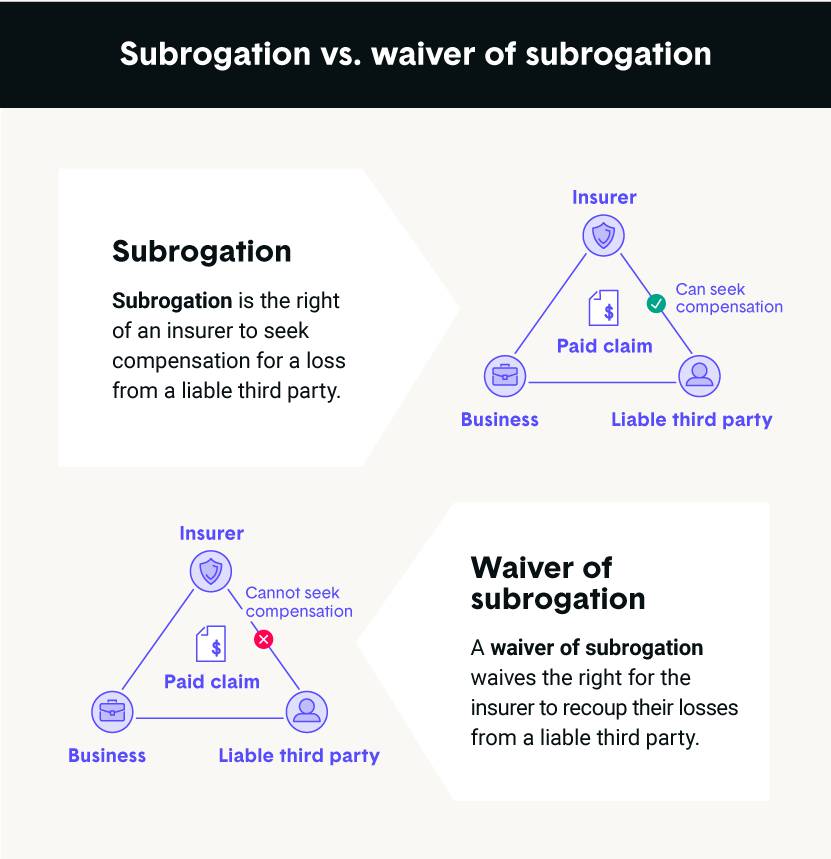

As a small business owner, it’s necessary to understand important contractual documents and what provisions are available to you in them. One provision that you may have come across in contracts is a waiver of subrogation. A waiver of subrogation is an agreement where you waive the right for your insurance company to seek compensation from a negligent third party for their losses.

Although this waiver can offer certain benefits for your clients and your working relationships, it also exposes your insurance company to greater risk, as they can’t recoup their losses. Insurers typically charge an extra fee on top of your small business insurance premiums to offset some of this risk. To help you understand what a waiver of subrogation is, keep reading to find out what it means, why you may want it and how to get one.

Additionally, we’ve outlined the pros and cons so you can determine if a waiver of subrogation is best for your small business success. For more information on how to avoid costly small business claims, jump to the infographic below.