Best Car Insurance for Doctors

Do doctors get car insurance discounts?

Medical professionals earn an average savings of $19 per six-month auto insurance policy. While your occupation isn't the most impactful contributor to insurance premiums, it does make a difference. Insurance companies see doctors and healthcare professionals — and clients with more education in general — as less risky drivers, making them less expensive to insure.

Let's review some ways to find better auto insurance rates as a doctor or healthcare worker.

Cheapest insurance companies for doctors

Your best bet for finding cheap car insurance as a medical professional is USAA. With an average rate of $545 for a six-month policy, USAA is $189 cheaper than the group average.

| Insurance Company | 6-Month Premium |

|---|---|

| Allstate | $1,011 |

| Farmers | $822 |

| GEICO | $601 |

| Liberty Mutual | $791 |

| Nationwide | $714 |

| Progressive | $744 |

| State Farm | $647 |

| USAA | $545 |

The Zebra’s auto insurance data methodology

The Zebra’s Dynamic Insurance Rating Tool for home and auto insurance rates utilizes the latest ZIP code-level rate filings from across the U.S., sourced from Quadrant Information Services and S&P Global. These filings, typically updated annually or biennially by insurers, are verified through Quadrant’s QA process and then integrated into The Zebra’s estimator.

The displayed rates are based on a dynamic home and auto profile designed to reflect the content of the page. This profile is tailored to match specific factors such as age, location, and coverage level, which are adjusted based on the page content to show how these variables can impact premiums.

For a comprehensive understanding, see our detailed methodology.

GEICO and State Farm are the next-cheapest options. GEICO charges $56 more per six-month policy than does USAA. If you have car accidents or citations on your record, your rates may vary.

Get auto insurance for doctors today!

Why do doctors pay less for auto insurance?

Insurance companies do not use income as a factor that helps to determine how much a client pays. Doctors may earn more than an average person, but insurance companies don't raise their rates accordingly.

Many insurance companies do predict risk through the filter of educational attainment in an effort to estimate the probability of their needing to cover a claim payout. Insurers see drivers with more education — such as medical professionals — as less likely to take risks when driving. To an auto insurance company, less risk equals fewer expenses.

| Education Level | 6-Month Premium |

|---|---|

| None | $798 |

| High School | $786 |

| Bachelors Degree | $774 |

| Masters Degree | $770 |

| PhD | $770 |

Those with higher levels of education — often employed as engineers, doctors, lawyers, and Ph.D. scientists — pay less for car insurance than do those in occupations requiring fewer credentials.

Is using education level to price car insurance a discriminatory practice?

California, Hawaii, Georgia and Massachusetts do not allow the use of education level in determining car insurance rates. These states consider this rating practice discriminatory. The difference in insurance pricing between education levels is typically negligible. Depending on your insurance provider, there might not even be a difference.

Companies offering discounts for doctors

As insurance is regulated on a state basis, not every company offers an occupation-based discount. Some popular auto insurance companies offer special discounts or incentives to medical professionals:

| Occupation | Average 6-Month Premium |

|---|---|

| Other | $774 |

| Proprietor | $773 |

| Civil Servant | $773 |

| Unemployed | $771 |

| Manager | $767 |

| Teacher | $757 |

| Law Enforcement | $756 |

| Fire Fighter | $755 |

| Scientist | $755 |

| Doctor | $755 |

| Lawyer | $754 |

| Engineer | $754 |

| Military | $752 |

Stay in touch and subscribe!

Get advice, insights and tips from our newsletter.

How doctors can save on car insurance

Insurance can be expensive regardless of what you do for a living. Here are some suggestions on how to save on your car insurance policy.

