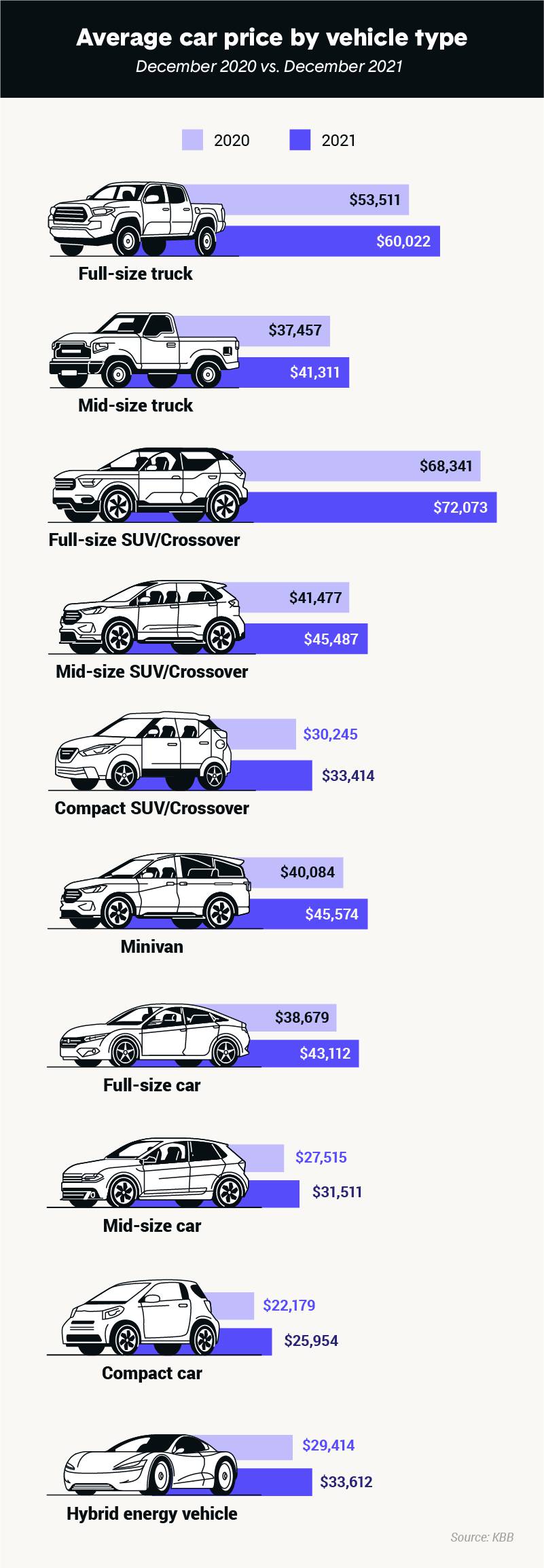

Many vehicles are selling well over MSRP today. The MSRP is only a suggestion from automakers on what the vehicle is valued at, but dealerships are free to sell at whatever price they decide. Supply and demand, plus the dealership’s profits, are the main reasons prices are highly marked up.

While it might be difficult in today’s market, it’s worth at least trying to negotiate the sticker price. If the dealership won’t budge on the sticker price, see what other incentives and add-ons you can negotiate. Some things to consider asking for could be window tinting, tire upgrades, all-season floor mats, entertainment systems and more.

2. Compare car insurance quotes

The average cost of car insurance in the U.S. is $124 per month. While premium costs vary depending on an individual’s age, location and vehicle, there are ways to save on auto insurance.

You may want to reconsider whether you’re purchasing a new or used car. Insurance on used vehicles is typically cheaper than insuring a new car, but that’s not always the case. Shop around for quotes from different providers when it comes time to buy a vehicle. On average, Nationwide, Geico and Progressive tend to have the lowest rates.

3. Pay cash if you can

Buying a car in cash is not something everyone can afford. However, if you can, you’ll not only save money by avoiding interest but also avoid negative equity. Negative equity is when you owe more on a loan than the vehicle is worth.

4. Put down a higher down payment

If you can’t pay cash, it may be worthwhile to put down a higher down payment. When buying a car, you should expect to put a minimum of 10% down. However, to reduce monthly payments and earn a better loan interest rate, consider putting 15%-20% down instead.

5. Improve your credit score

Another way to earn a better interest rate on an auto loan is to increase your credit score. Having a score of at least 661 will likely get you a good interest rate between 3.5% and 5.5%, depending on if the vehicle is used or new.

