How much do traffic tickets impact your car insurance rate? What are the most expensive violations, and how do they vary by state?

How 26 common traffic tickets raise the price you pay for car insurance

Table of contents:

Find affordable insurance rates by comparing quotes now.

Introduction

If you’ve been caught speeding or forgetting to use your turn signal, traffic ticket fines are not the only price you’ll pay for breaking the rules of the road.

You can also face steep penalties when it comes to your car insurance costs. Drivers who have recent tickets or car accidents on their driving record are considered higher risk (i.e. they’re more likely to file an insurance claim). That means insurers will typically charge them higher rates.

How much more drivers have to pay for car insurance depends both on the type of violation and where they live. For example, a Pennsylvania driver could pay 13% more for insurance after getting a speeding ticket, while a North Carolina driver could pay 48% more for the same offense.

Here we take a look at how common traffic tickets and claims affect car insurance rates nationally, and the violations with the biggest impact in each state.

1) A single traffic ticket can raise car insurance costs as much as 82%

The traffic violation with the single biggest impact on car insurance rates is leaving the scene of an accident — a “hit and run.” Drivers charged with this crime can expect to pay on average 82% (or $1,200+) more per year for car insurance.

However, insurance penalties for traffic violations don’t always line up with what drivers may assume is the most dangerous driving behavior. Getting a ticket for driving too slowly, for example, can spike rates nearly as much as speeding in a school zone.

*Speeding violations aggregated. See below.

Drivers can also face insurance penalties for getting into car accidents and filing claims for the damage. Who was at fault, the size of the claim, and the terms of the driver’s insurance policy can all impact whether and how much a claim raises rates.

| Claim | Insurance rate increase by % | Insurance rate increase by $ |

|---|---|---|

| One medical/personal injury claim | 0.3% | $4 |

| One comprehensive claim | 4.4% | $64 |

| Two medical/personal injury claims | 5.5% | $80 |

| Two comprehensive claims | 10.7% | $158 |

A medical or personal injury claim pays for medical treatments and recovery costs for those injured in a car accident.

A comprehensive claim pays for damage not caused by an accident. This includes theft, vandalism, animal, and weather damage.

2) The more severe the violation, the bigger the insurance penalty

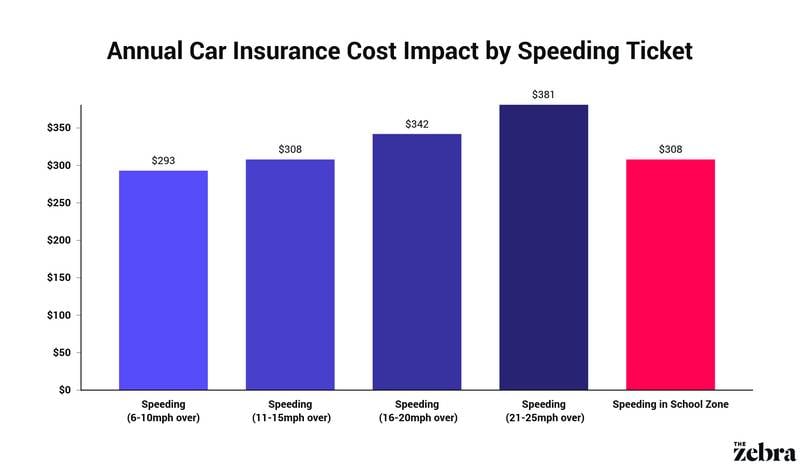

While violations like not buckling your seatbelt are pretty straightforward, others come with degrees of severity. If you’re caught speeding, for example, just how fast you were going over the speed limit will impact the size of your insurance penalty.

Getting ticketed for driving 6-10 mph over the speed limit increases car insurance rates about 20%, while speeding 21-25 mph over the limit raises rates almost 26%.

3) The most expensive violations vary by state

Getting a ticket for a driving violation can raise your car insurance rate no matter where you live, but the additional costs vary dramatically across state lines.

For example, a drunk or drugged driving violation (DUI) can increase rates by 181% ($3,200+) in California, while in Indiana the same offense raises rates by only 42% ($480+).

Why? It all comes down to differences in risk, and how insurance is rated and regulated from state to state.

It’s important to remember that some insurance companies may assign lower penalties — or none at all — even in states where drivers tend to see steep cost spikes for violations, so it’s always important to compare insurance quotes.

Below are the violations with the biggest impact on car insurance rates in each state across the U.S. [Note: Each state name hyperlinks to more information about all violations in that state.]

4) What drivers need to know about driving violations

Driving violations can impact insurance rates for years (but not forever)

Insurers typically consider violations on your record for three years after the infraction, though certain activities can impact auto insurance rates even longer. A DUI violation in California, for example, will impact a driver’s insurance rate for 10 years.

While violations often no longer count after three years, drivers usually aren’t eligible for “good driver” discounts, which can further lower rates, until they’ve been violation-free for five years.

Insurance penalties can cost more than the traffic ticket itself

The insurance impact of most driving violations is often far more costly than the ticket itself, especially when you consider how costs endure for several years.

The legal fine for a speeding ticket is about $150 on average. On top of that, ticketed drivers are likely to see their car insurance costs rise $340+ per year — for three years — after the violation. That means one speeding ticket can cost drivers more than $1,000 in insurance penalties alone.

Insurance penalties after a violation differ from company to company

How heavily you’re penalized for a traffic ticket differs from one insurance company to the next, just like it differs from state to state. While most insurers increase rates for drivers with violations, some may charge you less than others.

In addition to comparing rates to find the best deal, you may be able to lower your insurance rate by participating in a driver safety course accepted by your insurer.

Methodology

The Zebra’s 2021 State of Auto Insurance Report analyzed 61 million unique rates to explore pricing trends across all United States zip codes including Washington, DC. Analysis used a consistent base profile for the insured driver: a 30-year-old single male driving a 2014 Honda Accord EX with a good driving history and coverage limits of $50,000 bodily injury liability per person/$100,000 bodily injury liability per accident/$50,000 property damage liability per accident with a $500 deductible for comprehensive and collision. The driver’s driving history was changed to include violations in order to obtain rate differences.

Stay in touch and subscribe!

Get advice, insights and tips from our newsletter.