Cheap Same-Day Car Insurance

- Buy car insurance online from GEICO, Progressive, Allstate and more. Instantly and for free.

- No sales pitch. No spam calls. No junk mail.

Can you buy same-day car insurance?

You can get instant car insurance online or over the phone with almost any insurer to start the very same day. Through online quote tools, directly from the insurance company's website, or from a licensed insurance agent, a new car insurance policy can be available to you in no time.

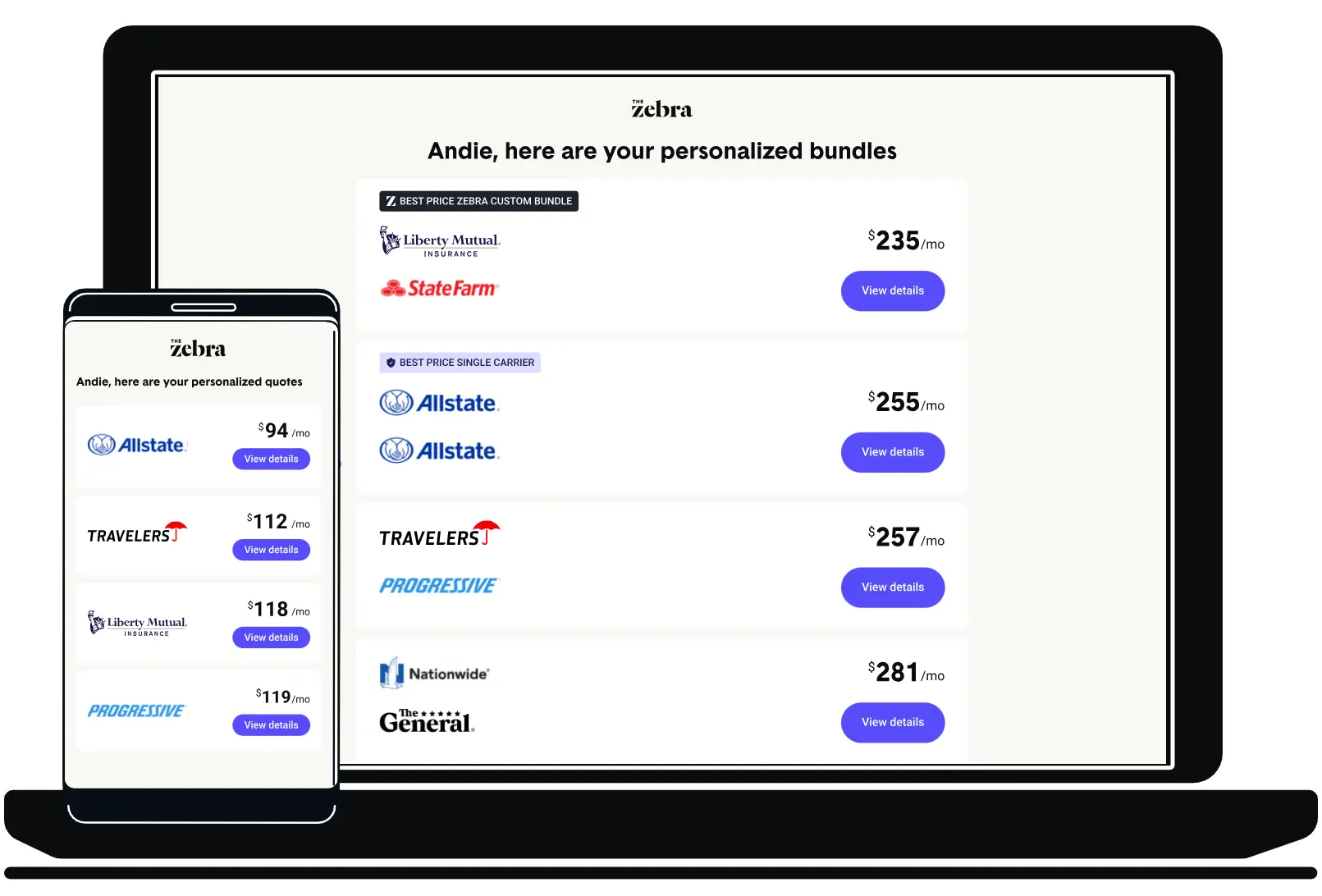

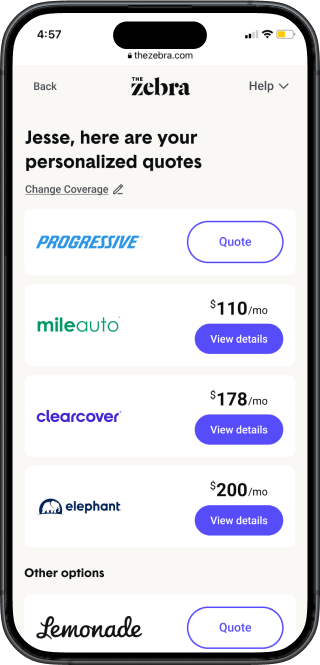

Needing immediate car insurance coverage is a common question, in fact. According to our data, 20% of Zebra customers are looking for an insurance policy to start the same day. No need to panic, our online quoting system only requires one quick form to see your options from large and small companies alike. You can sort by price or by coverage level to find the right car insurance for you— instantly and for free.