A few things you can do to make small improvements to your credit score are:

- Make frequent payments on credit cards and never miss a payment

- Pay your minimum balance and any interest you can afford

- Keep credit card usage under 30% if possible

- Pay off smaller credit card debts first to lower your average credit card usage

- Don’t open new credit cards just to increase your overall spending limits or to lower average card usage

- Do not close paid-off credit cards before making a big purchase

- Prioritize paying off credit cards vs. loans as closed accounts can temporarily hurt credit scores

- Download a personal finance coaching app, like Credit Karma, so you can evaluate your score and get personalized suggestions

If your score is on the lower end, spend a few months focusing on your credit score prior to making the purchase.

6. Shop around for interest rates

If you can’t pay cash and need a loan, shop around for loan servicers with the best interest rates. Though volatile, average new car loan rates are on a year-over-year decline and down 1.4% to 3.86% in 2021.

Newer car loans inherently have lower interest rates, so while used cars have lower sticker prices, sometimes it’s worth buying new for a lower interest rate to save money over time. Keep in mind that interest rates vary significantly depending on the purchaser’s credit score. If your credit score is good, you can try negotiating interest rates with loan servicers.

7. Trade in your old vehicle

If you don’t have savings to put toward a down payment, you can trade in your current vehicle to put toward a new purchase. Since supply is so low currently, many dealerships are offering more than a vehicle’s worth as mentioned above, especially for specific models like the Kia Telluride and Toyota Tundra.

When trading in a vehicle, come prepared knowing what your car is worth. You can do this through sites like Kelley Blue Book or by getting a quote from an online car dealership like Zroom. Knowing your car’s worth or having another offer can help you negotiate with a dealership if their offer seems low.

8. Travel to find the best price

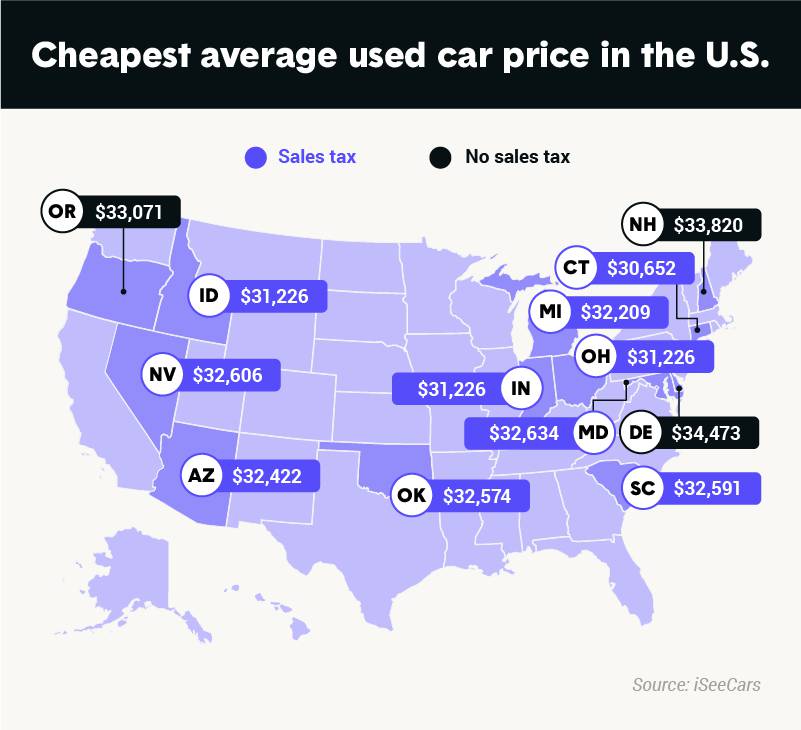

When shopping around for new cars, it might be worthwhile traveling a little farther out of your typical radius to find a better deal. Be broad in your online search.

Buying a car is cheaper in some states compared to others, and specific makers might be more affordable in certain states where they are manufactured. For example, five states, including New Hampshire and Delaware, don’t have sales taxes, so the upfront costs of buying a car would be cheaper.

If you are headed out of state to purchase a new car, be aware of the tax laws in your home state and the state you’re buying in. In most cases, you’ll be required to pay double sales taxes — once in the purchase state and once when you register the vehicle in your home state.

Depending on the dealership you’re buying from, you might be able to have the vehicle shipped to you or a local dealership for a fee. The shipping fee will more than likely be less than paying double sales taxes.