Credit and car insurance

How does your credit score affect the price of your car insurance rates? How does that vary by state?

Most consumers know that credit plays a big role in their finances, whether they’re applying for a credit card or considering a car or home loan.

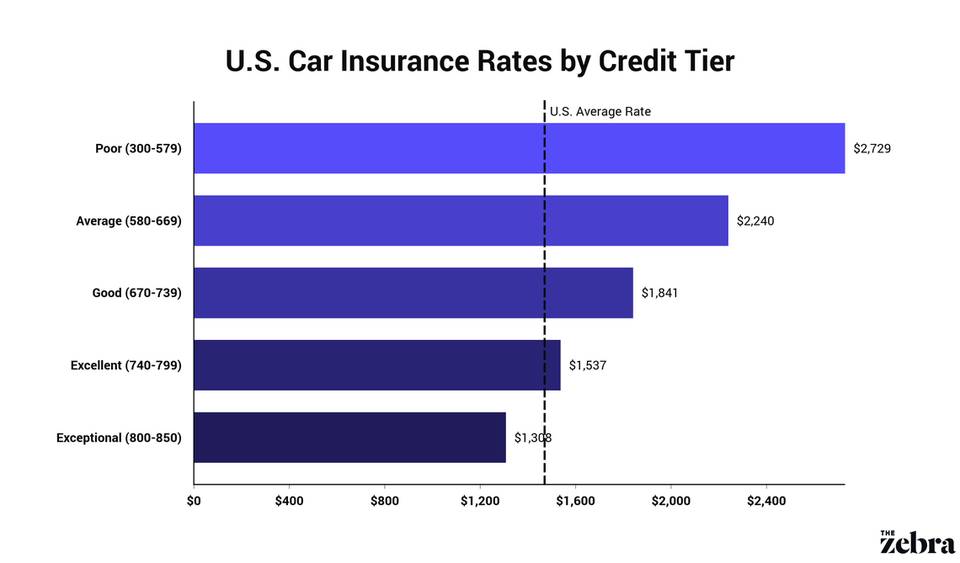

What most consumers don’t realize is that, in nearly every state, credit also has a huge impact on what they pay for car insurance. In fact, dropping just one credit tier can increase a driver’s car insurance premium an average of 17% or $355 per year.

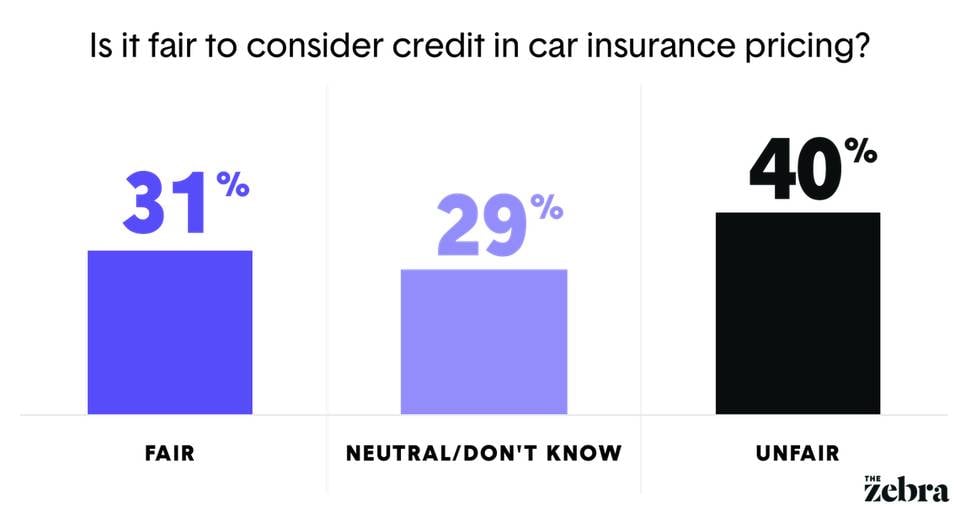

If this sounds concerning to you, you’re not alone. Three states (California, Massachusetts, and Hawaii) currently ban insurers from using credit in car insurance pricing.[1] Michigan will become the fourth once legislation passed in May 2019 goes into effect next year.

Just how big of an impact credit has on insurance rates varies by insurer and location. Here, we review the impacts in each state — and share what consumers can do to make sure they’re getting the best rate.