Key takeaways:

- The easiest way to get same-day car insurance is to purchase a policy online

- Shopping for cheap insurance online is perfectly safe and reliable

- Almost every major carrier offers online quotes

- Our data indicates Travelers, USAA and Nationwide are the cheapest online insurance providers

What you need to get insurance instantly

Of course, there is not a set-in-stone list of information needed to receive a car insurance quote. However, most insurers will require roughly the same types of information to get the process started. If you're at a dealership and need car insurance immediately to drive off the lot, you might be able to simplify the process by having your information ready beforehand (especially if you have multiple drivers).

To get an accurate insurance quote as quickly as possible, you need to have the following information available.

Personal information: (needed for each driver on the policy)

- Driver's license number

- Date of birth

- Address

- Marital status

Vehicle information:

- The make, model, and vehicle identification number (VIN) of the vehicle(s) for which you're getting a quote

- Mileage on the car

- Date of purchase of the vehicle

- Name of the registered owner

- Recent driving history of any motorist(s) listed on the policy, including accidents, citations, claims or completed driving courses

- Details on your car insurance coverage background — some companies require at least six months of continuous coverage prior to issuing a policy

Here's how to get car insurance now:

- Have your information prepared - make sure you have all the necessary information needed to purchase your policy.

- Select your coverage options - Liability-only is the cheapest but the least protection; full coverage protects more but is pricier. If you are leasing or financing your vehicle, verify that you are meeting the coverage requirements set by your lending association.

- Get your quotes - Use The Zebra quote tool or go directly to the insurance company's website to get your personalized quotes and choose a policy that's right for you.

- Pay for and start your policy - If possible, try to avoid a lapse in insurance coverage. Start your new policy before canceling an old one, if you're switching insurance providers.

Dial 1-888-255-4364 to get started with a licensed insurance agent.

How long does it take to get auto online?

If you're getting a new quote from a , you should be able to get a in less than an hour. Since you are starting an entirely new policy, you are required to make a down payment in order for your policy to be considered active. If you have an established auto insurance policy, it should only take a few minutes to get a quote— online or with an agent over the phone. Be sure to have all the necessary information on hand to streamline this process.

To get a better idea of cost, calculate your new car insurance rate below by inputting the information in the list above. Or, skip to our data on average rates from top companies.

Fetching your estimate

Here at The Zebra, we make it easy for you to find the right coverage—at the right price. We compare top companies so you can find what works for you.

We can also help you:

Same-day auto insurance: risks to look out for

Instant car insurance quotes are easy to obtain, but there are some disadvantages to waiting until the last minute. Lets take a look at some of the risks and drawbacks to same-day insurance.

In some cases, particularly with rare or valuable cars, the underwriting process may take longer than a day. In this scenario, car insurance coverage would not be able to begin on the same day.

Without spending the time it takes to compare companies, assess discounts, and understand your coverage needs, you lose the opportunity to find the best rate for your needs.

For the average driver, this is rare. But if you apply for insurance and are rejected due to a risky driving record, poor credit, or incomplete information, this could pose a problem for you in obtaining same-day coverage.

"Applying for car insurance the same day you need it comes with risks; your premium can be higher since it is needed day of, and adding certain coverages— like comprehensive, collision and unisured/underinsured motorist coverage— can pose a problem if you don't send pictures of your vehicle.

Further, let's say you're at the dealership trying to purchase vehicle and finalize a policy, but the sale does not go through due to issue with vehicle or a loan not being approved. This could lead to cancellation by the insurance company and possible fees."

Summer Popovich - Customer Service Advisor at The Zebra

Why you might see a delay in coverage

When drivers get quotes, companies use the information submitted to generate pricing. The biggest reasons you may not be able to get same-day are if some of this crucial information is missing, or if circumstances require that to assess whether it can provide for you. Some examples that could prevent you from getting same-day include:

- Not having a permanent address: companies use your location as a factor in your quote, so may not sell you a policy if the can't verify your address.

- Having too many accidents or citations on your record: This is a sign of liability to companies, meaning you could be too risky of a client. It could be more difficult to find depending on the state of your driving history, but some companies will offer you a policy - it just might require more research. Learn more about how to find as a high-risk .

- You drive a unique, rare or classic car: If you drive a vehicle that isn't listed in a company's database, it could require more work to find a policy. Not all will sell you a policy for a rare or classic car; you may need to get quotes from insurers that specialize in classic cars, like Hagerty.

- : Your is one of many factors that are evaluated when getting quotes for . Depending on your score and the information available, this could lead to a delay if an needs more information.

If you can't get a online, we recommend calling the and getting personalized help from one of the company's representatives.

Is it safe to buy online?

Yes! Most insurance shoppers tend to buy their coverage over the phone or online. While you should always exercise caution with online purchases, it is generally safe and convenient to buy your car insurance online.

If you need car insurance immediately but also for the cheapest price, your best bet is to use comparison sites like The Zebra. We partner with big and little insurance companies across the US to instantly provide customers with options based on coverage, price and company.

