Choosing a beneficiary

When it comes to planning for your estate, choosing a beneficiary is one of the most important tasks you’ll have to complete. Not only does it help you make sure your loved ones will be taken care of, but it’s a way for you to plan your legacy after you’re gone. It’s important to approach this decision-making process with thoughtful consideration, so we’ve outlined everything you need to know about what a beneficiary is and what else to consider when making this important decision.

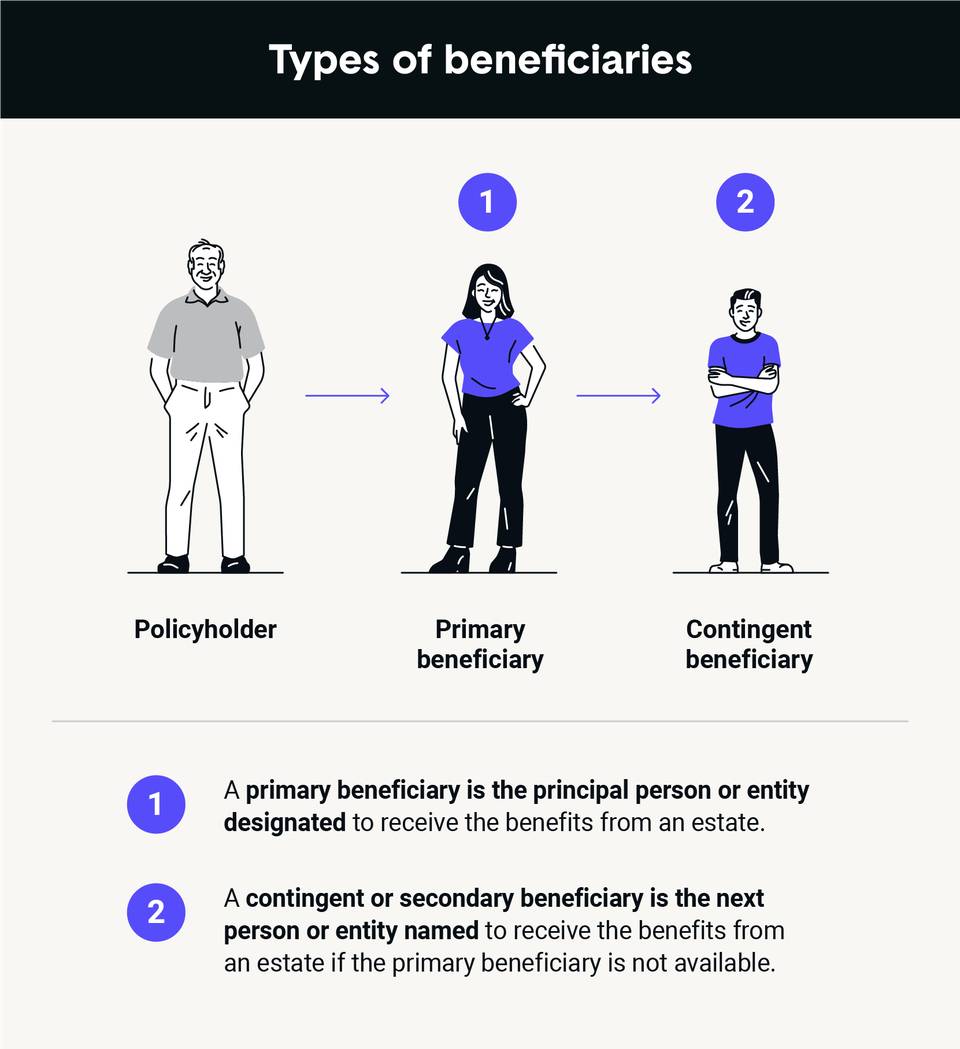

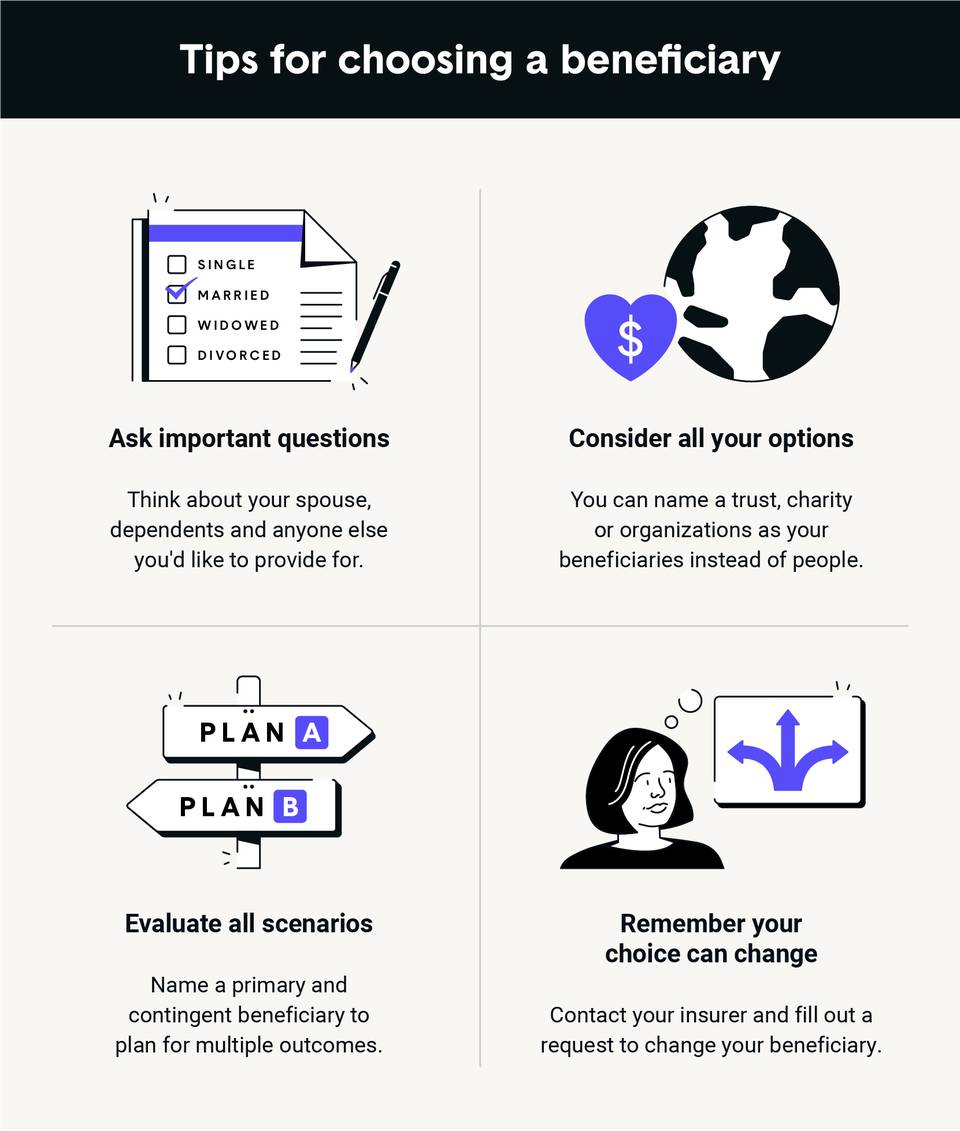

A beneficiary is any person or legal entity that you designate to receive benefits from your estate. Benefits often come in the form of monetary payments, property or anything else you may own. The term is commonly seen in life insurance policies and is used to name the recipient of the death benefit, which is paid when the insured person passes away. If a beneficiary isn’t named, the insurer will pay the death benefit to your estate. When choosing a beneficiary, you can name any of the following entities:

- Your estate

- A trust (managed by a trustee)

- A charity

- An individual

- Two or more individuals

Keep reading to learn everything you need to know about the different types of beneficiaries, answers to frequently asked questions and tips for naming one. Additionally, jump down to our printable checklist for everything you need to include in a letter of instruction to guide your beneficiaries, as this information will be a huge help to those planning for your estate after you’re gone.