Your credit score has a major influence on your life. That one little number can help you secure more credit, which can lead to obtaining a credit card with more favorable terms, a car loan or a better mortgage rate (or any mortgage at all).

Before anyone lends you money for something, they look to your credit score to determine how big a risk you are, and how likely they think you are to pay them back. The more risk they're taking, the more they're going to want you to pay.

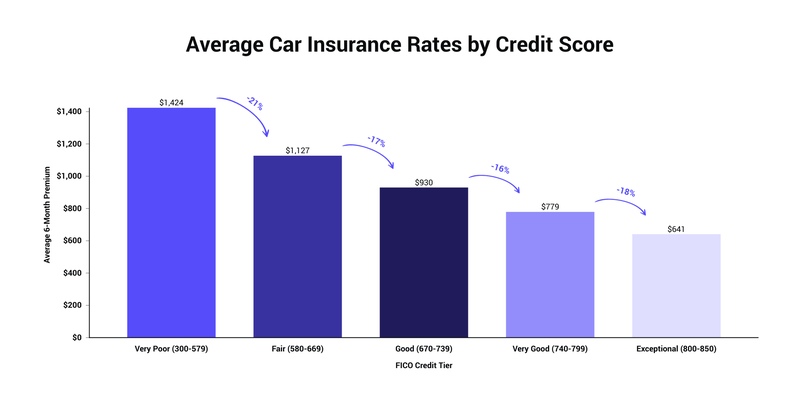

But even when you're not borrowing money for something, a bad credit score can still bring you down. For example, in my states, insurance companies charge you more for policies if you have a low credit score. Credit scores can also affect your ability to rent an apartment or get a new cell phone.

The gold standard of credit scores is the FICO Score. Created by the Fair Isaac Corporation, the majority of lenders look at your FICO Score when considering your credit. The higher your score, the better.

Without further ado, here are the five most impactful factors that make up your credit score.