Learn more about how insurance comparison websites like The Zebra work.

The Zebra is an insurance comparison site, not a lead generator or an insurance company. You won’t receive spam from either us or are partners when you use our tool.

You can trust us to handle your personal information securely. We never sell your information – our bottom line is to keep your insured. See our Privacy Policy for more information.

Rather than jump from site to site in order to find the best deal, we’ve streamlined the research process. With us, you fill out one quote to see multiple options at the same time.

Not only do we work with most of the biggest names in the insurance industry, but we also partner with regional and non-standard providers to help get you insured today.

No pressure or sales pitch here. You can save your quote and return when you're ready to buy.

If you need more assistance, we are always here to help! Call 1-888-244-4364 if you would like more guidance at any stage of your insurance shopping experience.

| Company | Avg. Annual Premium | Avg. Monthly Premium |

|---|---|---|

| Travelers | $1,342 | $112 |

| USAA | $1,365 | $114 |

| Nationwide | $1,476 | $123 |

| GEICO | $1,542 | $129 |

| American Family | $1,568 | $131 |

| State Farm | $1,569 | $131 |

| Farmers | $1,786 | $149 |

| Progressive | $1,882 | $157 |

| Allstate | $2,413 | $201 |

While the rates above are based on a certain driver profile (see methodology for more), individual car insurance premiums are assessed from a set of rating factors. Details like your age, gender, location, credit score and driving history have a significant impact on how much you will pay for an auto insurance policy. Understanding your rating factors brings you closer to understanding your insurance premiums— and why you may be denied or delayed same-day coverage.

The Zebra’s Dynamic Insurance Rating Tool data methodology

The Zebra’s Dynamic Insurance Rating Tool for home and auto insurance rates utilizes the latest ZIP code-level rate filings from across the U.S., sourced from Quadrant Information Services and S&P Global. These filings, typically updated annually or biennially by insurers, are verified through Quadrant’s QA process and then integrated into The Zebra’s estimator.

The displayed rates are based on a dynamic home and auto profile designed to reflect the content of the page. This profile is tailored to match specific factors such as age, location, and coverage level, which are adjusted based on the page content to show how these variables can impact premiums.

For a comprehensive understanding, see our detailed methodology.

Same-day auto insurance coverage

Same-day coverage options are the same as standard coverages, even if you planned in advance. Take a look at the coverages you'll see when applying for same-day car insurance.

Get auto insurance online now!

Need "one-day" car insurance?

Technically, all car insurance is "one-day" car insurance, as you can activate your policy and terminate it at any point. Still, being covered by an insurer for only a single day can land you in trouble for several reasons.

- You may not get your down payment back - Most insurance companies require a down payment. If you cancel your insurance policy the day after it was issued, you won't be guaranteed to get your money back for that month. Learn more about auto insurance with no down payment.

- You are legally required to have insurance - Car insurance is required by law unless you live in New Hampshire, where proof of insurance is not a requirement. By canceling your policy after leaving a dealership, you run the risk of being ticketed for driving without insurance.

- Leased and financed vehicles often have contractual stipulations requiring insurance - If you're leasing or financing your vehicle through the dealership or a bank, they typically require you to maintain full coverage (collision and comprehensive coverage) on your vehicle in addition to liability insurance. By canceling your policy, you are putting your vehicle in danger of repossession if they (your bank or dealership) find out.

- You could be putting yourself at risk on the road - If you're found as the at-fault driver after an accident without an active car insurance policy, you will most likely be ticketed, face license suspension and can even be sued for property or liability damages.

Although car insurance can be expensive, it’s cheaper than the world of trouble you can get yourself into if you’re caught driving uninsured or get into an at-fault accident without insurance. The financial responsibility you could face in those circumstances is typically far worse than the auto insurance rate you will pay. There are affordable options, and you can easily compare car insurance rates to make sure you're getting the best deal. Many companies also offer a variety of car insurance discounts that you may be eligible for.

Instant quotes: what to consider

Instant car insurance quotes are easy to obtain. However, remember that the underwriting process for putting your new policy in place will take longer. Most major should be able to provide same-day . If you're looking for in order to legally drive your new vehicle off the lot of the dealership, make sure you have all the information ready to make the process as painless as possible.

If you opt to forgo — or only purchase it temporarily before dropping — you risk being caught driving without consequences you will face will be much more costly than an elevated . Enter your ZIP code below to see cheap from national and local providers.

Affordable same-day auto insurance: FAQs

Related Content

- How Long Can You Stay on Your Parents' Car Insurance Policy?

- Car Insurance for Renters

- What is a Named Driver Policy?

- State Farm vs. Costco Car Insurance

- Can You Share Car Insurance?

- Car Insurance for Multiple Vehicles

- Car Insurance for Commuting

- The Consequences of Driving Without Insurance

- AARP Auto Insurance

- What is Pleasure Use Car Insurance?

Related Questions

Read or submit your own question about instant car insurance!

Do I have a legal three-day window to drive to NY in my new car without plates?

Is there a temporary non-owners car insurance for foreign drivers?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.