Introduction

Despite changing cultural influences, milestones and priorities, 70% of first-time homebuyers spanning three generations still believe in homeownership as part of the American Dream. Today, that dream looks less like a Norman Rockwell painting and more like a patchwork quilt, with each generation having very different experiences achieving their dream of homeownership.

The Zebra surveyed 1,205 first-time homeowners to discover what the experience of buying and owning a home has been like for them. We found shifting priorities and sentiments as homeowners aged:

- Generation Z was the most racially diverse generation of first-time homeowners, and the generation putting the most pressure on themselves to buy a home.

- Millennials were the most financially prepared generation, and the most stressed out by the homebuying process.

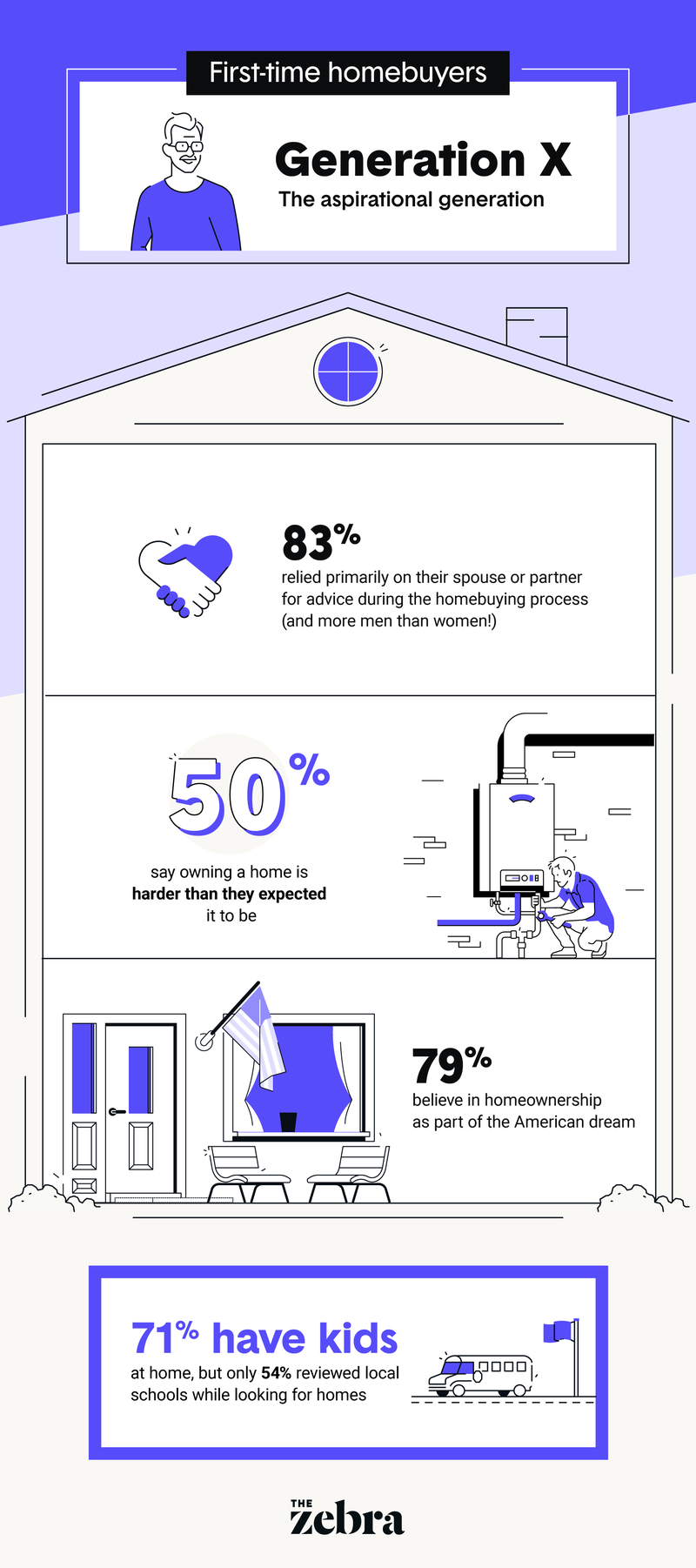

- Generation X believed the most in homeownership as part of the American Dream, but had mixed feelings about owning their first homes.

Let’s take a look at these three generations of homeowners in depth.