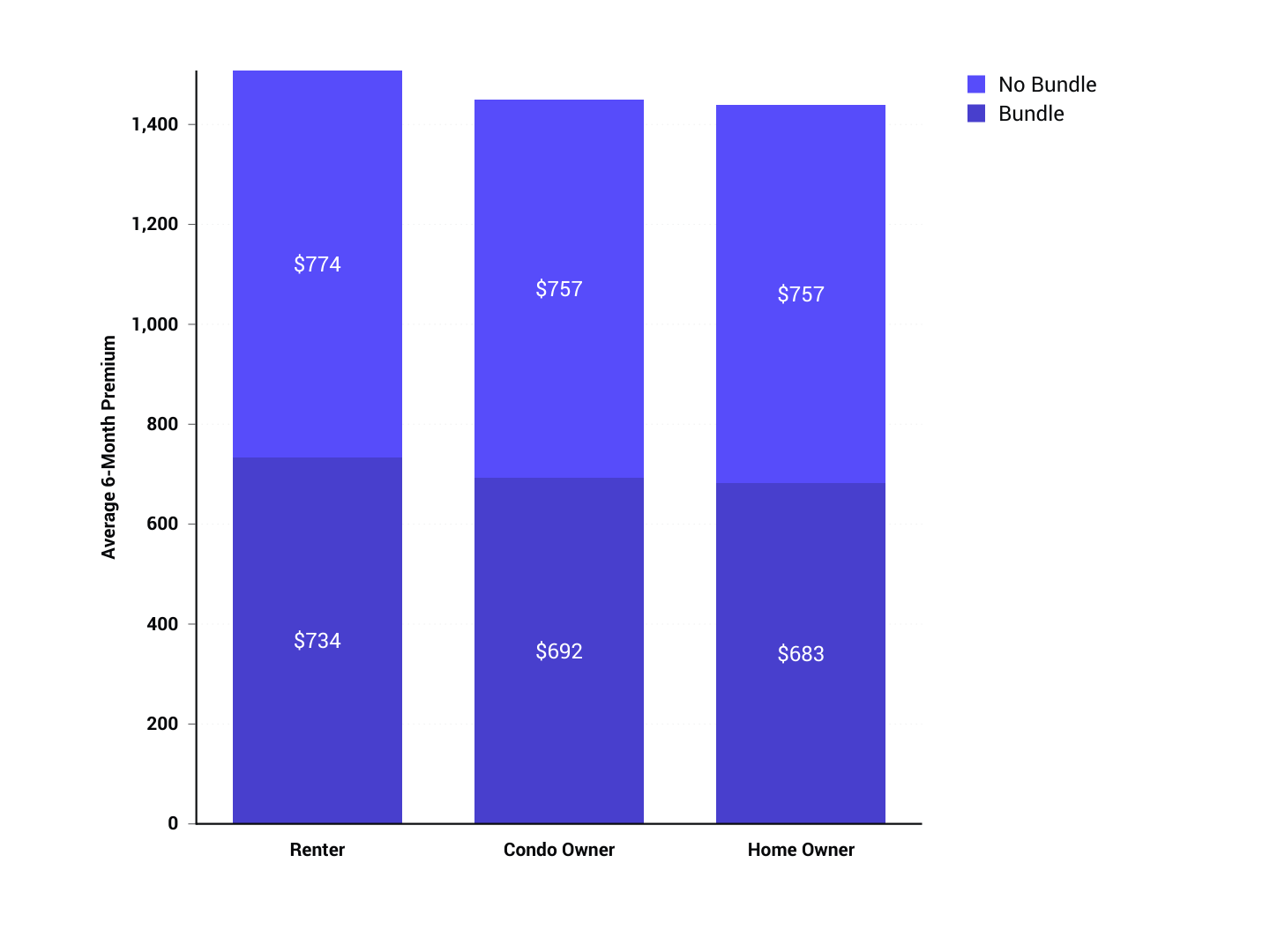

Bundle multiple policies

If you have renters, condo, or homeowners insurance, cover all your assets — cars included — with one company. This will result in your receiving a multi-policy discount and limit the number of insurance providers you have to deal with.

Be smart with your claims

In some scenarios, it makes financial sense to pay your costs out-of-pocket after a collision. An at-fault insurance claim can raise rates an average of $665 per year (2021 average).

This post-claim penalty can stretch for as long as three years, adding up to as much as over $2,300 in additional premiums. If you’ve been in an accident and aren’t sure how to handle the insurance or the claim, consider the following:

- Get a cost estimate for the damage independently.

- Use The Zebra's State of Insurance analysis to see how much an at-fault accident would raise rates in your state. Again, consider this surcharge over three years.

- Compare the three-year surcharge value plus your deductible to the out-of-pocket expenses you learned in step one. If it is cheaper to pay for your claim out-of-pocket, do that.

*Depending on policy stipulations, you may need to inform your insurance company of the accident. This may cause your rates to increase. If your insurance company drastically increases your rates before you inform them of an accident, consider this an opportunity to do some car insurance comparison shopping.

For additional information on when and when not to use your insurance coverage, see our comprehensive guide to insurance claims.

Be smart with your coverage

By this, we are referring to the sad truth that cars depreciate over time and so will the right coverage. So, if you have an older vehicle, it might not require the same coverage that a newer vehicle would — specifically referring to comprehensive and collision insurance.

Use Kelley Blue Book or NADA online to determine the value of your vehicle. Generally, if a vehicle is worth less than $4,000, you may not need comprehensive or collision. If you decide to drop these coverages, consider adding uninsured motorist property damage coverage. This will protect your vehicle if it is damaged or totaled by an uninsured motorist or a hit-and-run incident.

Keep your credit score high

In most states, your credit score is a major factor in determining your car insurance rates. Having good credit can save you substantially.

Consider telematics

Telematics — or usage-based insurance — utilizes a plug-in device to monitor the way you drive and generate an accurate premium. Rather than using data that isn’t directly correlated to your driving, telematics can illustrate to an insurance company what kind of client you will be and more accurately determine your premium. Here are some potential savings.

| Company | Estimated Savings |

|---|---|

| Progressive SnapShot | Average of $130 |

| Allstate Drivewise | Average of 10-25% |

| State Farm Drive Safe & Save | Up to 15% |

| Esurance DriveSense | Varies |

| Nationwide SmartRide | Up to 40% |

| Liberty Mutual RightTrack | Average of 5-30% |

| GEICO DriveEasy | Varies |

| Root Car Insurance | Varies |

| Metromile Car Insurance | Varies |

Please note: these programs are not available in every state.

Shop around

You could do all of the above and still be paying too much for car insurance simply because you’re with the wrong company. Comparison shopping is a great way to shop rates and find the best car insurance coverage. Use The Zebra to compare car insurance quotes and find a great policy at an affordable cost.

Compare car insurance quotes today.

Related content

- Car Insurance for Teachers

- Car Insurance for Government Employees

- Rideshare Insurance

- Car Insurance for Firefighters

- Car Insurance for the National Guard

- Car Insurance for Marines

- Car Insurance for Uber Drivers

- Car Insurance for Unemployed Drivers

- Car Insurance for Delivery Drivers

- Car Insurance for Navy Personnel

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.