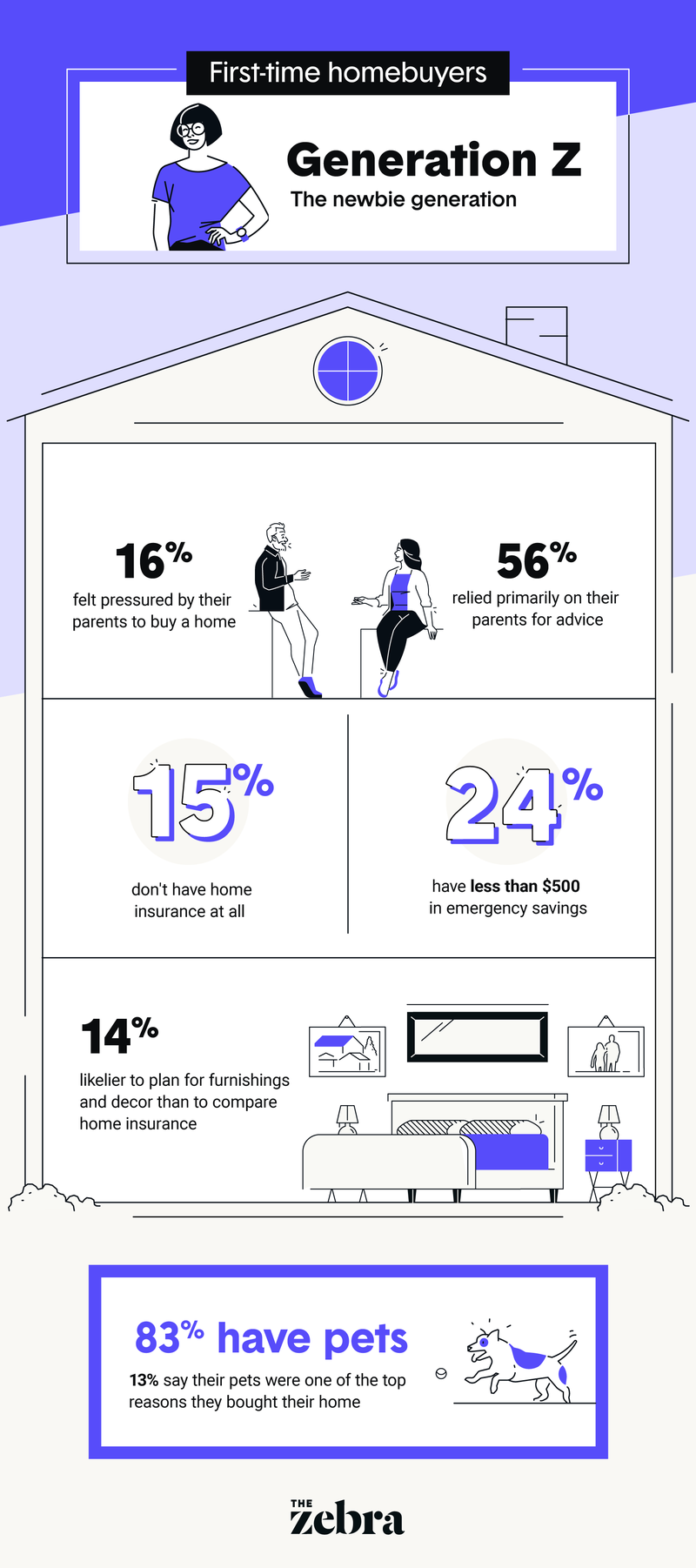

Generation Z: The newbie generation

Generation Z homeowners, aged between 18 and 23, are most motivated to buy a home by the desire to live in a better area. They’re much younger than the typical first-time homebuyer; accordingly, parents had the most influence on Gen Z homeowners during the buying process.

- 56% rely on their parents as their top source of advice while going through the homebuying process — more than any other generation. In fact, they’re almost as likely to rely on their parents for advice as they are to depend on a real estate agent: Only 61% of Gen Z homeowners hired one, compared to 67% of Gen Xers and 72% of millennials.

- 44% move straight from their parents’ homes into their own.

Thirty-four percent of Gen Z homeowners said they put pressure on themselves to buy a home, the most of any generation. Still, they’re often underprepared for the realities of homeownership:

- They’re 14% likelier to plan for home furnishings and decor than to compare home insurance policies, and 20% likelier to plan decor than compare home loans as part of their preparations for homeownership.

- Gen Z has the largest share of uninsured homeowners, with 15% reporting that they have no home insurance.

- 56% have emergency funds of $1,000 or less, falling short of financial experts’ recommendation to have 1-3% of a home’s value saved for repairs.

Gen Z homeowners have the lowest incomes of any generation, with 63% making $75,000 or less and 32% making $50,000 or less, compared to the American median household income of about $60,000. However, they’re still making their way into homeownership by purchasing smaller, less expensive homes. They’re also by far the most racially diverse generation of homeowners.